Most of us have had experience of going on a business trip, dutifully saving all of our receipts – meals, gas, dinners with clients, dry cleaning, and entertainment – for later reimbursement of expense report form.

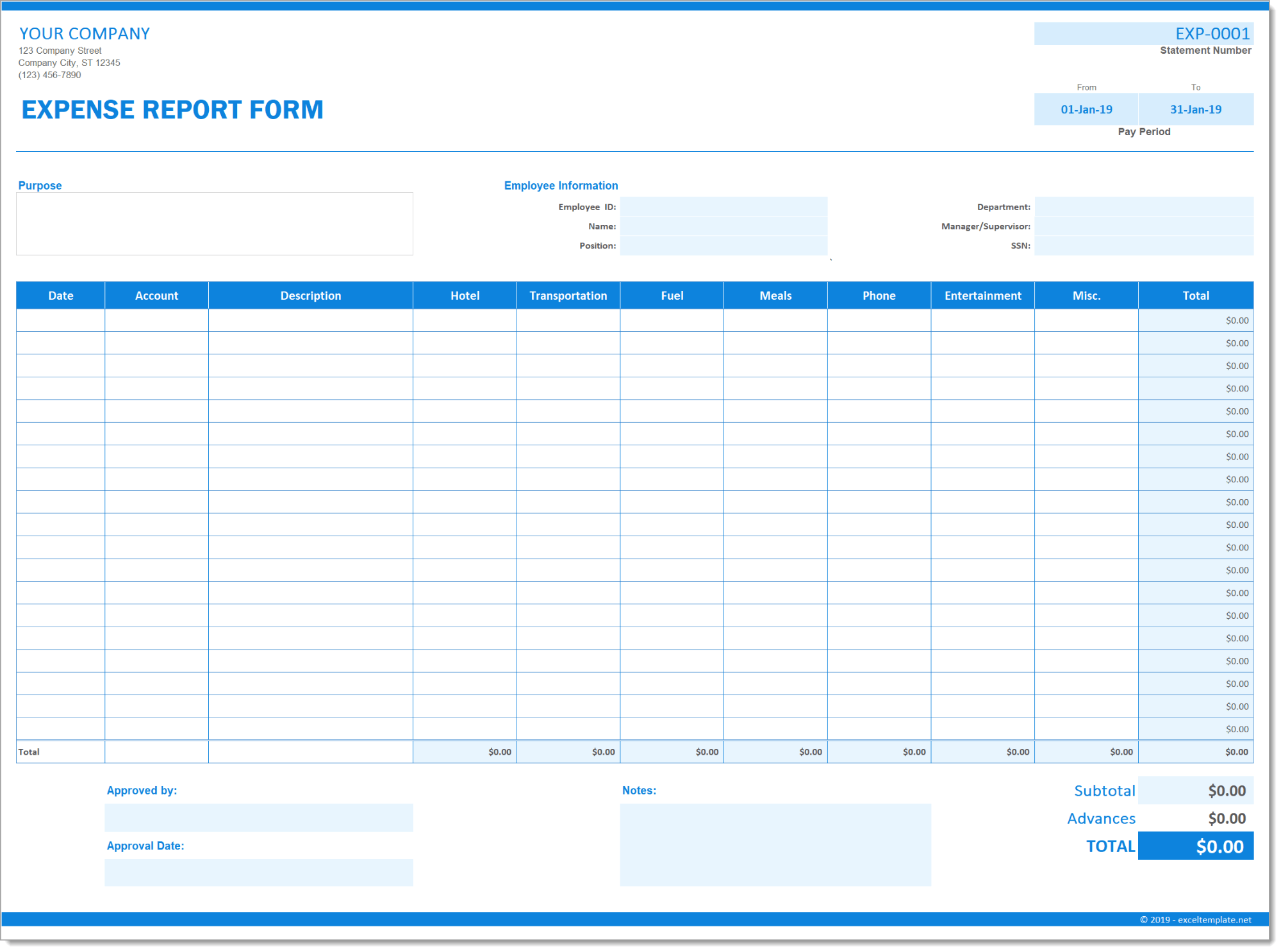

Expense Report Template

But then we get home. So, We dump out the pile of receipts we’ve accumulated and try to make some sort of order from the chaos. Thus, We pull out a notebook and start sorting the receipts, writing down the details that justify each expense. So, Through the fog of time, we try to remember the specifics of Tuesday’s dinner.

Then, we submit our somewhat less jumbled up pile of receipts to our manager or our accounting office. Moreover, We feel bad as they complain about the work we’ve added to their day, and we possibly argue about the expenses they can’t reimburse us.

So, as accountants and managers, we’ve all been in the position of having piles of receipts thrown at us in the hopes that we will make enough sense of them to pay our employees their due.

Travel Expense Report

If that sounds familiar, then our free Expense Report Form can help! For employees, it eases the pain of organizing travel expenses. For employers, it can double as your expense reimbursement form, or travel expense report. When all of your employees use a standardized form, it not only makes things easier for them, but it also makes the job easier for your accounting department. So, Once your employees create an expense report and submit it, with verifiable receipts, you can then use the form to directly reimburse employee expenditures.

And remember – business trips can be both productive and fun! Especially for employees who don’t travel full time. Also, They break up the daily work routine, help work feel more dynamic, and allow great opportunities for networking. Through interacting with peers or potential clients, business trips can remind us that there’s relevance in what we do outside the walls of our business office.

Business Expense Report Template

This Expense Report Form can be used as a digital document on your tablet or computer, or as a printout that you can take with you like worksheet – or both. Print out the worksheet, fill it in as the expenses happen, and then enter them into a digital version as you have time. The digital version will also auto calculate the total at the bottom of the report template.

Expense Forms

There is one spreadsheet in this simple Expense Report Form. This worksheet has a column for the most common expense categories. But, before you go on your business trip, make sure to read your employer-specific expense reimbursement policy. The expenses incurred during your travel, and recorded in this business expense report, are not necessarily reimbursable. So, before spending any money, it’s important to know what your employer considers “employee expenses”. What are “business travel expenses.” Also, it’s important to keep all cash and credit card receipts. You need the receipts as proof of payment for cash purchases and, even though credit card purchases will appear on credit card statements, some employers require receipts before reimbursing credit card purchases too. It should all be spelled out in your employer’s travel policy.

Travel Expenses Format

Now, whether you’re an employee or employer, you should have some ideas on how this Expense Report Form can help. As an employee, it can save you some frustration after the trip by reporting expenses – whether reimbursable or not. As an employer, adopting this reimbursement form can help you or your accounting department process travel expenses more quickly. A standardized form will help employees remember which line items are reimbursable, will make verifying their expenses faster to do, and will ease one of the more fraught interactions between employees and the company’s accountants.