How much house can I afford ? That is a questions that arise when people is planning to buy a new house. When people is looking for a new house to buy. There are two things regarding financial issues that they usually considered. Hence, The first one is front payment which consist of down payment and closing cost. Thus, The second one is the monthly mortgage payment. They consider these things because they have to see their personal financial situation if they have enough money to pay both payments and make house affordability calculator.

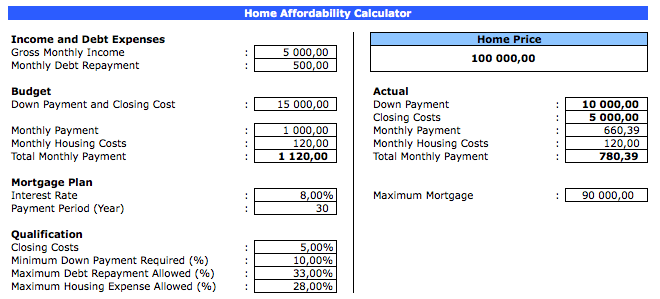

Home Affordability Calculator

Usually they consult with their financial advisors or they just go to bank or financial institution to find out whether they can afford to buy a house based on their financial situation. This house affordability calculator will help you to get an estimate figure about your affordability on buying a house.

Home Loan Affordability Calculator

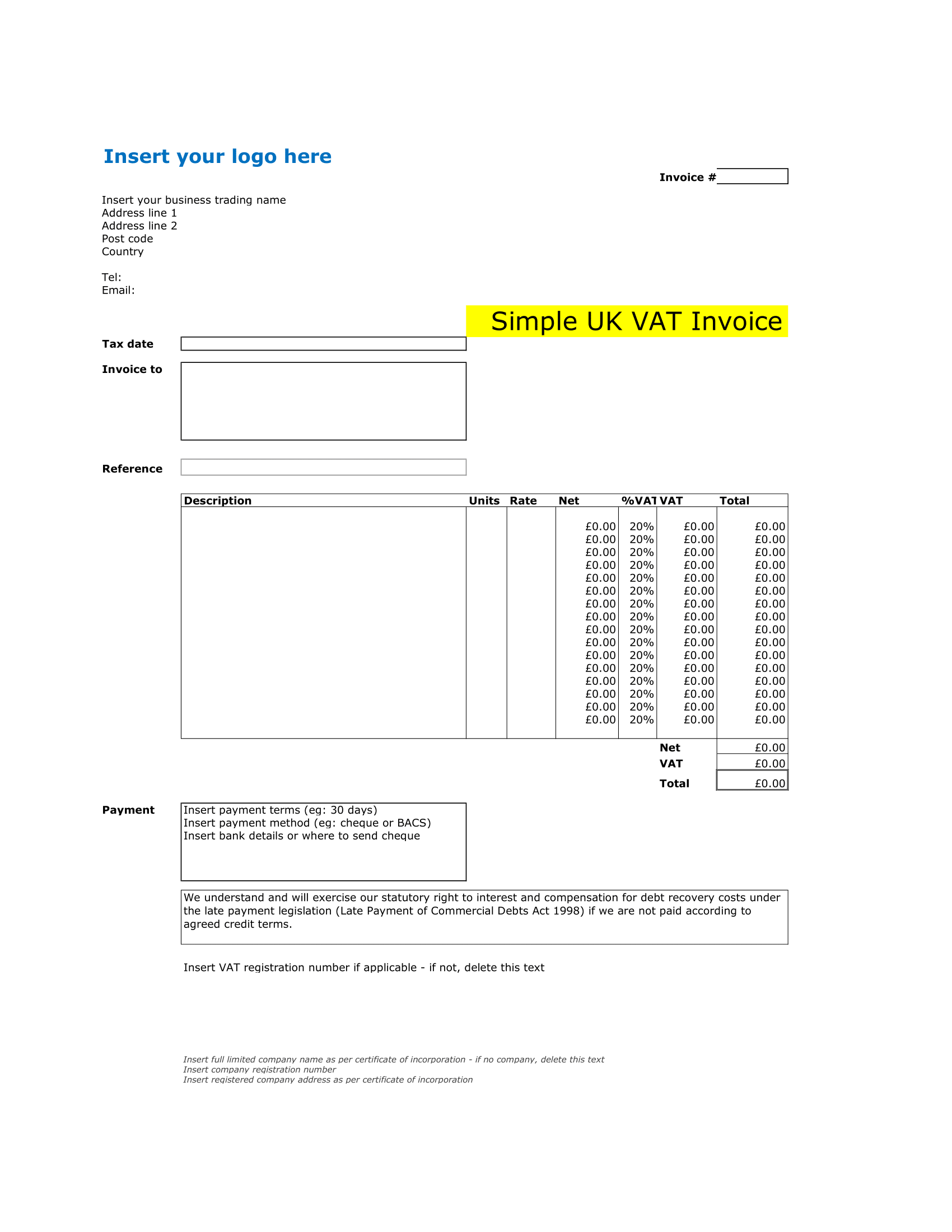

This spreadsheet consist of two worksheets. The first worksheet is a simple house affordability calculator that will help calculate house price quickly based on your expected monthly payment. Just fill your targeted interest rate, loan payment period and expected monthly payment and house price will be revealed with a help of excel built-in function.

