An income statement or profit and loss statement is an essential where the key value in the report is known as Net Income. For instance the statement summarizes a company’s revenues and business expenses to provide the big picture of the financial position . The income statement is typically used in combination with a balance sheet statement.

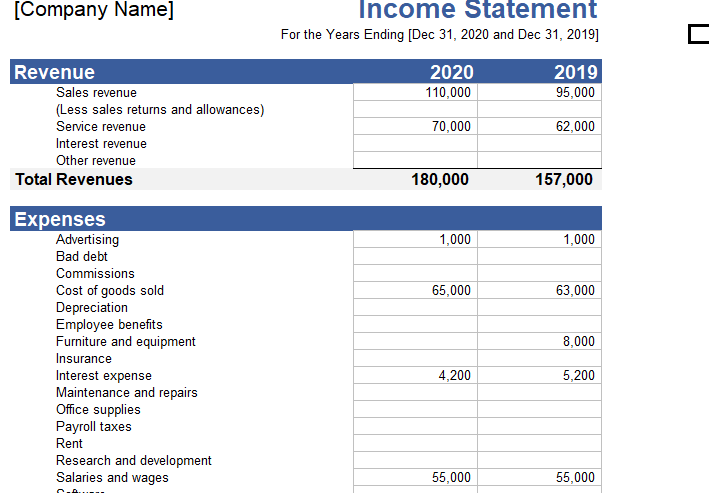

Multi step income statement example

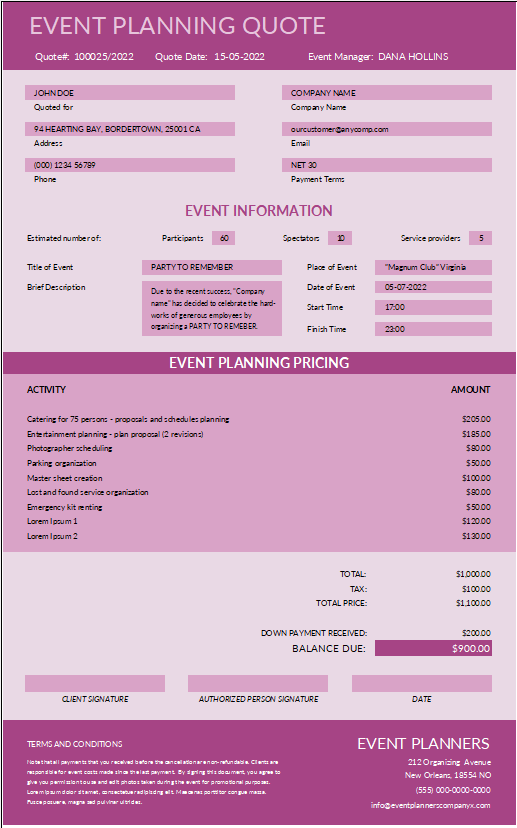

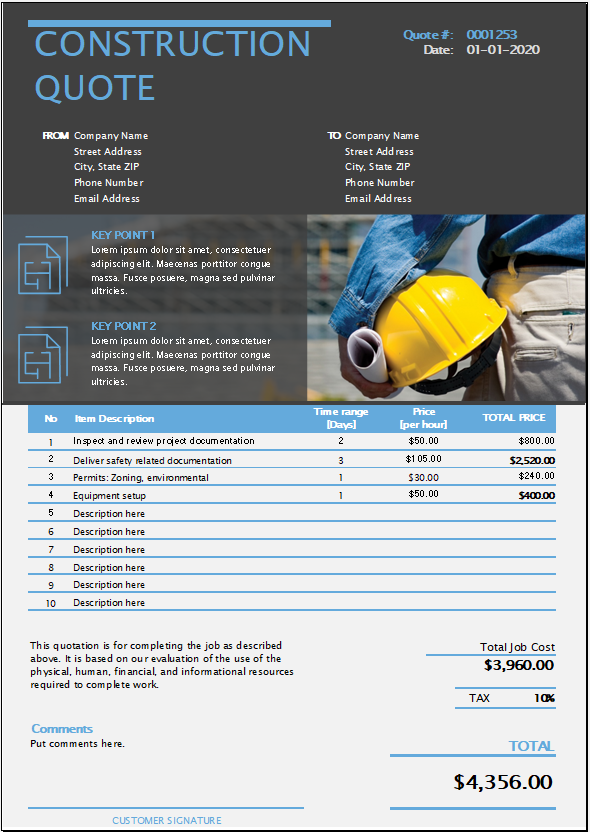

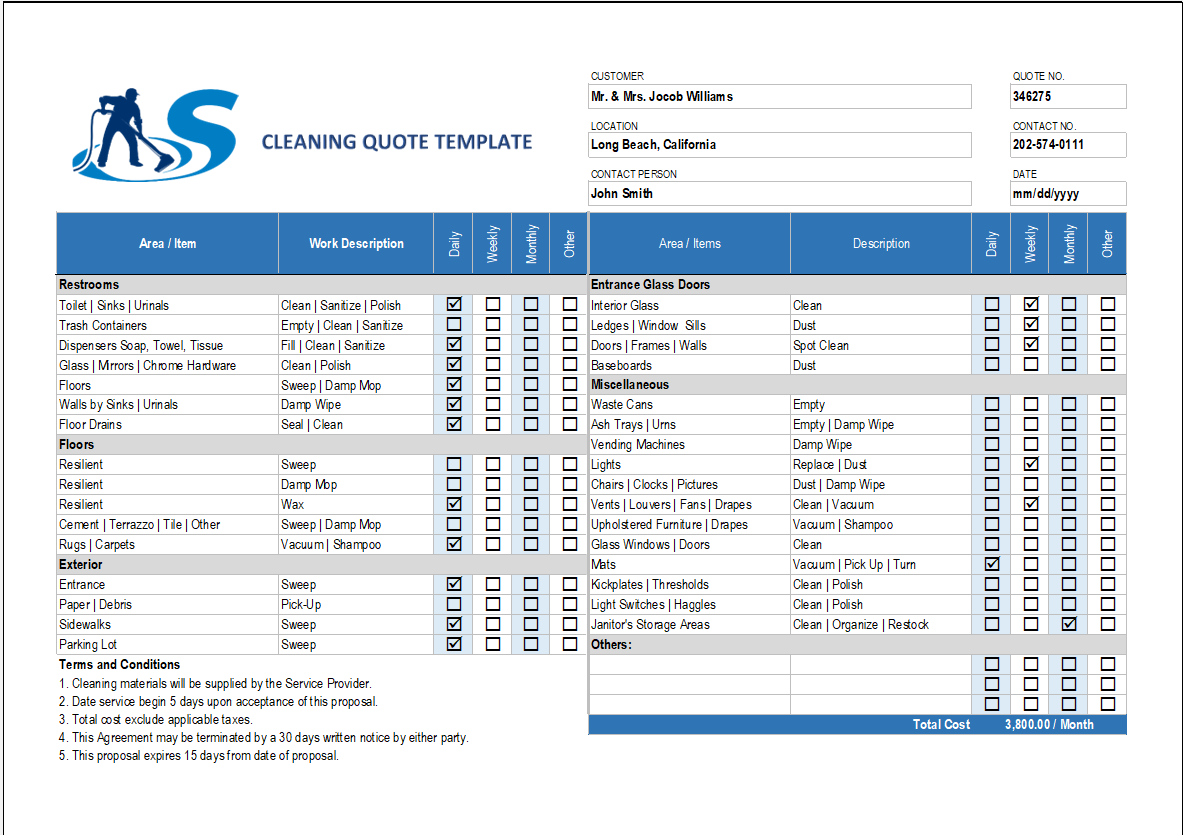

There are many ways to format an income statement. The two examples in the template are meant mainly for small service-oriented businesses or retail companies.

(1) The simplified “single-step” income statement groups all of the revenues and expenses, except the income tax expense.

(2) The “multi-step” income statement example breaks out the Gross Profit and Operating Income as separate lines. It first calculates the Gross Profit by subtracting COGS from Net Sales.

Certainly, It calculates the Operating Income and then adjusts for interest expense and income tax to give the Income from Continuing Operations.

Income statement template in excel

most importantly income statement template is for the small-business owner and contains two example income statements. The first is a simple single-step income statement with all revenues and expenses lumped together.

On other hand the second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income.

Formula For Net Income

Net Income = Total Revenue – Total Expenses

What is Revenue?

Revenue is the money generated from normal business operations, you can calculate as the average sales price times the number of units sold. It is the top line (or gross income) figure from which costs are reduce to determine net income. Revenue is also known as sales on the income statement.

In addition the income that provides a service are

- selling a product, earning interest on investments,

- renting extra office space,

- licensing technologies,

- selling advertising space,

- licensing the use of your brand name.

Meanwhile, there are categories for Sales revenue, Service revenue, Interest revenue, and Other revenue. You will likely want to customize the Revenue section to highlight your company’s main sources of revenue.

