How to Save money for future by Using Free Home Budget Excel Template

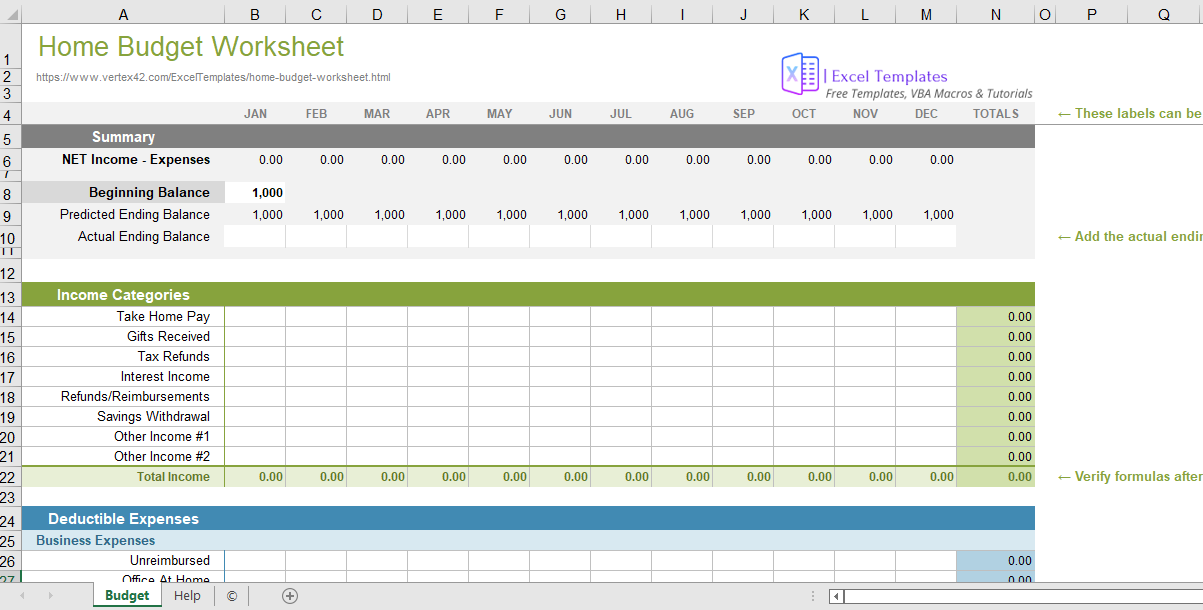

Home Budget Excel Template is an formula driven editable excel file. This worksheet makes your life easy, it helps to monitor your monthly family expenses. There are various categories which you can customize it as per your need. You can use it for planning your family and personal spending.

One of the unique things about this particular home budget is that the expenses are grouped into two main categories: deductible expenses and non-deductible expenses. Whether or not an expense is tax-deductible and how to deduct the expenses are details not addressed by the spreadsheet (ask your accountant about tax-related issues).

It is important to Save money and have debt free retirement life

Planning a home budget is one of the most important steps any homeowner or family needs to take to ensure their financial health. If you don’t have a solid plan to monitor your monthly cash inflows and outflow. Then your spending will in excess your savings. Thus, you fall in trap of debt burden. That’s why we’ve simplified the process of creating a household budget into four easy-to-follow steps:

- Sum up your monthly income.

- Less your monthly expenses.

- Factor in discretionary expenses.

- Make your adjustments and identify avoidable expenses.

Budgeting and monitoring is critical for financial well-being of your family, but it also matters down the road. In case, you are trying to start a college savings fund? or Looking to secure your retirement?. Then home budget planning and long-term financial management go hand in hand.

Here’s how to begin:

1. Sum up your monthly income

Your budget starts with your earnings on a monthly basis. It includes, Salary, Investment return, Interest earned from Fixed Deposit. You should also combine income of your spouse as well. You should have clarity on what you are taking back to your home.

2. Less your monthly expenses

Identify all or your fixed monthly expenses. Do not miss anything like:

- Monthly debt payments.

- Expected credit card payments.

- Mortgage payments.

- Utilities.

- Food and drink.

- Household goods.

- Living essentials.

- Car insurance.

- Retirement contributions.

- Anything else.

Not only is this comprehensive accounting important to the numbers but also to your overall understanding of where your money goes. Using a Home financial budgeting spreadsheet or app can help automate some of your recurring tracking.

3. Factor in discretionary spending

After deducting monthly expenses, you should also continue to subtract your discretionary spending. Basically, variable expenses, like dining and ordering out or entertainment.

4. Make your adjustments and identify avoidable expenses.

If you have balance money left, wonderful. You can use it for paying your debt. This will enable you to reduce your debt easily. Thus, enable you start investing and earn money. Moreover, If your savings is negative, it’s time to make changes.

If in the latter camp, start with adjusting your discretionary spending. Cutting back on takeout can save a lot more than you might think.

Also, consider your monthly expenses: Would a smart thermostat help control energy costs? Can you consolidate debt repayment or refinance student loans? Even if you’re in the black, planning a monthly budget can clue you into new areas where you can save.

How personal budget planning is linked to long-term financial goals.

Budgeting should be important part of your life. You should Segregate your expense categories while you plana home budget. So, that it gives you precise insight into your financial health. However, you should not to forget their value outside the immediate time frame. Means, your long-term financial goals should be align objectives

While long-term financial planning is undoubtedly different from home budget planning. There are intersections between the two. For instance, it helps to know what monthly retirement account contributions you make as you plan out your golden years and what you will need to live comfortably. If you need to increase those amounts, finding ways to trim discretionary spending through a home budget plan is a simple way to prioritize long-term goals. When you have a home and family to look after, the links between near-term budgeting and long-term financial well-being are clear.

The same workflow can be applied to any type of savings families want to increase or establish. Emergency funds are necessary to maintain, but often at the very end of the considerations list. College may seem incredibly far down the road, but wait too long to start saving and challenges arise. When you have a full picture of your current finances and your future goals, you can more easily marry the two: And it all starts with planning a home budget.

If you are looking for professional help to align your spending and financial means, as well as plan for long-term goals, talk to Comerica Bank today. Getting further personal financial advice can help you make the most of your budget. When you are saving to apply for a mortgage or another type of loan, there is no greater benefit than knowing how it factors into your monthly spending. Start your home budget today, and consider contacting us for more information on how we can help plan your personal finances in other ways.