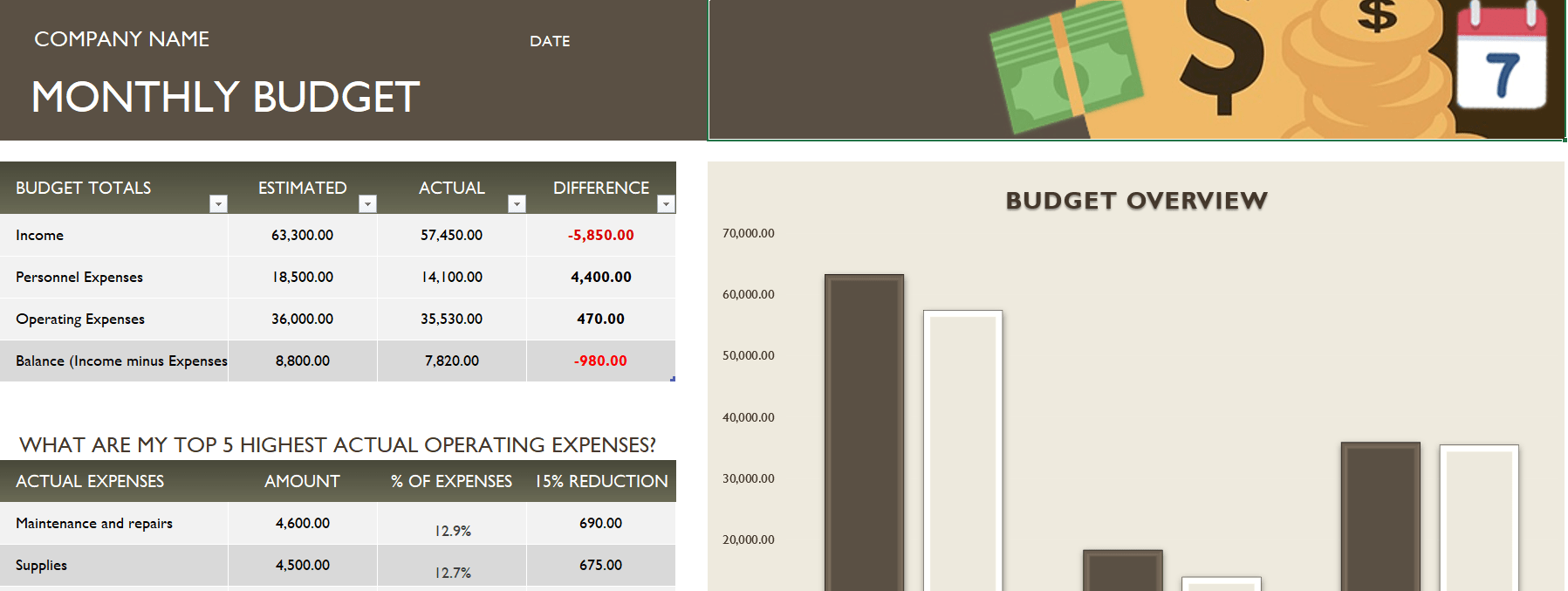

A monthly business budget provides a precise image of expenses and revenues and gave drive to important business decisions.

Whether to increase marketing or improve efficiencies in other ways. It also summarizes your organization’s financial and goals, so it is an action plan that helps you assign resources, design performances, and formulate plans.

Firstly having a business budget is important for any size business. Therefore, a business budget helps you decide whether you can increase your business, give yourself a lift, or purchase additional inventory and assets and helps you to avoid bankruptcy.

If you thinking of starting a business, it’s a free Business Start-Up Costs Spreadsheet. A startup expenses examination is an important part of a good business plan and can help you get things off and more detailed business budget.

