Simplify Your Loan Management with Our Excel Mortage Calculator Template

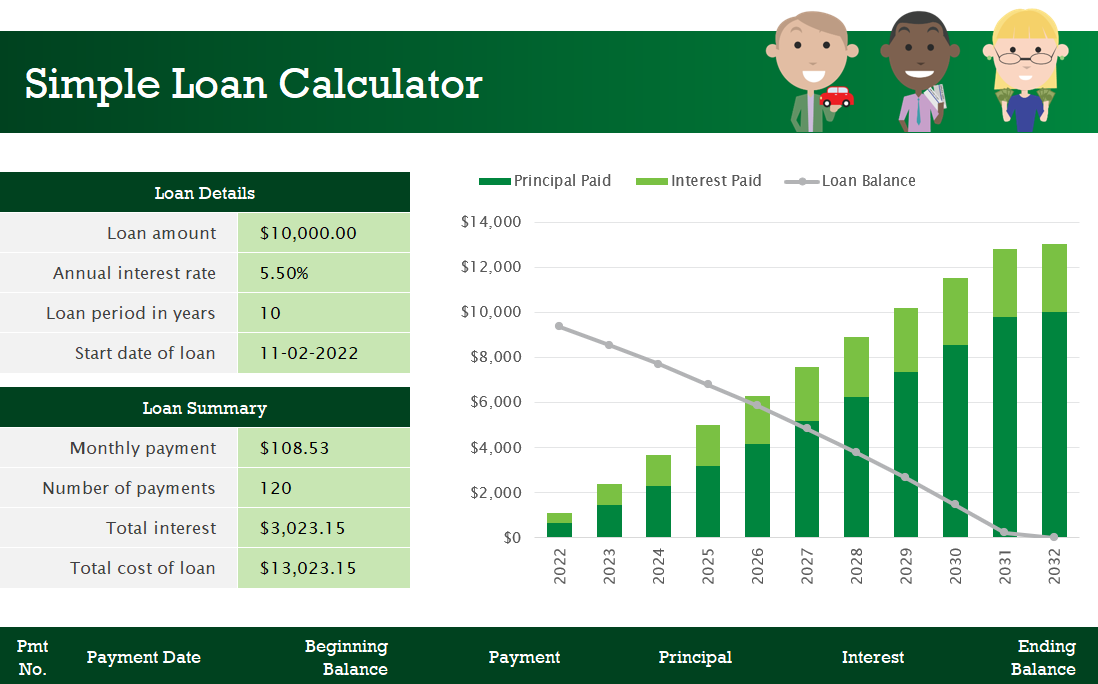

Managing loans can be a daunting task, especially when it comes to tracking payments, interest rates, and balances. The good news is, our loan calculator in Excel template makes it easy for you to monitor your loans, and it even includes a graphical presentation for better understanding. This template can also be used as an EMI calculator in Excel, making it an indispensable tool for managing your finances.

The Importance of Mortage/Loan Calculators

Whether you’re a business owner seeking financing, a real estate developer, or an individual looking for a personal loan, understanding the terms of your loan is crucial. Banks and other lenders have recognized the significance of small businesses and entrepreneurs, and have introduced special services to cater to this market. To facilitate faster approvals, the loan approval process is now largely based on numbers and ratings instead of an individual’s character.

Using Our Excel Loan Calculator Template

Our free loan calculator is user-friendly and provides you with essential information on your loan. The columns included in this template are:

- Loan amount

- Annual interest rate

- Loan period in years

- Start date of the loan

- Monthly payment

- Number of payments

- Total interest

- Total cost of the loan

To use the loan calculator worksheet, simply input the relevant details, such as loan amount, annual interest rate, loan period in years, and the start date of the loan. The results are automatically updated, making it easy for you to see the impact of any changes you make to the loan details.

Benefits of Using Our Loan Calculator

Our Excel loan calculator offers several advantages:

- Time-saving: No need to manually calculate payments, interest, and balances. The calculator does it all for you.

- Accuracy: With the automated calculations, you’re less likely to make errors in your calculations.

- Flexibility: Easily change the payment periods to see how it affects your loan.

- Informed decision-making: Analyze your financial requirements before committing to a loan, ensuring that you make the best choice for your situation.

Our loan calculator in Excel template is an invaluable tool for anyone looking to manage their loans more effectively. With its user-friendly interface, automatic calculations, and graphical presentation, you can quickly gain insights into your loan and make informed decisions about your financial future. Don’t hesitate to download our template and start simplifying your loan management today.