Every company, irrespective of size, gain profit from having a petty cash log fund as part of its accounting process to pay for small expenses. Companies have petty cash account to manage the company’s dealings. It becomes easier to track tax-deductible costs and to separate business expenses from personal expenses. So, it is important to understand petty cash to more precisely and effectively keep track of the company’s finances.

What is Petty Cash book?

A petty cash fund is a small amount of a company’s money, often kept on (e.g., in a locked drawer, envelope or box). to pay for smaller or incidental expenses, such as office supplies or employee refunds. A petty cash fund undergoes cyclic reconciliations (a process that compares sets of records) and then transactions record the financial statements. In larger organizations, each department has its own petty cash funds.

What is imprest system of petty cash book or why companies use Petty Cash Log?

Petty cash tool assures small dealings for which issuing a cheque or company’s credit card is unreasonable.

The amount of money for petty cash changes, many companies keeping between $500 and $800 as a petty cash fund.

For instance, setting up a petty cash fund allows companies to maintain the account for their expenses with a minimal cost rate.

the manager is responsible for controlling the petty cash fund and tracking the disbursements made from the funds. The petty cash fund is usually large enough to cover fundings for one month

Examples that petty cash fund is used for:

- Cards for Customers

- Office Supplies

- Paying for a created dinner

- Reimbursing an employee for work-related expenses

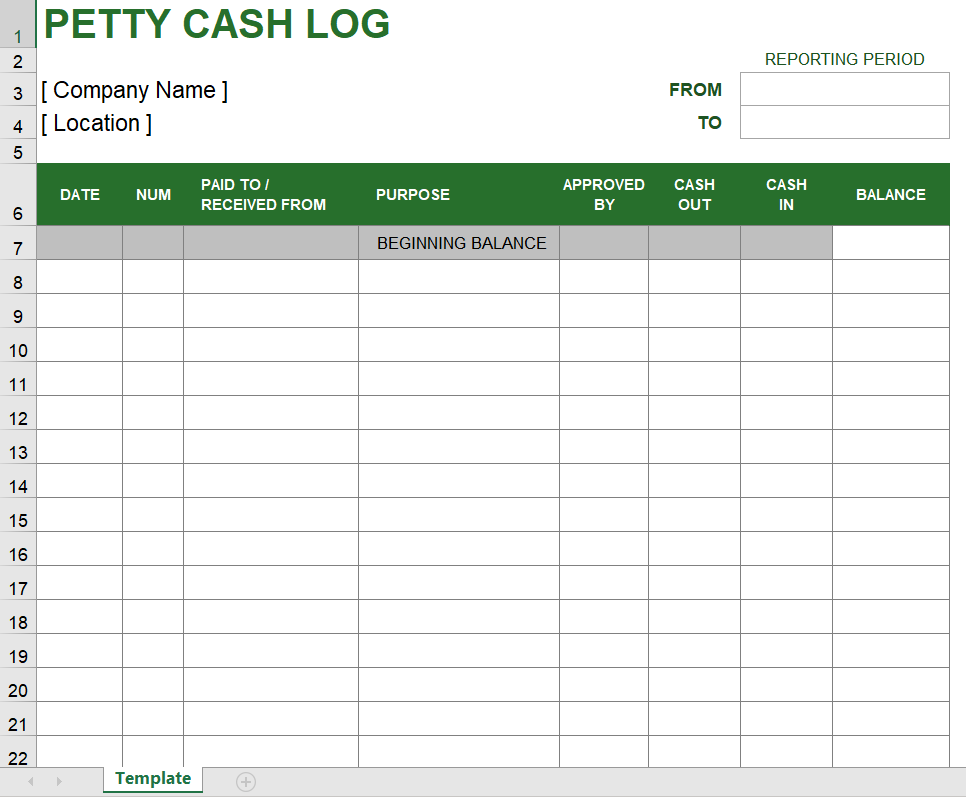

How to use this Petty Cash Log Template?

At the end of the recording track or when the petty cash log is filled, the keeper in charge of the cash will count the money and compare it to the ending balance on the form.

The keeper will likely be entering transactions into the accounting template and may require an employee to complete and proceed with revenues. The petty also provides a paper-based record of the cash-in and cash-out.

To customize a petty cash form for your business, download our free template below.

This template allows you to easily adjust the heading, labels and contains formulas in the Balance column. In case you want to track the petty cash log using the spreadsheets, rather than printing a blank form.