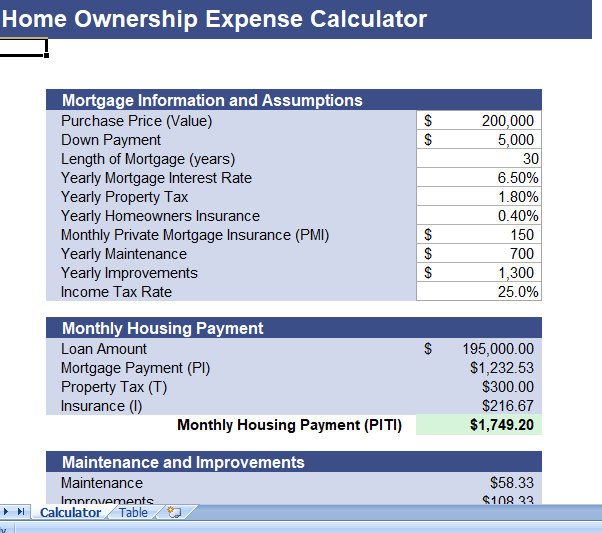

When looking for a home to buy, one of the main questions is “What can I afford?” at home. This is different than the question of “What size of loan do I qualify?” After reviewing your finances you find that you can afford to spend $1200 a month on housing. It is not just loan payment that is important to consider, but also property tax, insurance, maintenance, and home improvements. This Is Home Expense Calculator.

House Expense Calculator

How much home can I afford? This spreadsheet helps you answer this question by taking into account the mortgage payment (Principal + Interest), property Taxes, and Insurance (PITI) and also maintenance and home improvements into your account.

True Cost of Home Ownership Calculator

The Home Ownership Expense Calculator spreadsheet help you estimate the monthly cost of home ownership. It is one of the main considerations in deciding what home you can afford according to finances.

Home Expenses Included in this Calculator

Property Tax

Thus, Annual property taxes are often base on a percentage of the property value. The average is around 1.8%. Moreover you should call your Tax Collector’s office in city where you plan to buy the home for more information.

Homeowners Insurance

This type of insurance is meant to cover the dwelling, personal property, personal liability, etc. The annual cost of homeowners insurance is often estimate as a percentage of property value, averaging about 0.4%.

Private Mortgage Insurance (PMI)

Many lenders require PMI when down payments are less than 20 percent of purchase price.

Maintenance and Improvements

Maintenance: This includes repairs such as fixing plumbing, painting, or paying to have lawn mowed and weeds pulled. Thus, When selling your house, maintenance costs are not tax deductible.

Improvements: Although you might not spend this amount every year. Improvements such as roof replacements, remodeling, additions, etc. need to be budgeted. Money spent on some improvements may actually be tax deductible when selling the home, so keep receipts.

A rule of thumb for annual cost of maintenance and improvements is 1% of the purchase price.

Tax Adjustment

If you are itemizing deductions on your tax return, then you will be able to deduct mortgage interest and property taxes. Consult with an accountant to determine what’s your tax rate will be and whether you need to take the standard deduction instead. Many first-time home buyers find it better to take standard deduction their first year, particularly if the home is not purchased until the middle or end of the year.

The spreadsheet includes an estimate of tax adjustment, base upon multiplying the combine federal/state tax rate by monthly mortgage interest and property tax. This is only an approximation, because the amount of mortgage interest changes with each payment.