How to create a Monthly Business Budget in Excel

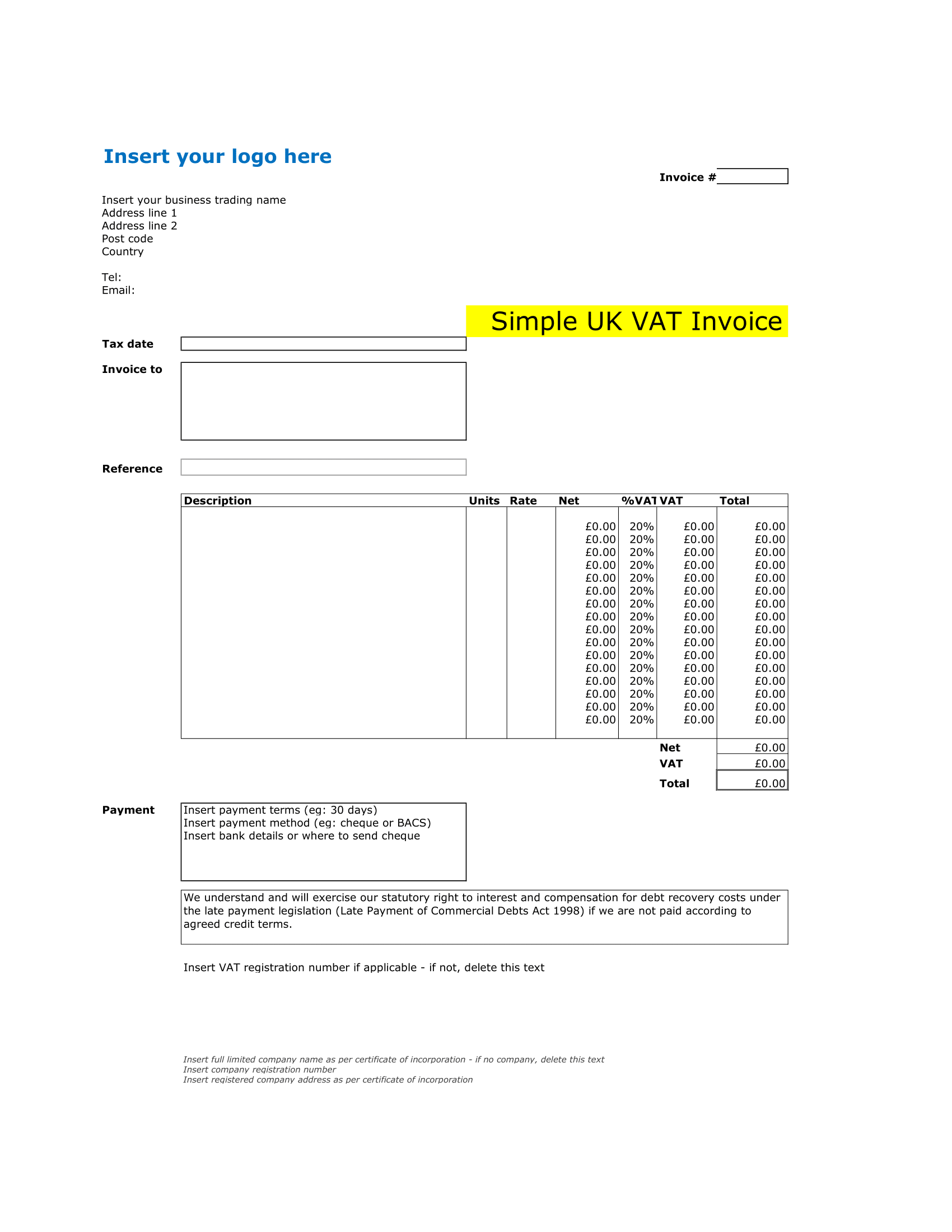

This spreadsheet contains sample business budgets created for companies providing services or selling products.

The Services template is a simple business budget that divides income and business expenses into different categories that closely match an income statement. The categories are complete, easy to add, remove, and adjust the categories.

The Goods template added the categories in the Services worksheet, also has a Cost of Goods Sold section for recording purchases and Gross Profit.

The sales and business expenses are broken down by month. It is helpful for budgeting quarterly expenses and other business expenses that occur at a specific time.

