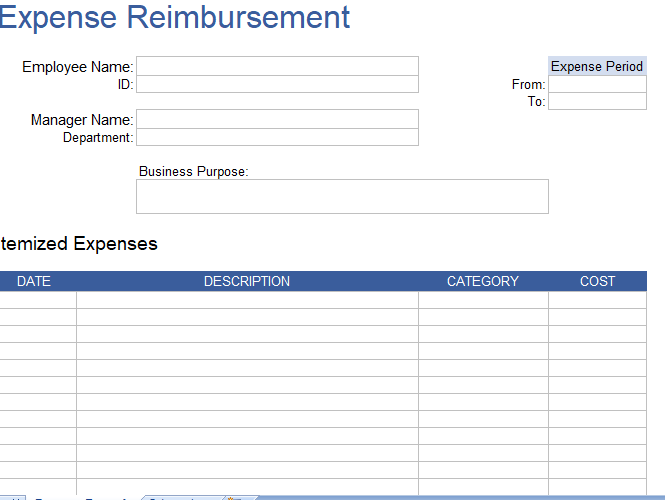

A expense reimbursement form is used by most every businesses. A new employer will soon realize they need a way to reimburse employees for general business expenses like office supplies, mileage, software, training fees, etc. For travel, you can use the Travel Expense Form or Mileage Tracker, but for these other expenses, a general expense reimbursement form will suffice. All you need is a simple spreadsheet for this type of form, so our Employee Expense Reimbursement Form below is just the thing. Moreover, you can also convert this expenses reimbursement form in pdf

Request for Reimbursement through pre defined form

This expense reimbursement request form was designed to allow employees to request reimbursement for general business expenses.

For travel-related expense reimbursement, use the Travel Expense Report. If you routinely use a vehicle for business purposes, download our Mileage Tracking Log.

Including digital receipts with reimbursement forms is becoming increasingly popular. Attaching electronic scans or photos of your receipts along with your form via email is an option. But, with this template you can insert images of your receipts below the form. Then you can print the form with the included receipts as a single PDF file.

For Employers

Customize the template as per your need, like travel expense report and then give a copy of the form to your employees when they need to submit a request for expense reimbursement. Make sure they know to attach a copy of their receipts. Remember to customize the list of items in the Categories worksheet and keep the mileage rate note up-to-date (see the references below for the current rates).

It would probably be good to write-up a short document that you can give your employees as a guide for what types of expenses you will reimburse and any other policies that you want to put into place (such as requiring an employee to get prior approval for any purchase over $XX).

Processing a Payment: For accounting purposes (assuming you are using an “accountable plan” – see IRS Publication 463), I find it simpler to write a separate check than to include the reimbursement in a payroll check. Employees may appreciate being reimbursed as soon as possible, instead of waiting for the normal paycheck. If you write a check, make sure to write Expense Reimbursement in the Memo field or otherwise indicate that the check is a reimbursement rather than a normal paycheck.

For Employees

For each expense, choose an appropriate category. If you have questions about how to use the form, ask your employer. Don’t forget to attach copies of your receipts.

Important: Keep a copy of your receipts and your reimbursement request form for your own records!

Business Meals: For business meals to be tax-deductible, there must be a clear business purpose, along with a receipt. You might include the purpose for the meal in the Description if you are listing many items on a single form.

Including digital receipts with reimbursement forms is becoming increasingly popular. Attaching electronic scans or photos of your receipts along with your form via email is an option. But, with this template you can insert images of your receipts below the form. Then you can print the form with the included receipts as a single PDF file.

New for Google Sheets: Google Sheets allows you to insert images into cells, so this could be done with receipts. However, GS currently doesn’t have a great way to easily view larger versions of the images within cells. This template uses a separate worksheet to allow viewing the larger versions of the images.