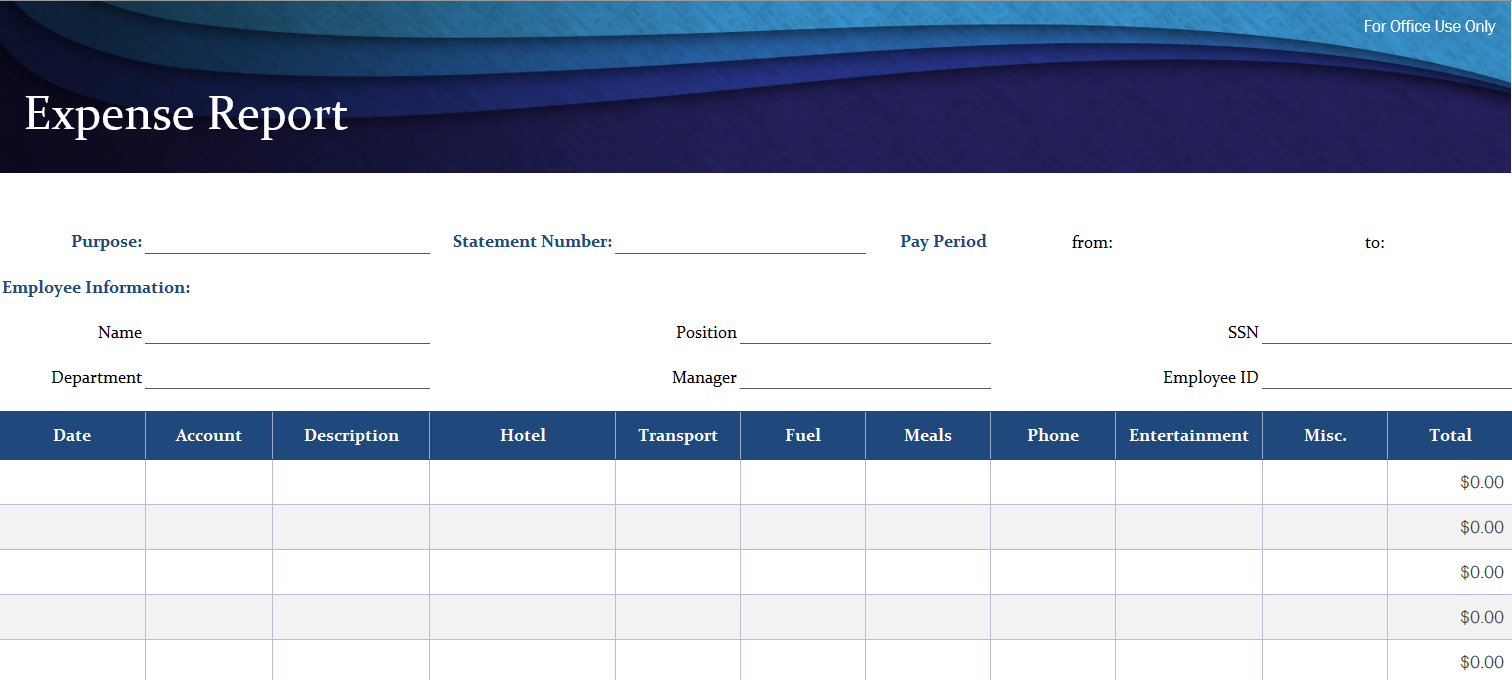

Download our user-friendly Expense Report Template in Excel and start organizing your finances today!

Keeping track of expenses can be a daunting task, especially when dealing with cumbersome manual processes or complex software. That’s where our free Expense Report Template in Excel comes in! This easy-to-use template is designed to help you efficiently manage your business or personal finances without any hassle.

We’ll explore the benefits of using our free Download Expense Report in Excel Template, and how it can make expense tracking a breeze.

- Save Time with Automated Formulas Our Expense Report in Excel Template comes with built-in formulas that automatically calculate your expenses for you. No more manual calculations or tedious data entry—just input your expense details, and the template will do the rest. This feature saves you time and ensures accuracy in your expense reporting.

- User-friendly Interface We understand that not everyone is an Excel expert. That’s why we’ve designed our template with a clean, intuitive layout that’s easy to navigate. Even if you’re new to Excel, you’ll have no trouble getting started with our Expense Report Template.

- Free to Download and Use One of the best things about our Expense Report Template in Excel is that it’s completely free to download and use. There’s no need to invest in expensive software or subscription services. Just download the template and start organizing your finances right away.

- Customizable to Fit Your Needs Our Excel template is fully customizable, allowing you to tailor it to your specific requirements. You can easily add, delete, or modify categories and fields to ensure that the template works perfectly for your unique needs.

- Improve Expense Tracking Accuracy With our Expense Report Template in Excel, you can easily monitor and categorize your expenses, providing you with a clearer understanding of your financial situation. This not only helps you make better-informed decisions but also ensures you don’t miss any important deductions or tax benefits.

- Ideal for Personal and Business Use Whether you’re managing your personal finances or overseeing a company’s expenses, our template is versatile enough to cater to both scenarios. It’s a simple and effective solution for individuals, freelancers, and businesses of all sizes.

Conclusion: Our free Download Expense Report in Excel Template is the perfect solution for anyone looking to simplify their expense tracking process. With automated formulas, a user-friendly interface, and full customization options, this template is a must-have tool for managing your finances. Download the template today and experience the benefits for yourself!