Loan Comparison Calculator is a ready excel template to compare multiple scenarios. Comparison is based on 4 different criteria; interest rate, installments, repayment duration and total repayment.

In addition to above, the template represents the comparison in graphical format. Moreover, it also consists of an EMI calculator and loan amortization schedule with loan foreclosure/prepayment provision.

Choosing between multiple loans is very confusing at times and if you are new, then it just becomes more confusing. Many times, lender makes it more complicated by using difficult terminology instead of simple terms.

The best part about this template is an individual can compare multiple scenarios for a personal loan, mortgage loans, auto loans, and even private lenders.

Mortgage Calculator Comparison Excel Template

We have create a simple and easy Loan Comparison Calculator Excel Template with predefine formulas. Just enter few details for each loan scenario and it automatically compares all loans for you.

Furthermore, this template also provides a loan amortization schedule for all scenarios. The template compares the loans of interest to be paid, total repayment amount, repayment duration and installment amount.

Contents of Loan Comparison Calculator Excel Template

This template consists of 3 sheets; Loan Detailed Sheet, Amortization Schedule, and Loan Comparison Calculator.

Loan Details Sheet

You need to enter following details for each loan:

- Loan Start Month

- Loan Amount

- Period (Years)

- Interest Rate

- Processing Fees

- Foreclosure Charges

The prepayment table is later used during loan repayment. If you make any payments higher than your EMI then you need to enter here.

When you make any prepayment foreclosure charges will be applicable as it decreases number of installments or tenure.

Thus, fill same for all the loans you want to compare. You can compare up to 3 loans in this sheet. If you want to compare more, then you need to insert more column accordingly.

Amortization Schedule

You don’t have to make any entry in this sheet. Amortization Sheet displays EMI serial numbers and dates on the right hand side. Additionally, it consists of complete month-wise repayment schedule until loan amount is 0.

It displays schedule for all three loans according to their tenure. The table consists of following columns:

Interest Amount

Prepayment Amount

Principle Amount

Balance Loan Amount

This sheet can calculate your loan installments for up to 30 years. It displays amortization schedule for all 3 loan scenarios with comparison rate.

Loan Comparison Calculator

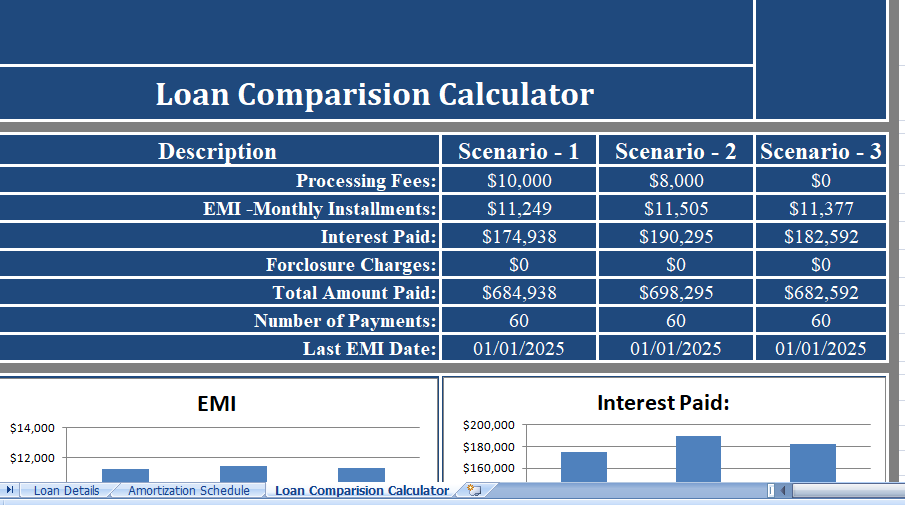

This sheet consists of a table that displays the summary of all the three loans. It consists of the following details:

Processing Fees

EMI-Monthly Installments

Interest Paid

Foreclosure Charges

Total Amount Paid

Number of Installments

Last Date of EMI

This sheet fetches the processing fees, EMI-Monthly Installment Amount, the number of installments, Interest paid, and last date of payment from the previous sheet.

Moreover, Total interest paid is the amount paid including the processing fees, principal amount, interest amount, and foreclosure charges if applicable.

Compare the Market Mortgages

Above all, The last sheet consists of a graphical representation of the loan comparison. It compares on the following 4 criteria: Number of Installments, Installment Amount, Interest Amount and Total Payment Amount.