A personal financial statement is a spreadsheet that details the assets and liabilities of an individual, couple, or business at a specific point of time. Therefore consists of two columns, with assets listed on the left and liabilities on the right.

Inclusion of Personal Financial Statement

Hence Personal Financial statement allows you to create and update an all-in-one personal financial statement that includes:

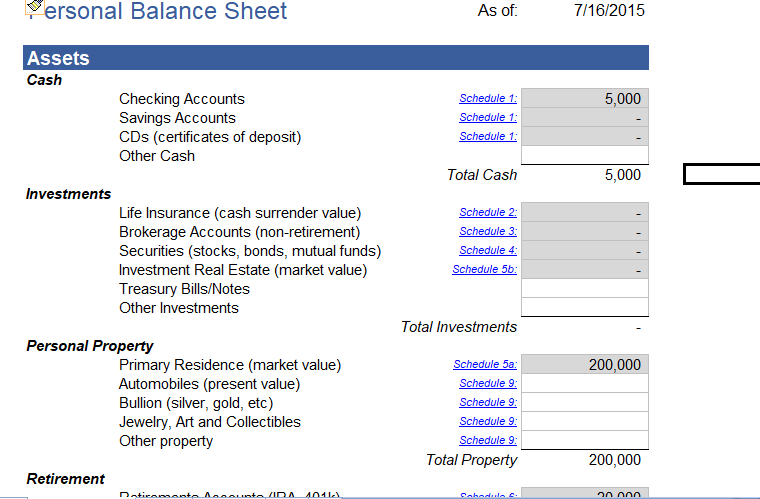

- Personal Balance Sheet – for listing assets and liabilities and calculating net worth.

- Cash Flow Statement – for listing all your inflows and outflows and calculating your net cash flow.

- Details Worksheet – for listing individual account balances and the details for your properties and loans.

- Info Sheet – for listing contact info that is typically required in loan applications (e.g. names and addresses of the applicant and co-applicant).

Certainly also includes calculations for some common financial ratios:

- Basic Liquidity (BLR) Ratio = Total Liquid Assets / Total Living Expenses ::Therefore, This ratio uses info from both the balance sheet and the cash flow statement.

- Debt-to-Income (DTI) Ratio = Annual Debt Payments / Annual Income :: A ratio commonly used by lenders to determine how risky is an investment. Hence, it should be below about 35% to consider acceptable hence comes from the cash flow statement.

- Debts-to-Assets Ratio = Total Liabilities / Total Assets :: certainly Indicates the degree of leverage to use for person or company to finance their assets. The higher this ratio the less financial flexibility you have. Above all this comes from the balance sheet.

Why is a Personal financial statement useful?

This statement is a tool that we use to analyze our current financial status therefore helps us to track net worth and set financial goals.

What are assets and liabilities?

Assets are investments and property of significant value hence can be used as collateral to secure a loan because salary and other forms of income are not assets. Lenders will typically ask to see them and list separately to gain a better understanding to manage liabilities. Common assets include:

- Account balances: savings, certificates, money market accounts

- Investment balances: stocks, ETFs, mutual funds, bonds, annuities, cash-surrender values of life insurance, commodities.

- Retirement accounts: 401(k)s, IRAs

- Real estate

- Valuable personal property: vehicles, boats, jewelry, or collectables

However liabilities are accounts that carry a balance to be paid down by regular installments. After that monthly accrued expenses (utilities, cable, cell phone, insurance payments, rent, food, and other general living expenses) are excluded. Common liabilities does not include:

- Credit cards

- Student loans

- Unpaid medical bills or unpaid taxes

- Mortgages or vehicle loans

- Loans that you have co-signed

How can you calculate net worth?

The Personal Balance Sheet

Step 1: List all your Assets

An asset is something that you own that has exchange value. However Your financial assets are your cash, savings, checking account balances, real estate, pensions, etc.

Watch out for the cells that are highlighted gray. Therefore, the values that come from the Details worksheet. If you overwrite the formula, you’ll need to fix it.

Step 2: List all your Liabilities

Liabilities are your debts and other unpaid financial obligations therefore Future expenses such as fuel for your car are not liabilities, but unpaid bills are.

Step 3: Calculate Net Worth = Assets – Liabilities

The full market value of your home is an Asset. Certainly, The amount you still owe on the mortgage is a Liability. The difference is therefore what you call Home Equity. However, In a typical business balance sheet, the terms Owner’s Equity or Shareholders Equity are the same as Net Worth: Owner’s Equity = Assets – Liabilities.