In finance, there are some standard value measurement that usually used to measure whether a new business or a new project is profitable or not. So we have created Net Present Value.

Net Present Value Meaning

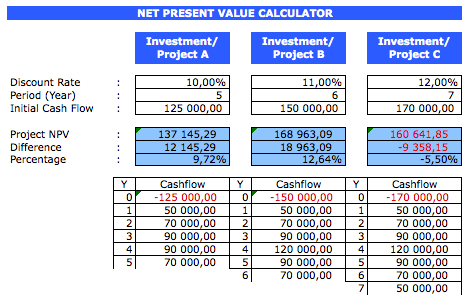

Some most common terms are ARR (Average Rate of Return), PP (Payback Period), IRR (Internal Rate of Return) and NPV (Net Present Value). All these terms can be used at the same time. It will also give you different result to value your investment. So, this is the first tool of those four I created to help you calculate. It is your investment profitability based on Net Present Value calculation. Where it is defined as the difference between the present value of cash inflows and the present value of cash outflows.

NPV Formula Excel

I am not an expert in finance, but I know the finance well because I am running several companies. I have some people who works for me. They do all financial things where I have to use their financial reports when I made some business decisions.

NPV Analysis

You can use this NPV method if you positioned your self only as an investor that received a fixed amount of money in a short period. In my experiences, for a longer period of time. Say more than 3 years, and with uncertain business risks, you should make a detail financial plan to justify your business plan.

Net Present Value Formula Excel

Microsoft Excel already provide a tool to calculate this NPV where you can use it directly. And in this spreadsheet, this calculation is used to compare three different projects or investments. It is based on discount rate, period, initial cash flow and yearly cash flow. And as I mention above, it is suitable only for a business with minimum business risks.

MPV Formula Example

If you are a student who want to learn the implementation of NPV method. You can play around with this spreadsheet or modify it to suit your purposes. Moreover you can read also the explanation in the Excel Help menu. Hence, just googling this Net Present Value term, and you will get hundreds of sites that provide detail information about it.