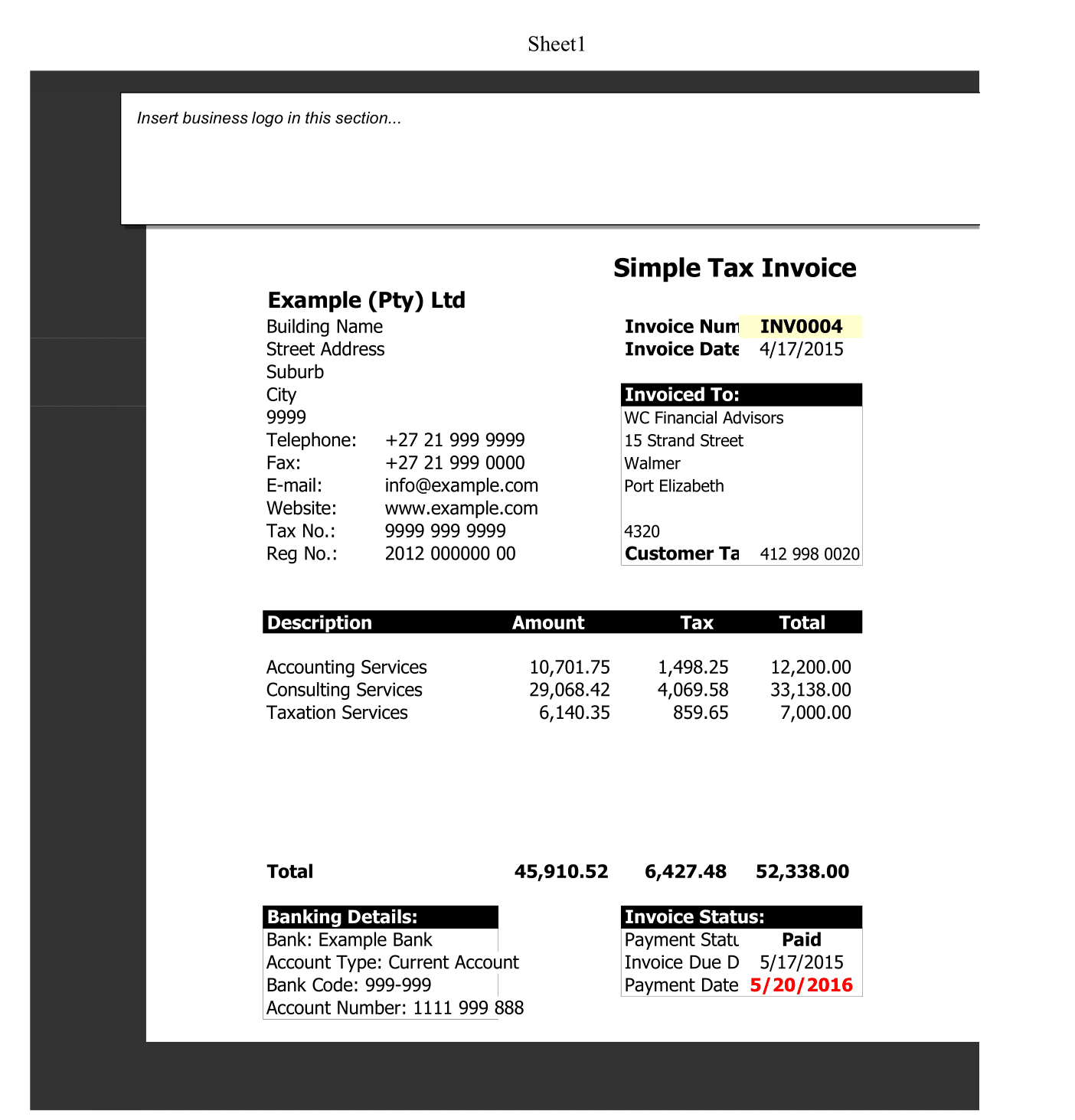

The Goods worksheet records sales and the cost of goods sold for multiple products.

A detailed review of your business expenses and cost of goods sold (COGS) if you are selling multiple products. For instance, Columns and Rows are included for calculating the Percentage of Total Sales for each product.

Why you Need a Monthly Business Budget

The budgets help businesses reach their target. If you need assistance in setting business priorities, a budget is the best place to start. Budgets also facilitate cutting business risk, problems and recognizing opportunities. Tool to organize and plan.

Without a budget, you are aimlessly creating your business. Example of business Budget Categories

