Every small business owner wants to be very successful. And it’s no secret that one key to success is having an intimate knowledge of business’s finances – but not every small business owner has an MBA. We’ve created our Profit and Loss Statement for Small Business template for all bakers, the rental property owners, the handypersons – for everyone who is an expert in their own field, but needs a little help running their finances.

Profit and Loss Statement template

A Profit and Loss (P&L) statement, as we’ll describe, is a way to track your business’s profits and losses. Profits are (hopefully) self-explanatory. They’re what you got into business for! Losses can come in form of payroll, damages, theft, supplies, utility bills… for the purposes of P&L, if something saps money out of your business, it’s almost certainly considered a loss.

Tracking your profits and losses is more than counting your coins. It’s about tracking your business’s health. If, for example, you’re receiving much damaged product. If too much product i damage in one person’s shift. You’ll be able to track that and respond accordingly, either by switching shipping companies, or by coaching careless employee.

Why do we need P&L account?

In larger corporations, P&L’s are prepared by accountants, and can be extremely detailed and complex. Smaller companies, of course, can go this route as well. There are CPA’s the world over who you can turn to help track and plan your business’s finances. However, they’re often expensive, and dig more deeply into numbers than most small businesses need.

Our Profit and Loss Statement for Small Business is create to help any small business owner track their most important sources of losses and profits. And it’s customizable, so that whatever business you’re into, you’ll be able to track whatever line items you need.

Income Statement Template Excel

Traditional financial statement are one tool for gauging effectiveness and profitability of a business. Business financial statement typically comprise of three elements: (1) a Balance Sheet, (2) a statement of Profit and Loss and (3) a Reconciliation of Net Worth.

The Balance Sheet details assets and liabilities of the business, along with its net worth. This report categorizes and list various assets owned and used by the enterprise, and what liabilities (or debts) the business has incurred. The difference between assets and liabilities is the company’s net worth, which gives the net value of business on the day the balance sheet is prepare. It is good but static report.

Profit and Loss Statement Excel

A Profit and Loss Statement is a numerical representation of the effectiveness and financial performance of the business. It details all operational activities of the company and translates those into financial results. The more profit the business makes, more effectively the business run. Losses indicate there may be economic, operational, or other negative influences on business preventing it from returning a profit on the business owner’s investment.

The Reconciliation of Net Worth brings Balance Sheet and the P&L together. It does this by reflecting the effect of the business’s activities indicated by changes in the two other reports. The net worth is numerical value of the business as on the date the report is prepare.

All three elements play critical roles in keeping small business owner informed, but an argument can be made that the P&L is most pertinent to the owner’s successful operation on a day-to-day basis. It is the P&L that all business activities are ultimately accounted for, and their effects on the business can be seen.

Profit and Loss Statement for Small Business Example

As its name implies, our Profit and Loss Statement for Small Business template is build expressly for small business owners. It is customizable and therefore suitable for businesses of all kinds and sizes.

Structure of the Profit and Loss

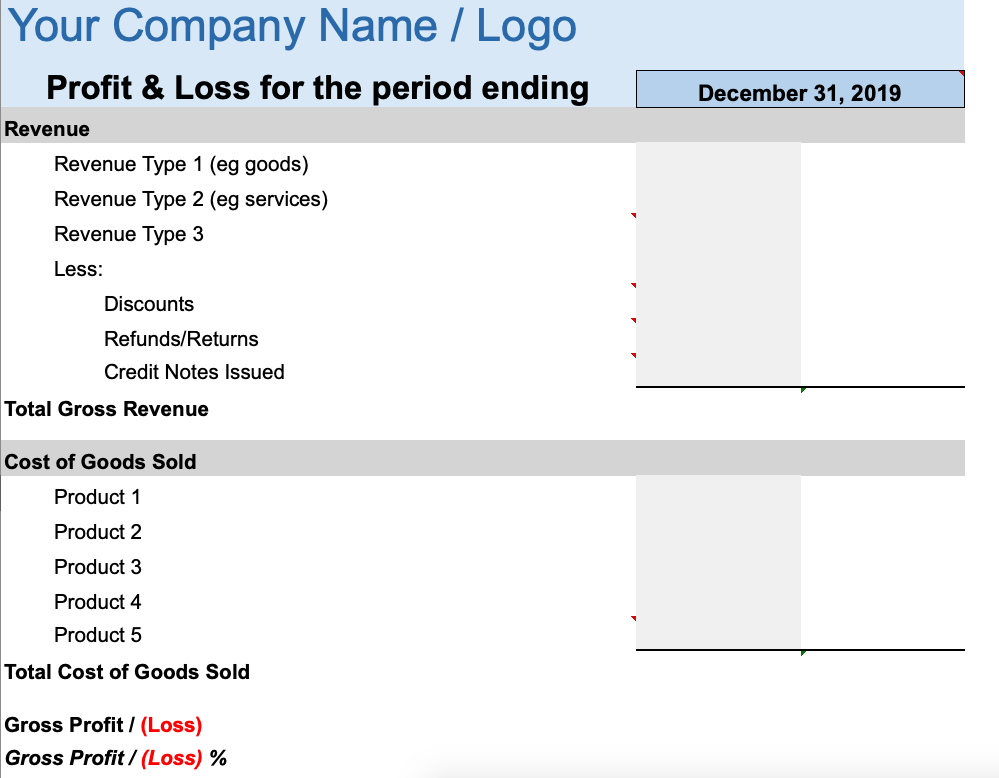

The P&L contains three distinct sections: (1) Gross Profit/Loss, (2) Net Profit/Loss Before Depreciation, Interest and Taxes, and (3) Net Profit/Loss.

Importance of Profit and Loss Statement

By reviewing this Small Business Profit and Loss Template, you now understand what a Profit and Loss Statement is, how to construct the elements of the report work together to reflect the business’s net result. And, you can appreciate the importance of this crucial piece of information to the business owner.

As detailed above, this information is available to the business owner in more complex and detailed financial statements. Moreover, The advantage of using financial reporting, is that information critical to the business owner’s understanding of his/her business is condense into a single easily-understanding report, without complexity or overuse of details. Many business owners prefer such clear and concise presentation to understand their business better.