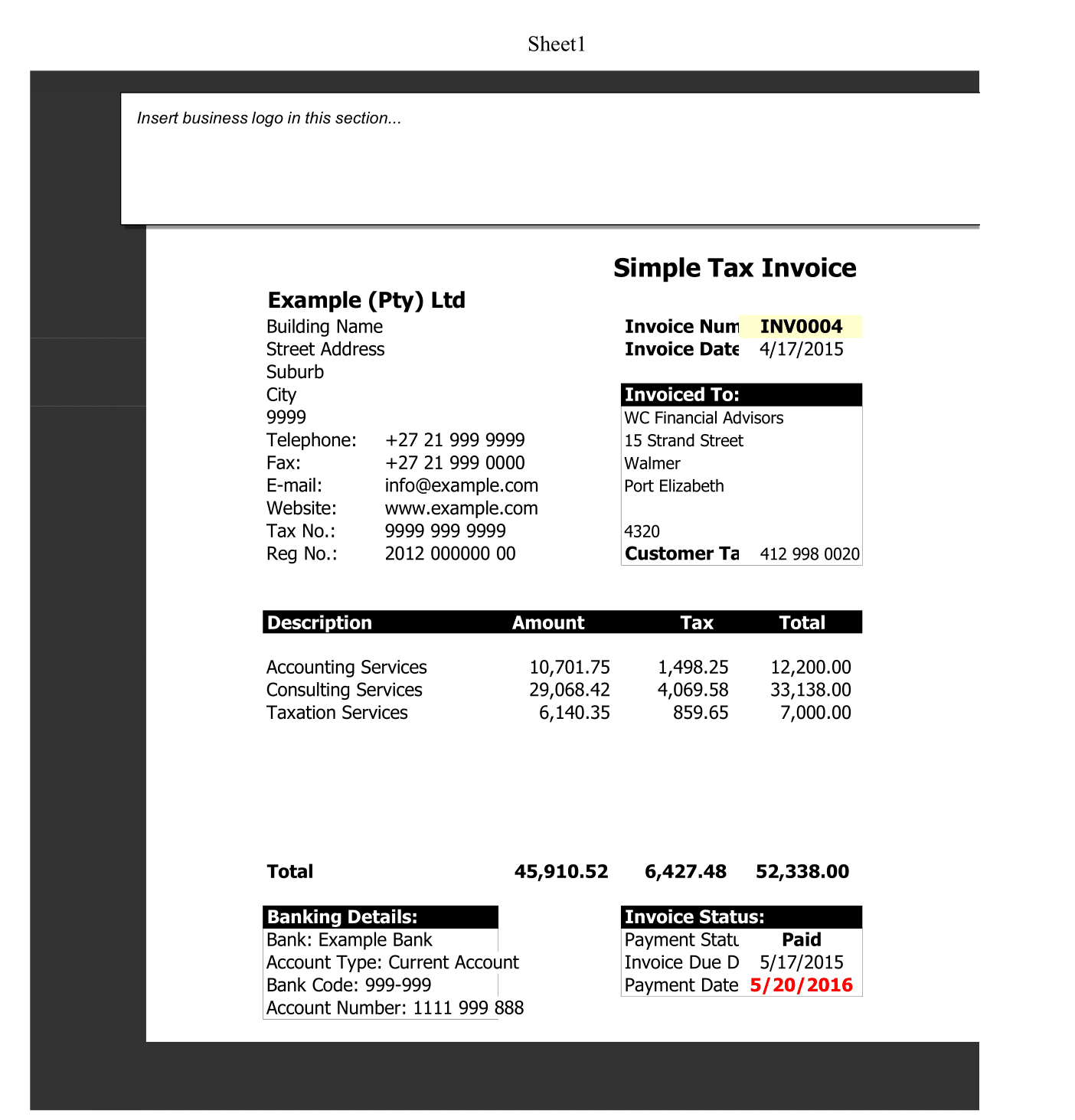

Moreover, The second worksheet is more detailed house affordability calculator, where you have to fill some detail information regarding your financial condition and your budget, your mortgage plan and bank or financial institution qualification. This calculator will calculate the optimum house price based on the closest conditions you can achieve mortgage calculator based on income.

Thus, Short description regarding each cells in this worksheet are as follows :

Income and Debt Expenses

- Gross Monthly Income : Your gross income per month

- Monthly Debt Repayment : Your debt obligation that you may have to pay monthly, for example your credit card loan, student loan, car loan etc.

Budget

- Down Payment and Closing Cost : I think you know what down payment actually means. And closing costs are any costs that arise in house transaction, like legal fee, administration fee, taxes etc.

- Monthly Payment : This is expected monthly mortgage payment

- Monthly Housing Costs : These are other housing costs in addition of your mortgage, like insurance, that you have to pay monthly along with paying your mortgage payment

Mortgage Plan

- Interest Rate : This is your expected interest rate based on bank or financial institution interest rate

- Payment Period : This is the period (in year) that you plan to payoff your mortgage

Qualification

- Closing Costs : Check your bank or financial institution qualification for minimum closing costs. I put 5% from the house price.

- Minimum Down Payment Required : Check your bank or financial institution qualification for the minimum down payment needed.

- Maximum Debt Repayment Allowed : Check your bank or financial institution qualification for maximum percentage of debt repayment allowed from your gross income. The total of your debt repayment + house payment cannot exceed this number.

- Maximum Housing Expense Allowed (%) : This number will limit the amount of your monthly expenses that has been budgeted for paying your monthly mortgage.

After you finish filling the left part of this worksheet. You can see your affordable house price including the detail of down payment. Closing cost needed along with allowable monthly payment.