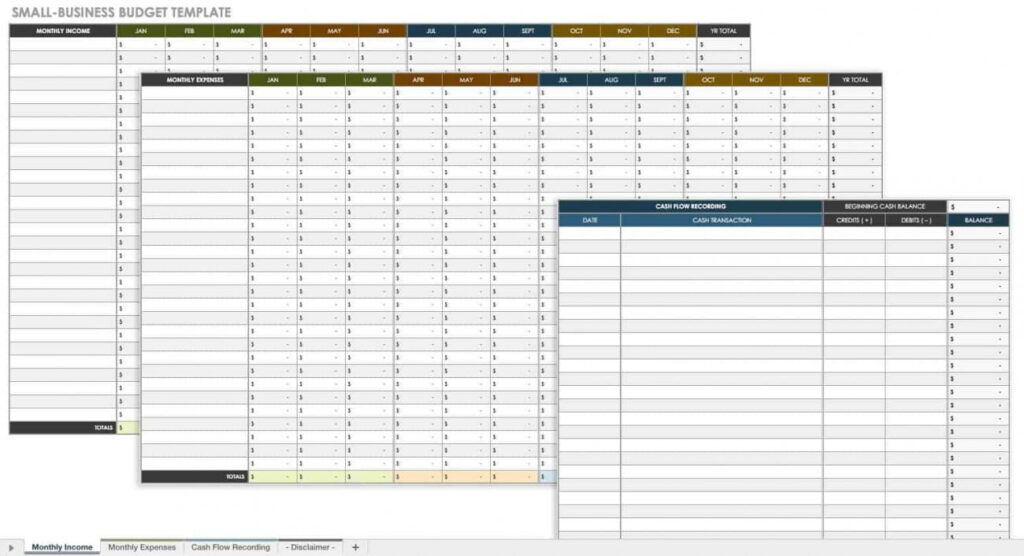

These Professional business budget templates will help you track costs and expenses associated with starting and running a business. Hence, Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Moreover, Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Thus, Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Every good budget should include seven components:

- Your estimated revenue. This is the amount you expect to make from the sale of goods or services. …

- Your fixed costs.

- Your variable costs.

- Your one-off costs

- Your cash flow.

- Your profit.

- A budget calculator.

- Seasonal businesses.

Budgets and business planning

New small business owners may run their businesses in a relaxed way and may not see the need to professional business budget. However, if you are planning for your business’ future, you will need to fund your plans. Budgeting is the most effective way to control your cashflow, allowing you to invest in new opportunities at the appropriate time.

If your business is growing, you may not always be able to be hands-on with every part of it. You may have to split your budget up between different areas such as sales, production, marketing etc. You’ll find that money starts to move in many different directions through your organization – budgets are a vital tool in ensuring that you stay in control of expenditure.

A budget is a plan to:

- control your finances

- ensure you can continue to fund your current commitments

- enable you to make confident financial decisions and meet your objectives

- ensure you have enough money for your future projects

It outlines what you will spend your money on and how that spending will be financed. However, it is not a forecast. A forecast is a prediction of the future whereas a budget is a planned outcome of the future – defined by your plan that your business wants to achieve.