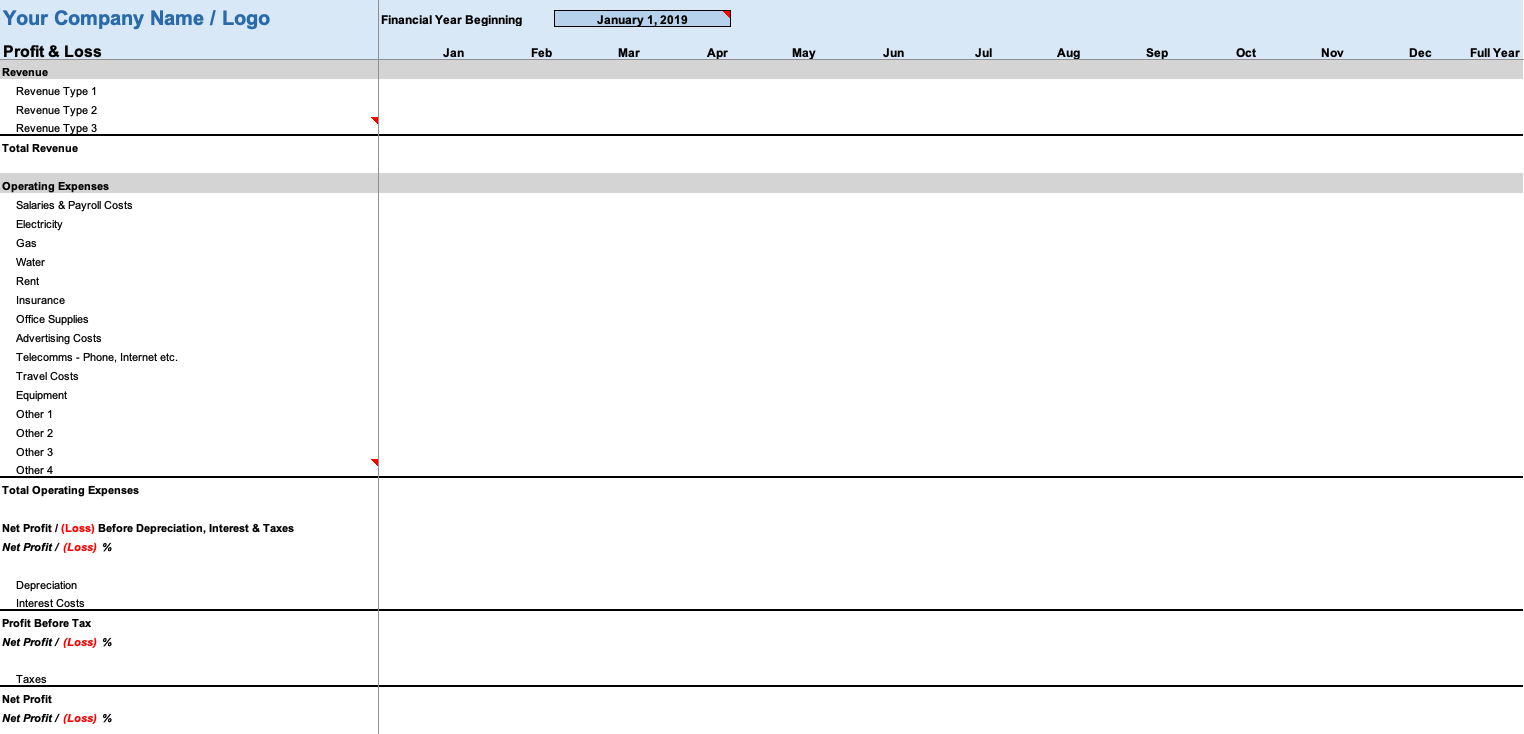

Monthly profit and loss statements provide better insights about operating position of a company. An annual profit and loss statement, which only shows yearly results. Viewed on a monthly basis, a P&L enable company to stay flexible and respond to issues and trends quickly.

Our free, monthly profit and loss template is design to help you assess the financial position of your company on a monthly basis. It allows you to track your Cost of Goods, Income Streams, Operating Expenses. Hence you can track them in near real time, and respond to them. Before they get out of hand or before opportunities are miss.

The template can easily adjust for small, medium and large enterprises by adding or deleting rows.

What is Monthly Profit and Loss?

Monthly Profit and Loss statements, also known as income statements. These are prepare by a company to assess its financial performance. They are always prepare over a period of time – monthly, quarterly, yearly, etc.

Under this statement, all incomes and gains are credited and all expenses and losses are debited to show the result in form of net profit or net loss.

P&L’s is use to monitor an organization’s revenue growth rate, or to make decisions with respect to cutting the costs, raising investments, applying for a loan, or assessing the profitability growth over different months to track seasonal performance.

Several metrics that can compare using our P&L template are gross profit margin, EBITDA (earnings before interest, taxes, depreciation, and amortization) margin, operating ratio, Cost of Goods Sold and net profit margin.

How to Use the Template

Separate sheet have create for manufacturing and service organizations. You only need to fill in your estimated or actual revenues and expenses. Our algorithms will do rest of the math for you, and populate the necessary fields.

Although revenue and expenses vary base on nature of a business, we have identify some common revenue streams and expenditures.

Some expense items will be same for both manufacturing and service organizations, while others may exclusively be for either of the two. One example is direct cost; there is usually no direct cost for service companies, while manufacturing companies always have direct costs.

Importance of Monthly Profit and Loss Statement

Monthly profit and loss statements measure the company’s financial condition and growth on monthly basis. The importance of monitoring your business’s profit and loss statement are:

- When complete breakdown of monthly revenue and expenditure is available. You can make better financial decision with respect to continuance or discontinuance of certain products or curtailing of any specific expenditure.

- It also serves as a record that shows to potential investors or partners who want to do business with your company. It is not only an important part of accounting process but also assists in financial analysis.

- The statement helps in comparing actual COGS with budget COGS fixed within your organization or as per market standards.

- Profit and loss statements provide you basis to compare your performance with competitors. This is execute through comparing various ratios, including profit margin, return on investments, etc.

- Banks and financial institutions look at monthly profit and loss statement to evaluate the credit worthiness of the borrower.

Conclusion

When combined with cash flows and balance sheet, income statements can prove to be a strong tool for benchmarking, analyzing margins, studying trends, and valuation metrics.

Profit and loss projections are prepare using the growth history from previous months. As well as market conditions prevailing at the time of forecast. This can help a company with investor presentations, evaluating the health of the company relative to the market, and planning for the future.