Money Manager for Kids is an important life skill that you can teach to children at a young age. Are you actually helping them learn how to save? Do they understand how a bank works? All of these things can be done and taught quite simply using the “family bank” concept and a very simple money management worksheet.

The Family Bank Approach

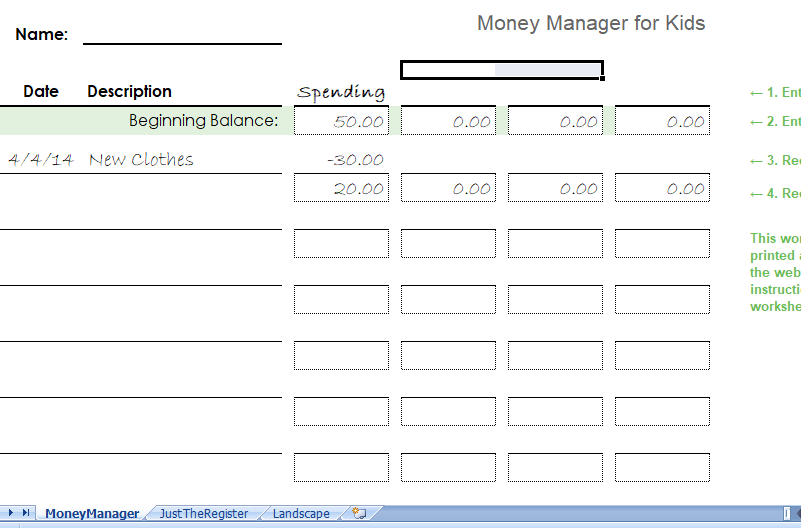

The basic idea is that parents act as Family Bank, and each child keeps track of how much money they have in the bank using a worksheet like the ones below. Moreover, Deposits and withdrawals are easy to handle, and when it comes time to give allowance, no cash needs to even exchange hands. Thus, The worksheets are tape to the inside of pantry door. We design these worksheets to allow you to track up 4 separate “accounts” such as (1) Spending, (2) Tithing, (3) Savings and (4) College. All Parents should keep track of how much the kids have in family bank just in case the worksheets ever get lost.

Personal Expense Tracker

Download the Money Manager for Kids spreadsheet if you wish to customize it or keep an electronic record.

Money Manager Expense and Budget

Balances: The current balance for each “account” or column is enter into the rectangular boxes. It is obvious how it works if you take a look at the example above.

Allowance: When you give an allowance, you don’t have to give cash, you simply record allowance as deposit, divided between tithing, savings, and/or spending.

Deposits: If your child receives cash for work they’ve done or birthdays, they can hand you (the banker) the cash, and you record the deposit in their worksheet.

Withdrawals: If your child needs cash for some reason, you hand them money from your wallet or purse (i.e. the bank) and record the withdrawal in the worksheet.

When you run out of space: After you’ve filled in a worksheet completely, you print out another blank copy and then record the current balances at the top of the new money manager worksheet.