Gratuity Calculator Template in Excel easily calculate your gratuity amount as per the Gratuity Act 1972 in India.

Gratuity Calculator with predefine formulas helps you calculate the end of service amount also known as Gratuity.

All you need to do is to enter your last drawn salary and the total years of service and it will automatically calculate your gratuity amount.

What is Gratuity?

Gratuity is end of service benefits provided by an employer to the employee for the service rendered to the organization.

An employee is entitled to gratuity when he/she:

- Resigns

- Retires

- Laid off

- Death or Disablement

Eligibility Criteria For Gratuity

According to the Gratuity Act, an employee is paid gratuity if he/she completes a minimum service of 5 years in that particular company.

Furthermore, in case of death or disablement, there is no minimum eligibility period. Disablement means loss of the earning capacity of an employee. It is of two types; temporary disablement & permanent disablement.

Gratuity Rule For Terminated Employees

The employer can cancel gratuity payment of employee even though he/she has completed 5 or more years only if the following conditions:

“An employee facing termination due to disorderly conduct. Disorderly conduct mainly includes physically harming individuals during employment.”

Gratuity Payment Process

The gratuity payment process involves following 4 step process:

- Apply

- Acknowledgment

- Calculation

- Disbursement

Thus, the eligible employee must send an application to the employer to process his gratuity payment. The employer then accept the application.

Furthermore, the employer initiates calculation process and sends it to the concerned department for disbursement. Finally, the concerned department disburses the Gratuity to the employee.

Gratuity Calculation Formula

The formula to calculate Gratuity is as follows:

Last Drawn Salary X Total Years of Service X 15/26

Last Drawn Salary: Basic Salary + Dearness Allowance (DA)

Total Years of Service: Number of years of service in a company. The mathematical rule of point will apply here in calculating years.

End of service calculator

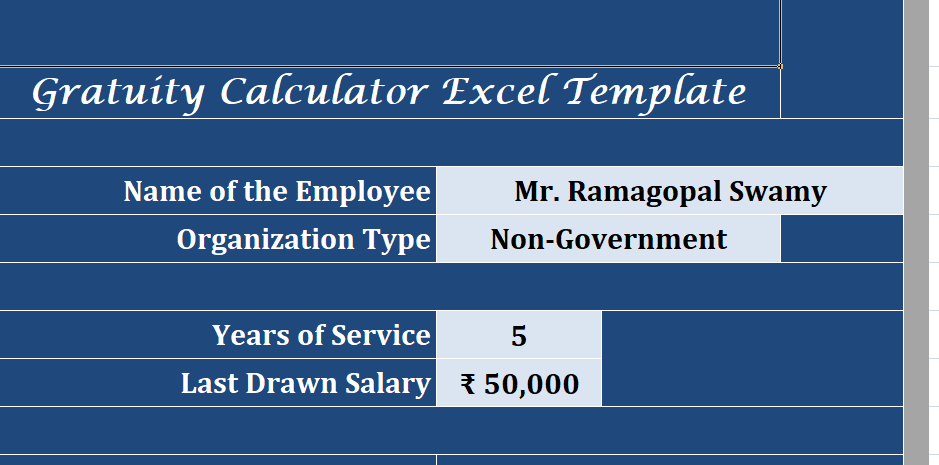

The template consists of 2 sections: Employee Information and Employee Gratuity Calculations

Employee Information Section

In this section, you need to enter name and your organization type. It can be government organization or a non-government organization.

Gratuity Calculation Chart

To calculate gratuity, you need to enter 2 main details: Last drawn salary and Total years of service. Applying the above-mention formula, the template calculates the gratuity for the given years of service.

The last drawn salary will not be a total take-home salary. It is only the basic salary in addition to dearness allowance.