Excel Template for Accounting for Manufacturing Company

Accounting System for Manufacturing Company is an Excel spreadsheet that record and create financial report for manufacturing companies. A free editable accounting template in Excel for manufacturing businesses can be a useful tool for recording financial transactions and generating financial statements. This template typically includes automated controls to make the process more efficient and accurate. It can include features such as pre-populated formulas and charts, as well as customizable categories to fit the specific needs of a manufacturing business. The template can also be easily edited and updated as necessary. Overall, it can save time and simplify the accounting process for manufacturing companies

Double-entry bookkeeping is a method used by manufacturing businesses to record financial transactions. In this method, every entry made to one account must have a corresponding and opposite effect in at least two other accounts. This requires knowledge of accounting to ensure that entries are made to the correct accounts. Without understanding the basic terms and concepts, the use of debit and credit classifications in different journal types can be confusing.

Features for Accounting of Manufacturing Operation

The spreadsheet for Accounting of Manufacturing Operations requires a basic understanding of double-entry bookkeeping. Excel formulas automatically process entries into financial reports, but incorrect input of transaction data may lead to inaccurate calculations and unbalanced balance sheets. The spreadsheet features include:

- A Home Panel with direct links to specific worksheets, arranged like a flowchart to guide users through tasks.

- Integrated journals and reports that use formulas to process and calculate entries to provide useful insights on the company’s performance.

- A simple journal entry system that includes one general journal and four special journals for recording all transactions.

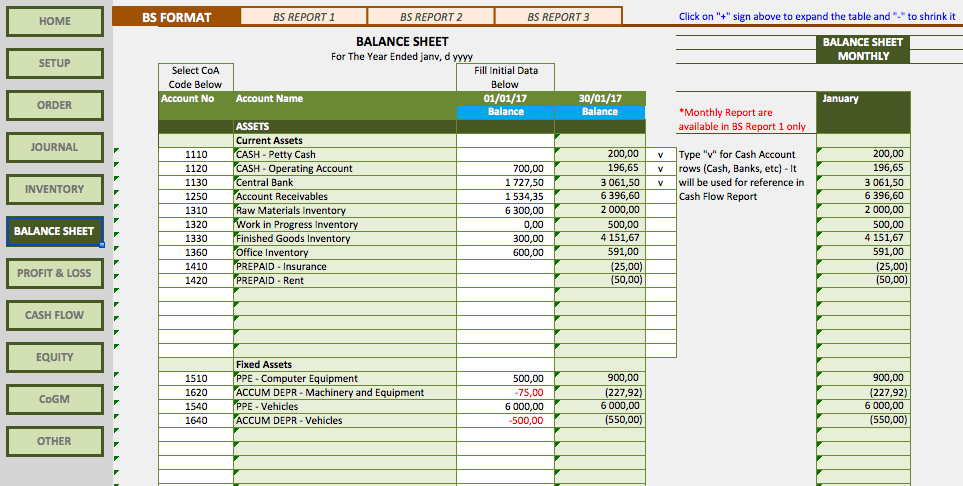

- A Customizable Balance Sheet Report that allows users to select specific accounts and automatically calculates and displays values, both in total and by month.

- A Customizable Profit and Loss Report that allows users to select specific accounts, and automatically calculates and displays values based on journal entries.

- A Customizable Cash Flow Report that allows users to choose between Direct and Indirect methods and set specific accounts to be displayed.

- An Automatic General Ledger that allows users to select specific accounts and toggle debit/credit to see them in positive values.

- An Automatic Depreciation Calculator that uses the Straight Line method to automatically calculate depreciation of company assets.

- A Customizable Cost of Goods Manufactured Report that allows users to select specific accounts, input initial raw materials inventory, and receive automatic calculations on manufacturing cost.