A business uses a petty cash account for tracking physical cash used to make small payments. The cash we keep in a small safe or locked file cabinet, perhaps in an manila envelope. Petty cash for meeting refreshments, reimbursing an employee for office supplies she, or other miscellaneous expenses. A petty cash log can be taped to the envelope or stored with the cash so that whenever you remove or add cash you can use the form to record the date, payee, purpose, and amount.

At the end of the reporting period or when the petty cash log is filled up, the custodian in charge of the cash will count the money and compare to the ending balance on the form. Differences are resolved and a new cash log is created with a new balance for the new reporting period. The custodian will likely be entering transactions into whatever accounting software he/she is using, and may require an employee to complete a voucher and submit receipts. The petty cash log provides a physical paper-based record of the cash-in and cash-out. To customize a petty cash form for your business, download the free template below.

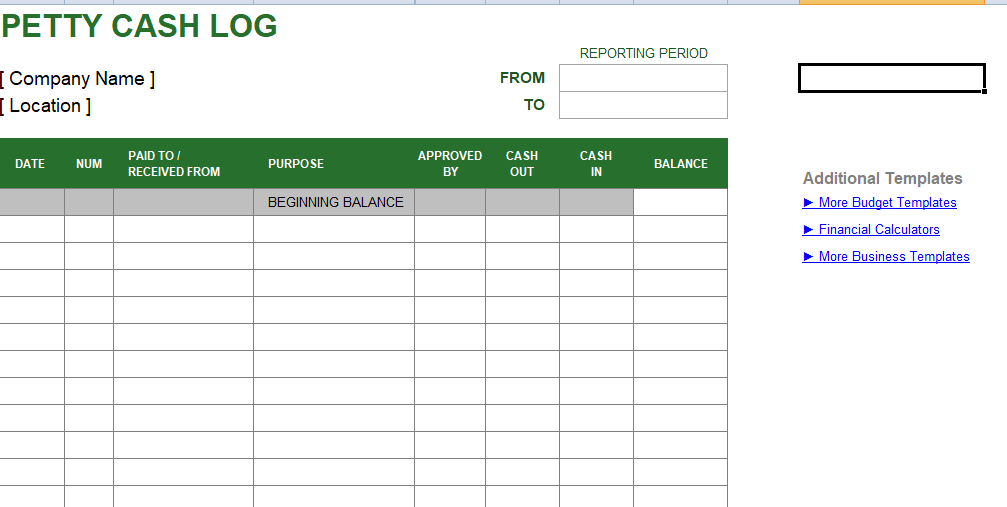

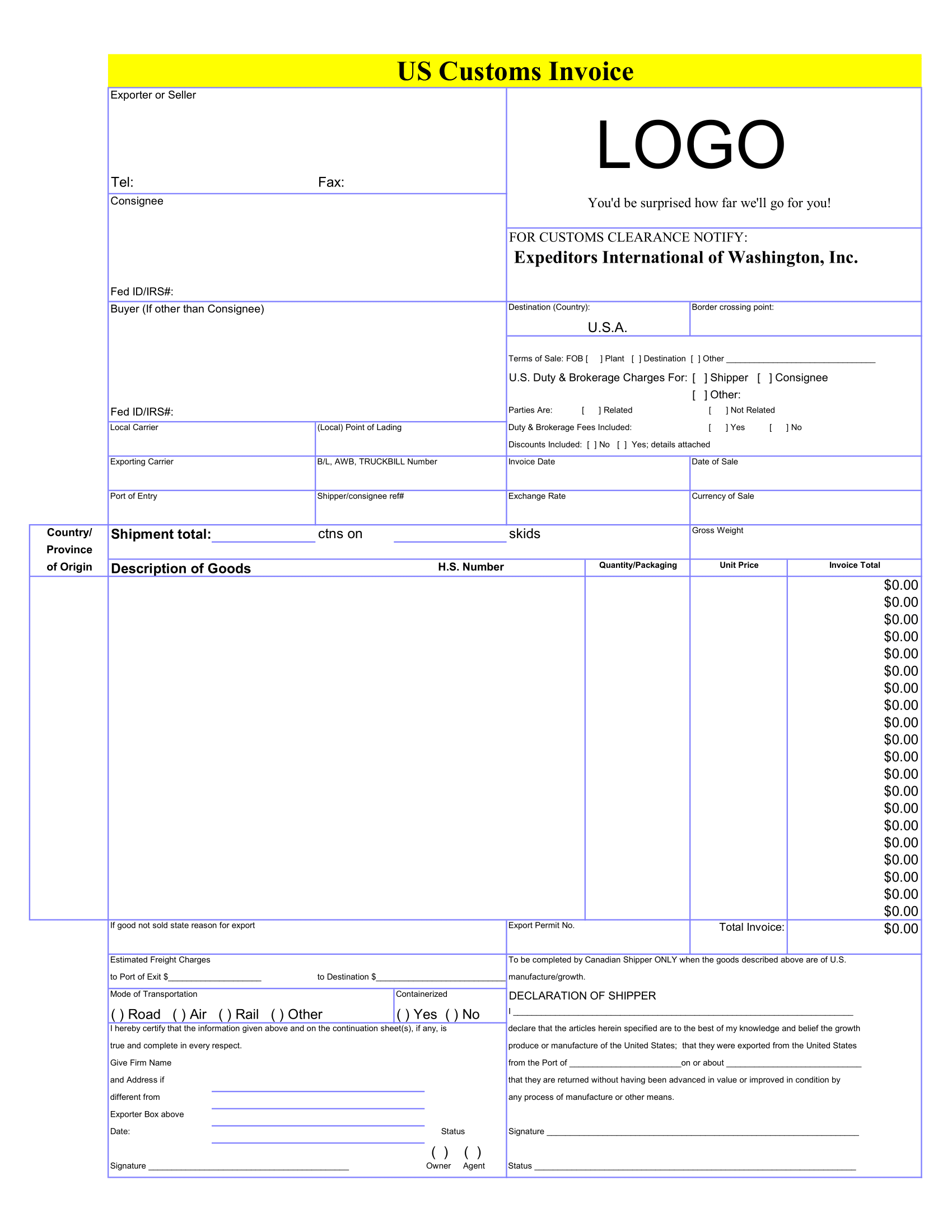

Petty Cash Excel Template

This petty cash log template allows you to easily modify the heading labels as needed and contains working formulas in the Balance column in case you want to track the petty cash log using the spreadsheets itself, rather than printing a blank form.

What is petty cash?

Petty cash is the money a business keeps on hand to pay for miscellaneous purchases. Most purchases made with petty cash are unexpecting expenses that can pop up.

One of the main reasons to have petty cash on hand is to quickly reimburse employees who have spent their own money on items for the business or to tip the delivery service driver who brought the office lunch.

Petty cash, like any other expenditure, needs accounting into your accounting software or manual accounting system since the expenses are business related and need to be properly recorded to ensure financial statement accuracy.

How to set up and use petty cash in your business

If you’re ready to set up a petty cash fund for your office have a secure place to store your petty cash funds, such as a lockbox or locked drawer.

1. Set account limits

Before you start a petty cash fund, you’ll need to decide how much you want the fund to be. Between $100 and $200 is fairly common, though you can go lower or higher, depending on your business.

You’ll also want to decide the replenishment point, so that your expenses can record, and a new check will write in the petty cash total back to its original amount. For example, if your petty cash fund is $100, you may want to reimburse the fund when it drops below $15.

2. Determine who will manage petty cash

If you have an office manager, they’re the most likely choice to manage the petty cash fund. If you only have a few employees, fund management may fall to you.

Whatever you decide, it’s important that only one person have access to the fund at any time. Thus to avoid unaccounted for withdrawals and/or theft. Once you determine who will handle petty cash, you’re ready to cash a check and deposit the funds into the petty cash lockbox.

