Download Our Excel Template for Money Management: The Ultimate Tool for Financial Success

Are you looking for an easy, efficient way to manage your finances and achieve your financial goals? Look no further! Our professionally designed Excel Template for Money Management is the perfect solution to help you take control of your financial life. With a range of expertly crafted formulas and excel sheets, our template is an essential tool for anyone looking to improve their money management skills. From a Yearly Saving Goal Calculator to an Investment Plan Expense Tracker, this comprehensive financial toolkit will revolutionize the way you approach your personal finances.

Key Features of this excel template:

-

Yearly Saving Goal Calculator:

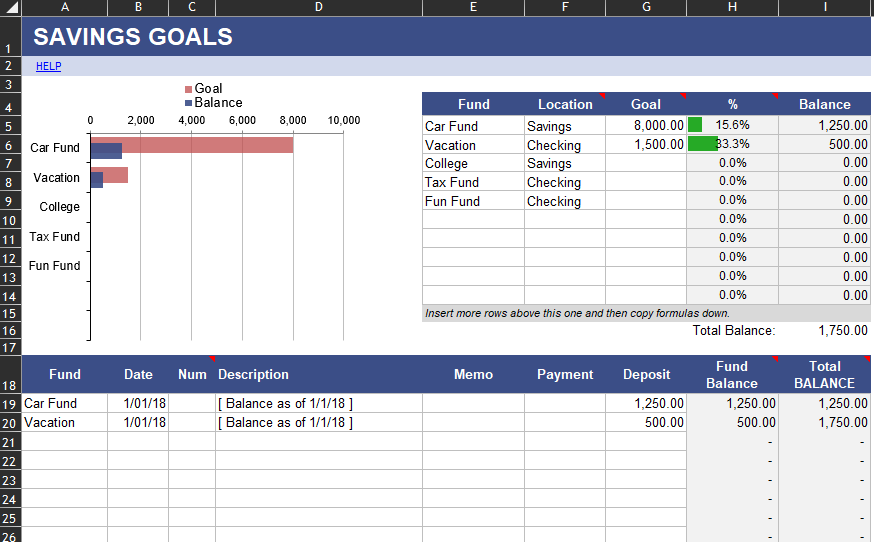

Setting financial goals can be a daunting task, but our Yearly Saving Goal Calculator makes it simple. With this easy-to-use tool, you can input your desired savings goal and timeframe, and our calculator will tell you how much you need to save each month to reach your target. Plus, the accompanying graph showcases your savings goal trend, allowing you to visualize your progress over time.

Creating a budget is crucial for effective money management. Our customizable Budget Template helps you track your monthly income and expenses, so you can easily identify areas where you can cut costs or increase savings. With pre-populated categories and formulas, you’ll be able to quickly and accurately monitor your financial health.

-

Investment Plan Expense Tracker:

Keeping tabs on your investment expenses is essential for maximizing your returns. Our Investment Plan Expense Tracker allows you to record and track all your investment-related costs, so you can make informed decisions about your financial strategy. Whether you’re investing in stocks, bonds, or mutual funds, this user-friendly tracker will keep you on top of your game.

-

Graphs to Showcase Savings Goal Trend:

Visualizing your financial progress can be a powerful motivator. Our Excel Template for Money Management includes dynamic graphs that display your savings goal trend, providing a clear picture of your journey towards financial success. With this interactive feature, you can easily monitor your progress and make adjustments to your financial plan as needed.

Conclusion:

Managing your finances has never been easier, thanks to our Excel Template for Money Management. With a range of powerful tools and features, this comprehensive template is the ultimate resource for anyone looking to take control of their financial future. So why wait? Download our Excel Template for Money Management today and start paving the way to financial success!