Cost of Goods Sold Formula

For a retail company, one of the main expenses is the cost of goods sold. However, Cost of Goods Sold broken out into its own section, with Gross Profit calculated as the Net Sales minus Cost of Goods Sold.

The cost of goods sold is by adding beginning inventory, goods purchased, raw materials and direct labor for goods manufactured, and then subtracting the ending inventory.

For service businesses, COGS might not be such a large factor, so that is why the Single Step worksheet doesn’t have a separate COGS section.

COGS = Opening Inventory +P − closing Inventory

where

What Is an Operating Expense?

An operating expense is an expense a business incurs through its normal business operations. Often abbreviated as OPEX, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development.

- An operating expense is an expense a business incurs through its normal business operations.

- Often abbreviated as OPEX, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development.

- The Internal Revenue Service (IRS) allows businesses to deduct operating expenses if the business operates to earn profits.1

- By contrast, a non-operating expense is an expense incur by a business that is unrelated to the business’s core operations.

Operating Income (EBIT)

Meanwhile ,In the multi-step ,the operating income is the Gross Profit minus the total Operating Expenses. Usually, interest expense and income tax expense are not operating expenses, which gives rise to the term EBIT or “earnings before interest and taxes” – another name for Operating Income.

Income from Continuing Operations

This is the “bottom line”, as the Operating Income minus interest expense and income tax (and plus/minus non-operating revenues, expenses, gains, and losses, if there are any). If there are no “below-the-line” items, then this is the same as the Net Income.

Below-the-line Items

Some forms of income, such as the sale of a building you are no longer going to be using, are “below-the-line” because they may not expect to occur in the future. In short these include the effect of accounting changes, income from discontinued operations, and extraordinary items.