A family budget is a record that summarizes a plan for a family’s finances, serving as a guide for how much you spent on various fixed and variable costs. You can prepare a family budget for a month and a year as well. Although, there are plenty of consultants and applications available to help you develop your budget. However, We do not recommend you to do that, as it will involve unnecessary cash outflow. So, it is better to use our free excel template to manage your expenditure budget or family budget.

Further, If you earn well but are unable to save. Have no idea where all your earnings are spent. You are sometimes forced to borrow money to pay your bills. If any of these things apply to you, it’s time to write down a household budget on a spreadsheet.

How to plan your financial budget and save money?

If you want to create a successful monthly budget you must include budget categories or buckets of income and expenses. You can get all the detailed things you like with your budget categories. To make things easier for you.

Categories you can include are

Essential Expenses 70%

- Food

- Life Insurance

- Housing

- Utilities

- Education

Savings 20% - Invest in Mutual Funds

- Life insurance

- Accidental Death Insurance

- Emergency Funds

Other Items 10% - Entertainment and Mobile

Keep it Flexible and set limits to your categories

Categories aren’t just all of your expenses, though but also used to track your income.

How to use Household Budget Spreadsheet?

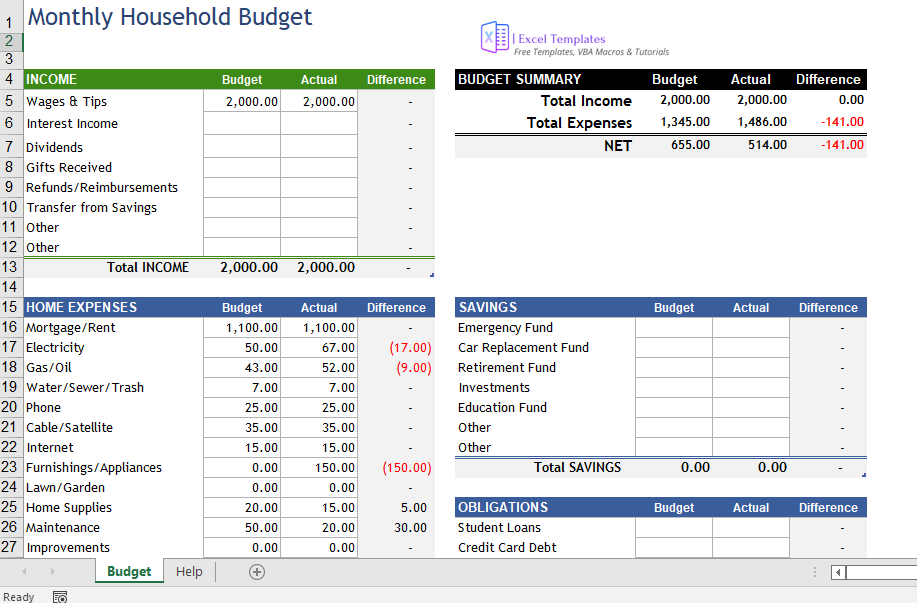

To use this spreadsheet, fill in the cells like (the “Budget” and “Actual” columns). You can replace the values in the Household Expenses category with your own. To prepare a budget, You must know about “How to Budget” and you can see this in our other Spreadsheet as well.

This worksheet is to help you compare your monthly budget with all your income and expenses. You can document your proper budget for each category in the “Budget” column. This serves as your goal – you’re trying to spend more than this amount. At the end of the month, you mark in the “Actual” column how much you spent during the month and a year.

In this spreadsheet, the calculations are set up in Positive and Negative to see your total spending. If calculations show negative numbers are bad. That means you’re spending more than your budget, the Projected values will be negative, and if your Actual income is less than your Projected income, the difference will be a negative number.

The Monthly Household Summary table totals up all your income and expenses and calculates as the Income minus Expenses. If your total is negative then you’re overspending from your monthly income.

You can add or remove categories. But make sure not to mess up the calculations and formulas.