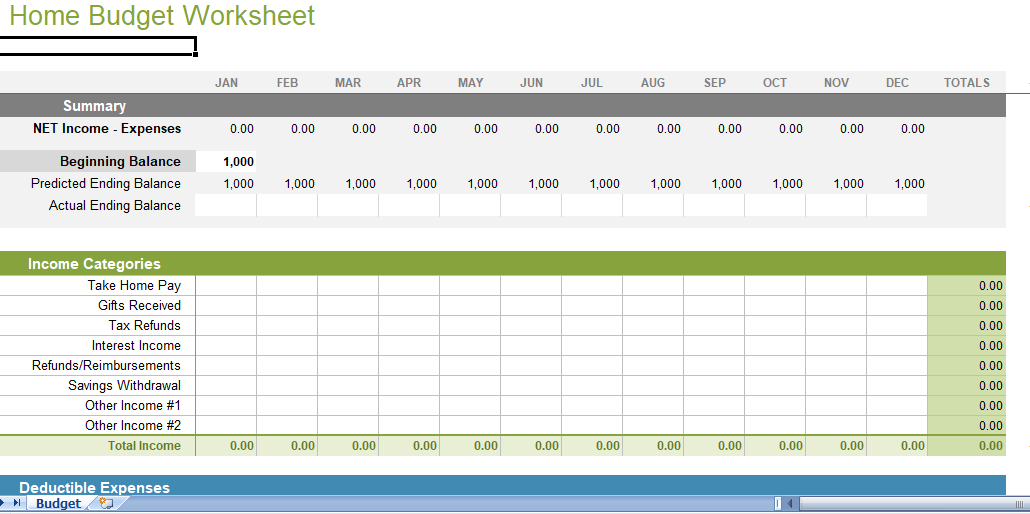

Home Budget Worksheet is a very simple solution for creating a yearly budget. It is designed to help you make predictions about your future financial situation. However contains a fairly comprehensive list of income and expense categories. It is very easy to customize the list for your specific use.

House expenses excel sheet

This Home budget worksheet makes it easy to create and update your own home or family budget. Customize the categories and use it for planning your family and personal expenses.

One of the unique things about this home budget is that the expenses are group into two main categories: deductible expenses and non-deductible expenses. Whether an expense is tax-deductible and how to deduct the expenses are details not addressed by the spreadsheet. This worksheet is based on the Excel 2003 version.

We also have for you some newer budget worksheets for you to try, such as the Family Budget planner. If you’d like a way to create and manage your budget, try the new yearly Budget Calculator or our all-in-one Money Management Template.

Using the Home Budget Worksheet

Why Use Excel for your Family or Personal Budget? Using Excel when working with my budget because that it gives me the flexibility to keep track of the information the way I want to.

I recommend using this Quicken to keep track of your expenses, or your budget projections will end up being only mere guesses. Make sure that you set up the Quicken categories the same as in your spreadsheet, or vice versa. That makes it easier to compare the spreadsheet to Quicken reports.

After each month passes, enter your actual balance in the summary section of the worksheet. If the actual balance is much different from the prediction, try to figure out why, and you may want to adjust your worksheet to reflect your actual income and expenses for the month.

How do I calculate my “actual balance”? What you include in the balance is up to you, but I usually just add up the balance of my checking accounts and then subtract the balance from credit card accounts. In other words, I don’t include investments, retirement, or savings accounts in the balance. I treat transfers to savings as expenses for home budgeting purposes.