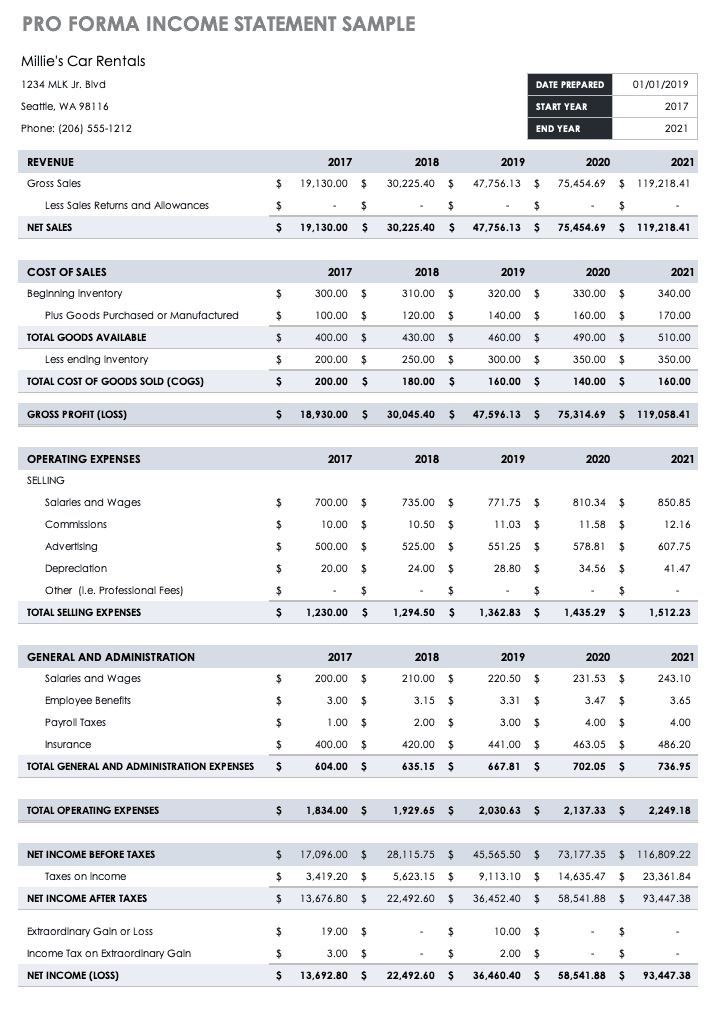

Also called profit and loss statements, these Pro Forma income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. Thus, The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

So, Use this pro forma income statement template to project income and expenses over a three-year time period. Therefore, Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

How to Do a Pro Forma Statement

- Calculate revenue projections for your business. Make sure to use realistic market assumptions to write an accurate pro forma statement. …

- Estimate your total liabilities and costs. Your liabilities are loans and lines of credit. …

- Estimate cash flows. …

- Create the chart of accounts.

What is the purpose of a pro forma?

Pro forma, a Latin term meaning “as a matter of form,” is applied to the process of presenting financial projections for a specific time period in a standardized format. Moreover, Businesses use pro forma statements for decision-making in planning and control, and for external reporting to owners, investors, and creditors

What are the 4 steps in developing a pro forma income statement?

In developing the pro forma income statement, we follow four important steps:

- Compute other expenses.

- Determine a production schedule.

- Establish a sales projection.

- Lastly, Determine profit by completing the actual pro forma statement.

How does a company calculate pro forma income?

It is calculate by dividing total earnings or total net income by the total number of outstanding shares. Therefore, The higher the earnings per share (EPS), the more profitable the company is. read more can increase, but the value of merger companies is lower than the acquirer and target.

Hence, A pro forma financial statement is one based on certain assumptions and projections (as opposed to the typical financial statement based on actual past transactions).