GST TRAN-2 return is filed by a dealers who are currently registered under GST but were previously unregistered VAT/Excise.

Henceforth, these dealers do not have invoices with VAT or excise to support the claim. The Government has given provision for transitional input for such dealers in GST TRAN-2.

So, GST TRAN-2 will not be filed by manufacturers or service providers.

Those dealer/traders opting for GST TRAN-2 will file this return at the end of each month

A dealer should match the following conditions:

- Goods in stock are not NIL or fall under the exempt category under VAT and Excise.

- This scheme will be operative for 6 months starting from the 1st of July 2017 and 31st December 2017.

- Such stock need to clear within this duration of 6 months to claim the credit.

- Documentary proof is present to prove the procurement of such goods.

- Such stock of goods on which the credit is claim must be store in a way that it can easily identify.

- We have created a copy of GST TRAN-2 form in Excel to help businesses claim the credit on the pre-GST stock.

Contents of TRAN-2 in GST Excel Template

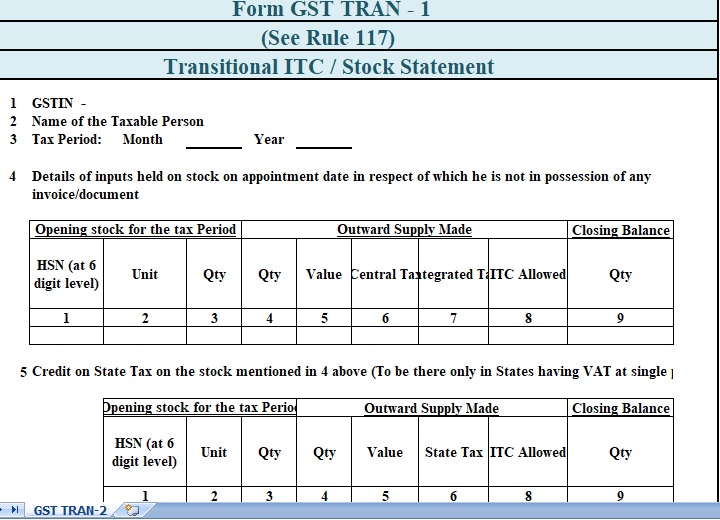

This form GST TRAN-2 consists of 5 main points as mentioned explained below:

1. GSTIN

Your GSTIN number.

2. Name of Taxable Person

Your registered legal name in full.

3. Tax Period

The period for which you are filing return in terms of month and year.

4. Details of inputs held on stock on appointment date in which he is not in possession of any invoice/document evidencing payment of tax carried forward to Electronic Credit ledger.

5. Credit on State Tax on stock mention in 4 above (To be there only in States having VAT at single point)

In this section, you have to record any credit of VAT on such stock. There are similar columns as in point 4. There we have 9 columns and here we have 8 columns.

Difference is only column 7 where the amount of SGST on sold goods will be mentioned.