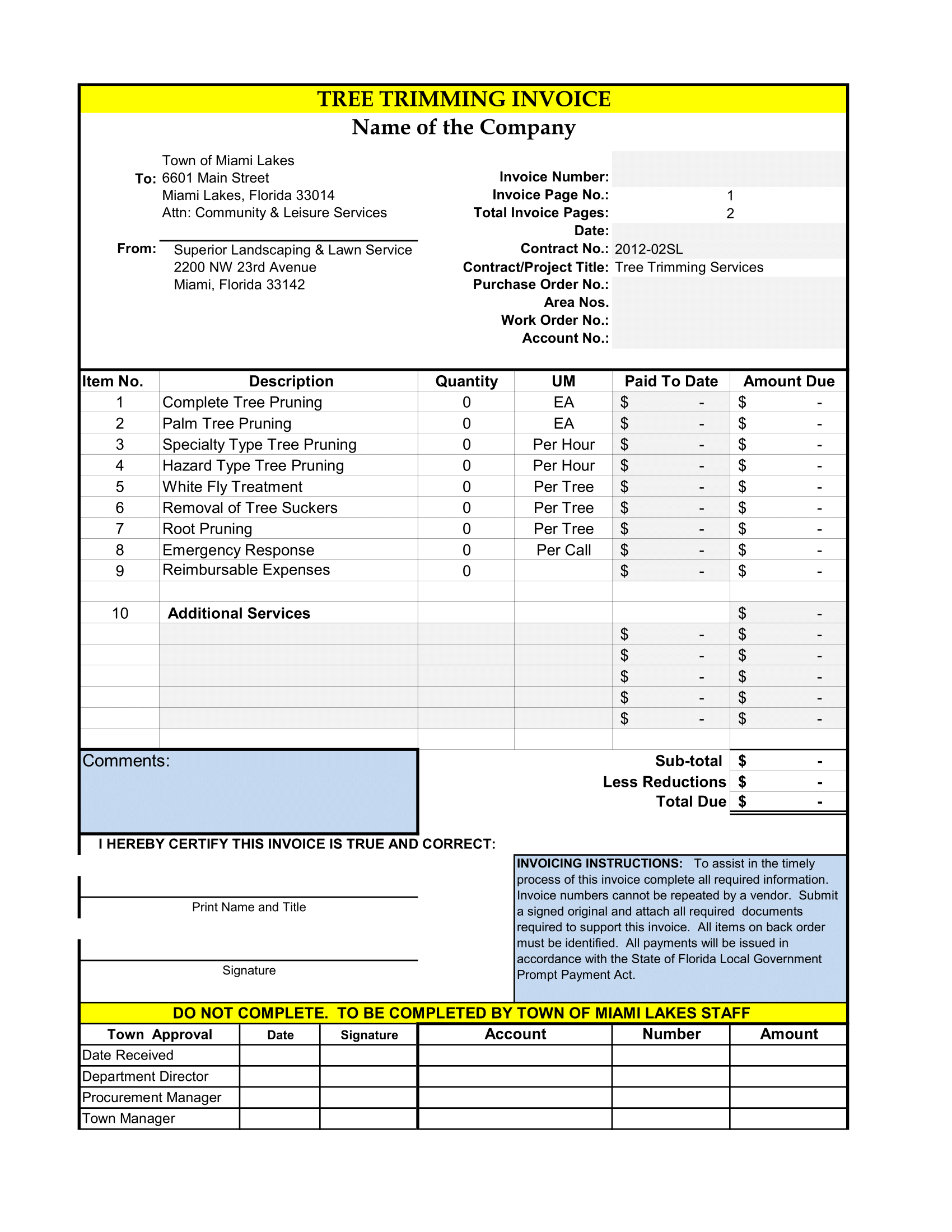

3. Create a Petty Cash Register

The petty cash log is one of the most important components of managing petty cash. Any transactions from petty cash or out of petty cash need to be recorded on the petty cash log. It’s also important that any money disbursed out of the petty cash fund have a receipt.