With continuous requests from our readers as well as authorities for making Pre GST and Post GST Price Comparison Template in excel, today we have created an excel template for the same.

GST was implemented on July 1st, 2017.

The main objective behind GST is to provide good and services at a lower price to the end consumer.

According to study, there has been a less impact on prices after GST.

The reason behind is that the benefit of input credit is not forward to the end consumer.

We have create excel template for Pre GST and Post GST Price Comparison Template.

This is helpful to Individuals, manufacturers, wholesalers, retailers.

Pre GST and Post GST Price Comparison Template

This template consists of 4 sections:

- Header Section

- Manufacturer Section

- Wholesaler Section

- Retailer Section

Important Note: Enter the amount in white boxes. All other amounts cells are pre-formula and will make calculations automatically.

1. Header Section

As usual, the header section consists of name of the company, address of the company, logo, and heading of the sheet ” Pre GST and Post GST Price Comparison Template.”

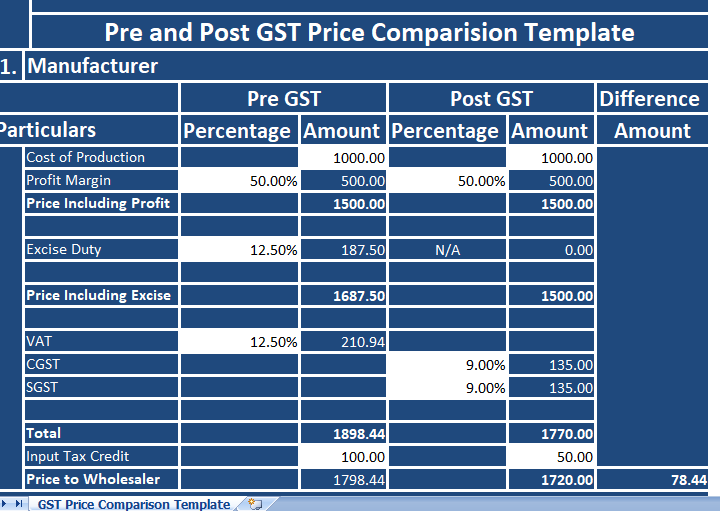

2. Manufacturer Section

In manufacturer section, there are calculations of Excise Duty which is applicable in the pre-GST regime.

Calculations of Pre GST Regime

Cost of Production + Profit = Price Including Profit.

Price Including Profit + Excise Duty = Price Including Excise.

Price including Excise + VAT = Total.

Total – Input of VAT = Price To Wholesaler.

Calculation of Post GST Regime

Cost of Production + Profit = Price Including Profit.

GST removed Excise and so excise is included in GST itself.

Price including Profit + GST = Total.

Total – Input of GST = Price To Wholesaler.

3. Wholesaler Section

Excise is applicable only in manufacturing and so it does not include in wholesaler section. All other calculations are similar.

Calculations of Pre GST Regime

Cost of Goods + Other Cost + Profit = Price Including Profit.

Price Including Profit + VAT or Other Taxes = Total

Total – Input of VAT = Price for Retailer.

Calculation of Post GST Regime

Cost of Production + Other Costs + Profit = Price Including Profit.

GST has removed VAT and VAT have been included in GST itself.

Price including Profit + GST = Total.

Total – Input of GST = Price for Retailer.

4. Retailer Section

Calculations of retail section are similar to wholesale section.

Calculations of Pre GST Regime

Cost of Goods + Other Cost + Profit Margin = Price Including Profit.

Price Including Profit + VAT or Other Taxes = Total

Total – Input of VAT = Price To End Consumer.

Calculation of Post GST Regime

Cost of Production + Other Costs + Profit = Price Including Profit.

GST removed VAT and VAT have been included in GST itself.

Price including Profit + GST = Total.

Total – Input of GST = Price To End Consumer.

This all is applicable only to some sectors only. Many other sectors are feeling heat and things are getting costly.