Networth calculator helps you to calculate your net worth by plugging in the values of your various assets and liabilities. It helps you to calculate your net worth by plugging in the values of your various assets and liabilities.

Net worth is the difference between all the assets and liabilities of an individual. In other words, it is what you own minus what you owe. Net worth calculator is very important for any business.

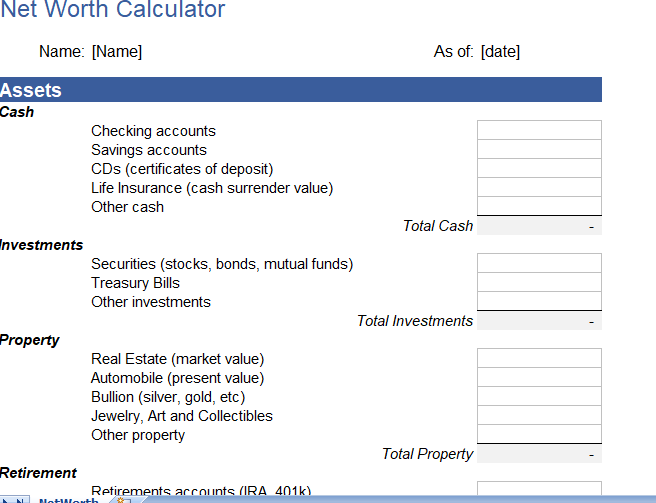

Networth calculator

Networth Calculator is not a complicated process. For both individuals and businesses, net worth is simply the total value of your cash, investments, and other assets minus everything that you owe. Some programs like Quicken tell you your net worth, but that is only accurate if you include all your asset and loan within the software. That’s not as simple as it sounds, so we created this free Networth Calculator in Excel to help you easily list everything in a single spot.

This simple spreadsheet helps you calculate your networth by providing a ready-to-use list of asset and liability categories. You can save networth calculator to your computer, and work offline.

How to calculate Networth?

Networth = Assets – Liabilities (Networth calculator)

When talking about assets and liabilities, we aren’t talking about personality or character traits. 🙂 Your financial net worth is subtracting your financial liabilities from your financial assets.This way you can calculate your networth

Assets

Your financial assets include the cash in your checking and savings accounts, certificates of deposit, life insurance cash value, retirement accounts, your home and real estate investments, stocks, bonds, mutual fund. Basically, anything of value that could be converted to cash. You can also include the money owed to you by other people (but only if you think they are going to pay you back). In the calculator, this would be the “Notes and Accounts Receivable” category.

Some people prefer to not list their home or personal property because they wouldn’t want to sell it. The reasons for listing your home or automobile is that these assets one can use as collateral when applying for loans, or if you really had to sell them, you could. I include my home in the calculation because I also include the mortgage in the liabilities.

You can also include your future retirement income from pensions and social security as assets.

Liabilities

Your financial liabilities include everything that you owe, such as credit card debt, student loans, auto loans, money (notes) etc

If you find that you have a lot of liabilities (debt), you may be interested in our debt reduction calculator.

Networth tracker

Your net worth is the value of your assets minus your liabilities, Its everything you own minus everything you owe. Getting a handle on your net worth is like giving yourself a financial report card. When you count up all of your assets and liabilities, you can understand what’s working in your financial life.

Total Networth

Net worth is the value of the assets a person or corporation owns, minus the liabilities they owe. It is an important metric to gauge a company’s health, providing a useful snapshot of its current financial position.