We have receive requests from our readers for making Monthly GST Input Output Tax Report in which they can maintain and carry forward their previous month’s balance of ITC as well as reverse charge.

Contents of Monthly GST Input Output Tax Report

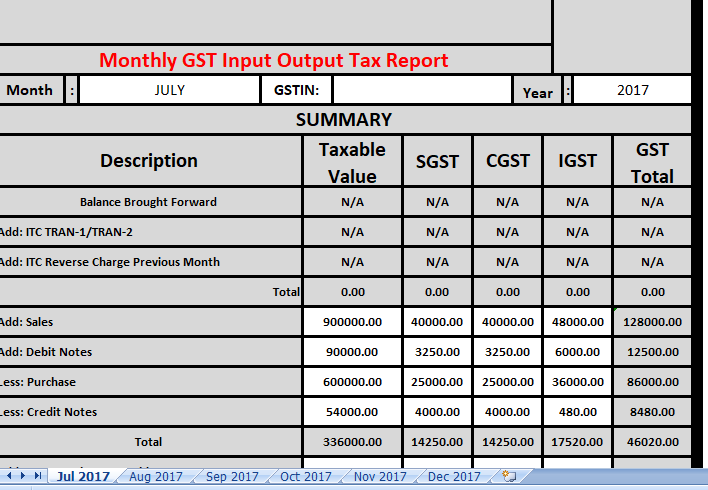

This template contains 6 files, one for every month from July 2017 to Dec 2017.

All 6 sheets have similar columns and rows and headings.

There is a little difference in the first file which is the month of July 2017. Reason being difference is that in the first month you will not have prior data.

It consists of column headings of SGST, SGST

There are 4 sections:

- Header Section

- Previous Month Balance and ITC

- Current Month Computations

- GST Payment and Balance Carried Forward

1. Header Section

Header section consists of your Company name, address, logo, and GSTIN.

2. Previous Month Balance and ITC

As mention the taxable value, SGST, CGST, IGST and GST total column are applicable to all the subheadings.

Previous Month Balance and ITC section consist of following subheadings:

Balance Brought Forward: Here the cells take data from previous sheet. They are link to previous sheets Balance Carried forward cells for SGST, CGST, IGST and GST total.

ITC from TRAN-1/TRAN-2: As you may have files TRAN-1/TRAN-2 form, you are eligible for availing the ITC on the sale of previous stocks. Enter these amount here.

ITC Reverse Charge of Previous Month: We all know reverse charge has to be paid in cash. Once it is paid in current month, you will get the ITC of the same in the preceding month.

You don’t have to enter the amounts here as this field is also link to previous month’s payment of the reverse charge.

Previous Balance and ITC Total: Total of all the above three subheadings are given here.

3. Current Month Computations

Either you can link the cells to sheet in which you have maintain the daily data or you can copy and paste to respective cells.

Data can easily copy as they are in the same format.

Current month Computations consist of following subheadings:

Sales: Enter the taxable value of sales, SGST amount, CGST Amount and IGST amount.

Debit Notes: Enter the taxable value of the Debit notes, SGST amount, CGST Amount and IGST amount.

Purchase: Similar to sales, enter the taxable value of purchases, SGST amount, CGST Amount and IGST amount.

Credit Notes: Similar to Debit notes, enter the taxable value of purchases, SGST amount, CGST Amount and IGST amount.

Total: (Sales + Debit Notes – Purchase – Credit Notes) – Previous Balance and ITC Total.

Current Month Reverse Charge: Apart from Sales and Purchase, a taxpayer also has to pay the reverse charge on purchase from unregistered.

Hence, The goods that are purchase for the furtherance of business then you are eligible for ITC. ITC is credit to your ledger in the preceding month.

This is amount is added you the total liability.

4. GST Payment and Balance Carried Forward

GST Payable Amount: In payment & Balance Carried forward section, if this is negative value it is credit with GST. If it is positive value then it is your tax liability which is to be paid to the government.

GST Paid: You need to enter the payment amount manually. Please note that if it is positive amount, full amount has to be paid. If you don’t pay the full amount, interest and late fee will be applicable.

Balance Carried Forward: It is the end balance of GST. Any amount in the cell will carry forward to next month’s sheet as Balance brought forward either negative or positive.