Employee Provident Fund Calculator is an important document for all HR Professionals. They require calculating retirement benefits for employees retiring in their organization.

What is EPF?

EPF is a retirement benefits scheme available for salaried employees introduce by the EPFO under the supervision of Government of India. EPFO is Employees Provident Fund Organization of India.

EPF is a saving platform which helps employees to save a proportion of their salary every month. Employees can use this if they are unemployed, unable to work, or at the time of retirement.

As an employee, we would like to know how much provident fund has accumulate during the years of service.

Eligibility for EPF

Registering with EPFO is mandatory by the labor law for all organizations with more than 20 employees to register with the EPFO.

It is obligatory for the employees to have EPF contribution with a salary below Rs 15000 per month to register for EPF. Moreover, employees having a salary above the prescribed limit can register for EPF with prior permission from the Assistant PF Commissioner and mutual acceptance between the employee and his employer.

EPF Contribution

However, The Employee Provident Fund is built with monetary contributions by; employees and their employer from the salary every month. Both usually contribute 12% of the employee’s basic salary including dearness allowance. Minimum Contribution amount is 12% of Rs. 15000 that is Rs. 1800.

So, The entire 12% of employee contribution along with 3.67% of the employer goes to the EPF account. Whereas the remaining 8.33% of the employer contribution goes to Employee Pension Scheme.

Employees Provident Fund Organization

Above all, Employees who register for EPF are eligible for a much of benefits. These benefits ensure financial stability and security for employee.

The list of benefits that an employee can avail after registering with EPF scheme:

- The EPF offers a pre-fixed interest on deposits.

- 8.33% of employer’s contribution to Employee Pension Scheme making your retirement healthy and easy on maturity.

- The EPF also acts as an emergency fund in hard times or during times of unemployment.

- An employee can take a tax exemption for the PF amount under Section 80C of the Indian Income Tax Act.

- Earning through EPF are also tax-free up to 1.5 lacs.

- The EPF also allows partial withdrawal for higher education, constructing a house, wedding expenses, or medical treatment purposes.

Employees Provident Fund Organization

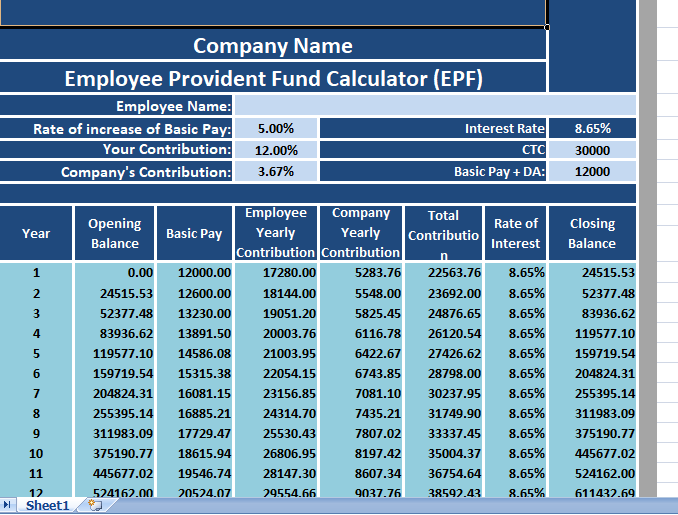

So, We have created an Employee Provident Fund Calculator in Excel with predefine formulas. You just need to enter a few details and sheet automatically calculates the PF up to 35 years.

Also, This template helps to calculate the year-wise contributions of employee and the employer along with yearly interest amount on Provident Funds.