About Monthly Cash Flow Management Excel Template

Monthly cash flow is a budgeting term that tells you the amount of money that comes in and goes out through your bank account or wallet and also analyzes your monthly cash flow information which is essential for month-end financial statements.

In other words, calculate the total cash flow of your incomes and expenses in a given period and analyze them. If you spend less than you earn then your cash flow is positive and if it is more than spending your cash flow is negative.

Why it’s important?

Firstly, to grasp what quantity you’re spending on your expenses, a corporation and office use it to gather and track their total expenses and income on monthly basis. to begin preparing your plan, it’s always a decent idea to begin together with your cash statement.

When you see your monthly income spending it helps you for example whether you wish to form any changes in your spending habits or not. to grasp the difference between income and expenses and the way much money is saved, thus it might be saved for emergencies or invested in future funds.

If your income is negative, then it’s a decent time for a change in your expenses. And monthly income statement should simply facilitate your to choose, which section is that the first one to start out saving money on.

How to prepare monthly Cash flow in Excel through FREE XLSX TEMPLATES

Create your Cash Flow Spreadsheet

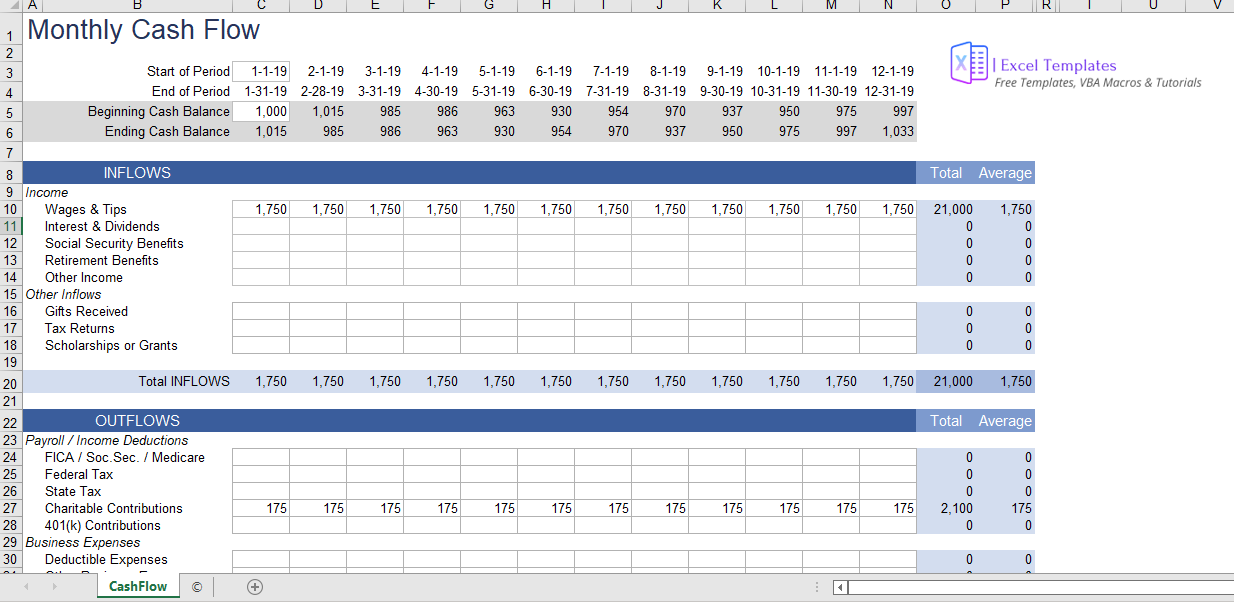

When you open a spreadsheet you’ll see some listed things for example; money that comes in (income/funds) and money (cash, checks, credit, and bills) that goes out. The intention is to record every item from either side of the equation and evaluate how much you are gaining or losing each month. We want to gain and save in this monthly cash flow.

To see what the sample categories are, so you can recognize the kinds of things in your own daily life that you want to include in the cash flow spreadsheet; inflows like wages and tips, interest and dividends and tax returns or outflows like federal tax, business expenses, mortgage payment, and other living expenses.

How to make Cash Flow work for you

You will, of course not adapt for this sample cash flow chart what is ins and outs. Predict as best as you can what your total per annum would be for each item that isn’t fixed in your monthly amount, and divide it by 12 so that it will come up with a monthly estimation. Since this is about keeping track of your actual cash flow, your report will also include any large out-of-delivery expenses and bills.

What to List on your Monthly Cash Flow Chart?

You should list everything- the same as you would do for your budget. You see the whole picture of where you get your money and where you spend it. Once you know everything, you can begin to find ways to recognize savings and plan for the future. So, think carefully about where you spend money or whether you use cash or not and list out these things in a particular row.

Monthly Report In the end monthly report tells you what were your expenses, incomes, funds, and total bills that whether your cash flow is positive or negative. It also tells you the total goal amount, you should try to save next month.

Things to List on your Cash Flow Chart

Inflows – 1. Social Security Benefits 2. Retirement Benefits 3. Gift Received 4. Tax Refund

Outflows- 1.State Tax 2. Car Payments, credit card payments, billing 3. Insurance 4. Groceries