Total start-up funds

Costs and Debts

monthly revenue and expenses

Estimation of profits

Funds needed for expenses

How to create something useful for Budget

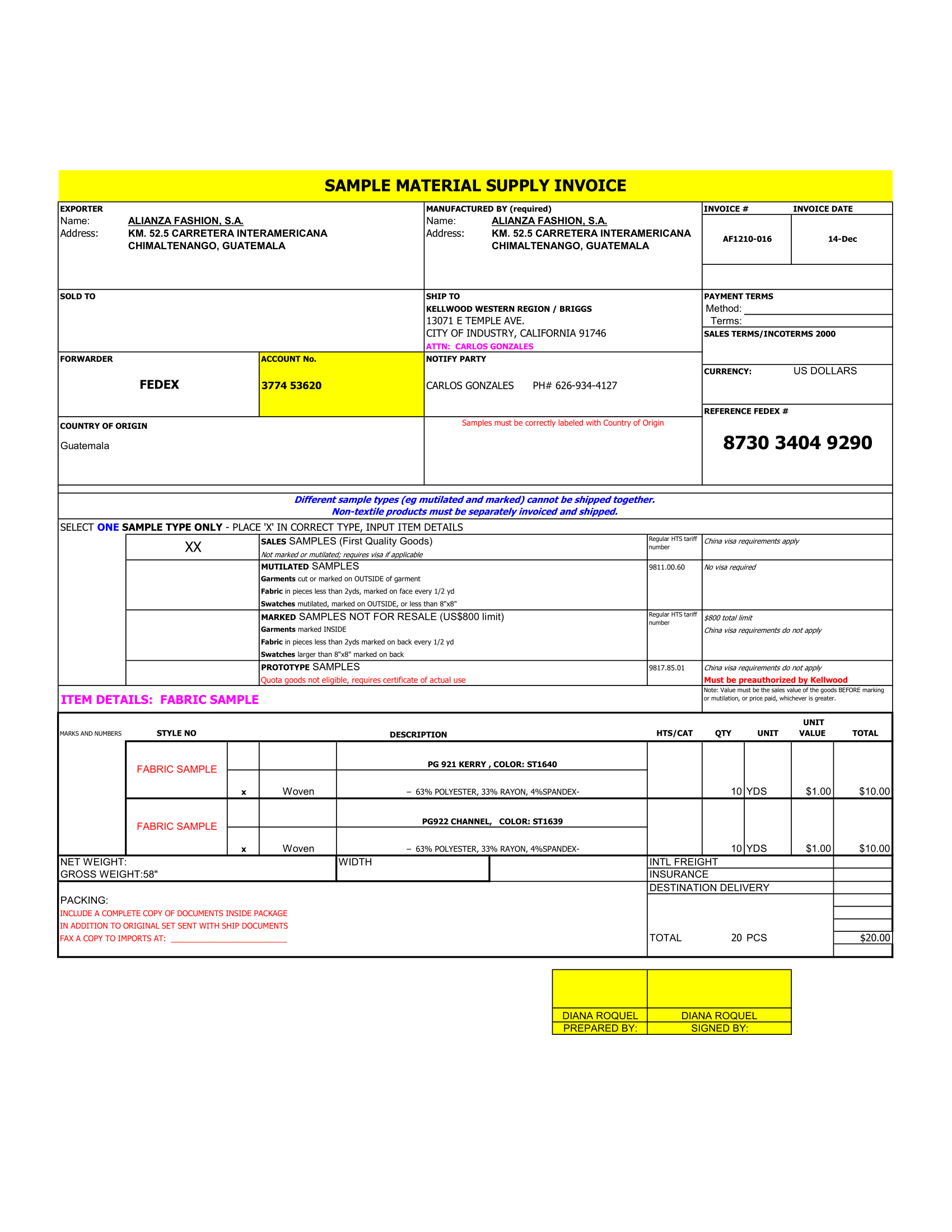

Calculate Fixed Costs

Create a business budget to calculate all fixed costs. The fixed cost refers to any periodic expense that remains the same each month. Fixed costs can be weekly, monthly or yearly expenses and revenues

A monthly business budget helps you to break them down separately for a clear picture. Each business has expenses that differ from its operation. This is where to record financial statements. Therefore, financial statements should include a customized list of all fixed costs.

Fixed costs include:

Insurance

Taxes and Rent

Supplies

Website Hosting

Average Income

If you are starting a new business, budgeting will need to be more stable.

Businesses can begin by estimating revenues. So, you would rather underestimate than overestimate. However, this can be adjusted monthly to illustrate income.

Budget planning begins with revenue and income. This helps determine your expenses

Average Income includes-

Product sales

Investment revenues

Debt

Savings

Variable Costs

Determining variable expenses is important. Variable expenses are those that address directly changes in inactivity. Expenses are things that don’t have set costs and vary from month to month.

Example of Variable expenses-

Marketing costs

Sales

Sales costs

Services

Travel