With GST into effect from 1st July 2017, taxpayers are looking for ready templates in order to carry on with their activities. We have created a separate template for all types of GST Compliant Invoices and Vouchers in Excel.

We have gather together all types of GST invoices and vouchers in one file. Just download and start using them.

Contents of All-in-One Excel Template for GST Compliant Invoices and Vouchers Formats

This template consist of following 8 files:

- Tax Invoice

- Bill of Supply

- Receipt Voucher

- Payment Voucher

- Refund Voucher

- Debit Note

- Credit Note

- Delivery Challan

- Export Invoice

1. GST Invoice Format

Every registered business entity with GST will issue GST invoice whenever the supply of taxable goods or services takes place.

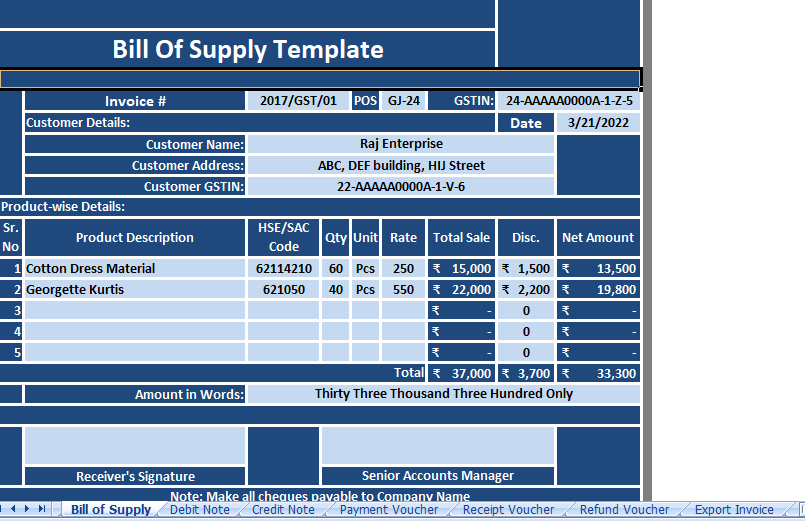

2. Bill of Supply

The GST Bill format for composition scheme holders and supply of non-taxable goods or services is the Bill of Supply.

3. Receipt Voucher

A receipt voucher is issued to when advance payment is receive. It is among the types of invoices and vouchers under the GST regime.

4. Payment Voucher

A customer who is liable to pay tax under reverse charge is require to issue a GST Payment Voucher at the time of making payment to the supplier.

5. Refund Voucher

Refund voucher is issue against refund of the advance payment when the supply of the goods services are not made.

6. Debit Note

However, The Debit Note is issue whenever the taxable value or tax charged in the original invoice is less than the actual invoice amount.

7. Credit Note

Moreover, Credit Note is issue against the return of the goods by the recipient or when the invoice is over billed.

8. Delivery Challan

Subsequently, Delivery Challan is issued in spite of tax invoice at the time of removal of goods for transportation for the purpose of job work, the supply of goods from primary office to branch etc.

9. Export Invoice

Further, An exporter issues an export invoice when goods or services are exported to another country.