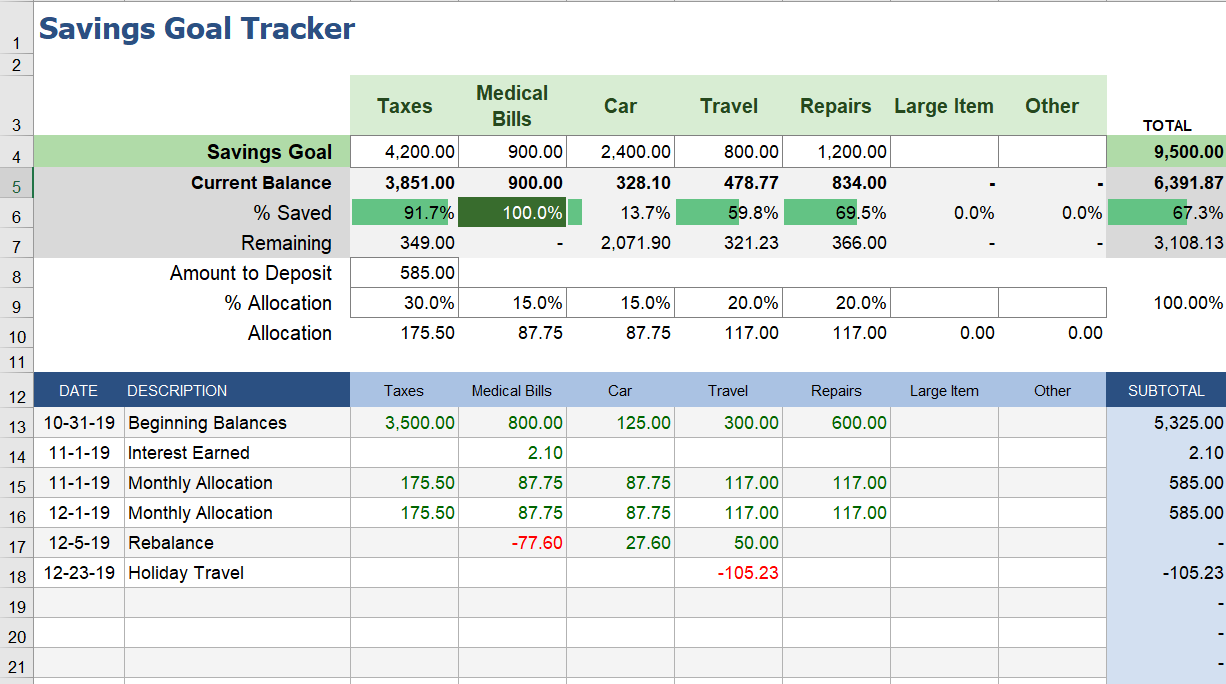

About Saving Goal Tracker:

Download this Saving Goal Tracker excel template to plan your savings for specific goals. To use this template, 1st you need to define your goals. After, you’ll have to define how much money do you need. Then, you will monitor your expenses and earnings. This sheet has an automated excel tool to prepare a report of your saving. Thus enabling you to plan to save for all your goal.

What Is Savings?

Savings refers to the money that a person saves and the leftover after spending their monthly income. Therefore, represent a net budget for an individual or household after all expenses had paid.

Saving can be increased through investing in different policies. So the savings goal tracker template is a complete track of your savings in a month.

How to use the Savings Goal Tracker

In a general budget, category savings is the main category and had different sub-categories like Emergency Fund and Vacation.

Money in your account is added into these separate columns categories “Savings Accounts” or “Goals Tacker”.

How to keep track of your monthly saving

Set Monthly Goals:- Evacuate how much you need to save each month.

Right Saving Investment:- choose the right type of account for your savings goals. If you are looking at saving money for a longer period.

Choose a specific saving goal:- To regulate what you’re saving money for.

Track Your Goals:- If you know what you are saving for, you need to figure out how much you need to reach your goal. Use separate accounts for each of your savings goals and track them regularly.

How much should you have in savings? or how to start saving money?

Have you ever faced a financial emergency like the things breaking down but not having the funds at hand to get it started?. Or have you wanted to save for something big but struggled to initiate?

Help is at hand. Here are the ways how to start saving money or to answer how much should have in savings:

1. Firstly, prepare a plan to Pay off your debts

You are unlikely to earn high interest on your savings than you pay on your debts, so aim to pay off expensive debts like credit cards, store cards and overdrafts before you start to save.

2. Start saving with small amounts, say 5 to 10% of your income

Even tiny amounts add up if you can save regularly. For example, saving just £3 a day adds up to £1,095 over a year.

3. Separate your savings from your daily need expenses

If you leave the money in your purse or bank account, it is much more likely to get spent. It helps to keep your savings separate.

4. Start Investing and Earn interest or return on your money

Open various accounts with your bank for e,g

- Saving Accounts with Sweep-in Facility: banks automatically transfer the fund to fixed deposit at a higher interest rate.

- Fixed Deposit Account

- Recurring Fixed Deposit

- Mutual Fund Investment: Equity, Hybrid Funds, Diversified Funds, Fixed Interest Bonds, Debt Fund.

- Demat account for Equity Investment: Only invest in blue-chip and dividend-paying stock for low-risk investment

- Invest in Crypto Currencies: Invest only on those coins with use case or e.g Cardano, Hbar, Etherium etc.

- Property investment with fixed lease rental

If you are setting up an emergency fund, look for accounts where you can get access to your money when needed, rather than tying it up for a long time. If you have a savings goal with a longer deadline you could go for a top-paying fixed-rate account.

Don’t ignore current accounts. Some are paying higher rates of interest right now, provided you follow all the terms and conditions.

If you do use a current account for your savings, consider running a second current account for your bills and expenses so the money doesn’t get mixed up.

5. Build a savings cushion

As a rule of thumb, it’s helpful to set aside an emergency fund with enough money to cover your essential outgoings for three months. So if you spend £1,000 a month on bills like your rent or mortgage, council tax, utility bills, food and so on, you will need to save up £3,000.

6. Set up a standing order for transferring to another bank account for a fixed amount

A standing order is an instruction to your bank to pay money from one account to another at regular intervals. If you set up a standing order to pay money into your savings account each month, your fund will soon start to grow.

7. Pay in after payday

If you set aside savings straight after you are paid, you are less likely to miss the money. Wait until the end of the month and the cash is much more likely to disappear in everyday expenses.

8. Set a savings goal

Write down what you are saving for and how much you need to save each month to reach your target. Then set a date when you aim to have saved enough.