Saudi VAT Payable Calculator is use to easily calculate VAT payable liability by just entering details of purchase and sales.

According to Article 45 related to Calculating Tax mention in Value Added Tax – Implementing Regulations of Saudi VAT Law:

Thus, VAT Payable = Output Tax – Input Tax.

Article 45 – Calculating Tax (Value Added Tax Regulations – Saudi VAT)

We pay VAT when we purchases and collect VAT when we sell. VAT paid on the purchase is our Input Tax and VAT collected on sale is our Output Tax.

According to VAT Law, a taxpayer is eligible to claim input on purchases of the goods or services used for taxable supply. It is also called recoverable input tax.

A taxpayer to pay VAT at the time of import of goods. This VAT is paid under Reverse Charge Mechanism.

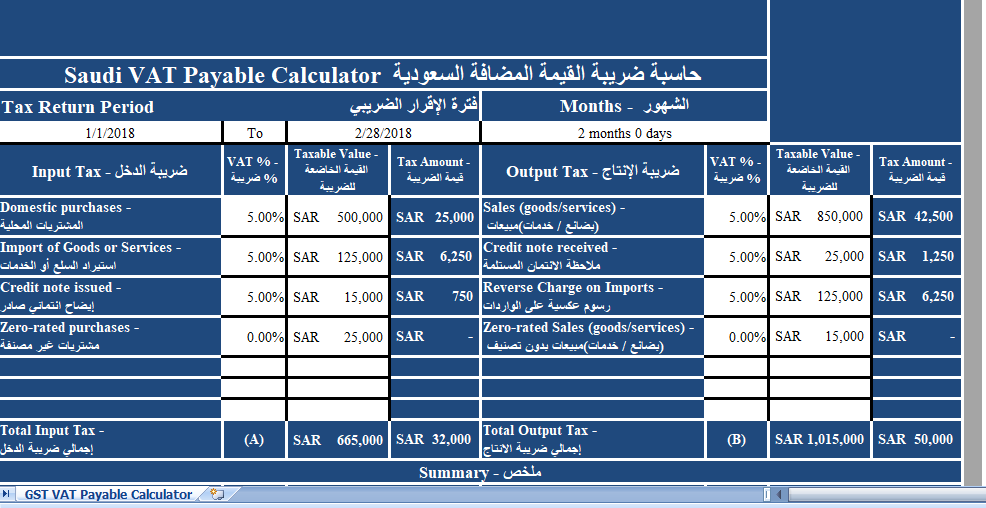

Considering the above points, we have create Saudi VAT Payable Calculator template with predefine formulas.

Just enter the details of sales, purchase, sales return, purchase return, imports, and exports and it will automatically calculate VAT payable to Tax Authority.

Contents of Saudi VAT Payable Calculator

Saudi VAT Payable Calculator consists of 4 sections:

- Header

- Input VAT Section

- Output VAT Section

- Summary Section

1. Header

Usually, the header section consists of the supplier.

In addition to the above, you have to enter the Tax period for which you want to calculate VAT liability.

2. Input VAT Section

Input VAT section consists of following 4 columns.

Firstly Input VAT, second is VAT %, third is Taxable Value and fourth is VAT amount.

You need to enter respective amounts of items in the respective cells.

In VAT % column, enter the vat percentage applicable. VAT is 5 % in general. However you need to enter 0% if the purchases are zero-rated.

Taxable value is the total of each head from the books of accounts. VAT amount is calculate using the following formula:

VAT Amount = Taxable Value X VAT %

3. Output VAT Calculation Section

Similar to the input VAT section, the Output VAT section has the same four columns.

Enter the respective amounts in cells and it will automatically sum up for you. Subtotal of both Input VAT Section and Output VAT Section is given at the end of sheet.

4. Summary Section

The summary section has the final calculation of VAT that is Output Tax less of Input Tax as per Article 45.

VAT Payable (B-A) = Total of Output VAT (B) – Total OF Input VAT (A)

In case amount of VAT payable is negative then it means that you have balance with the tax authority and this balance can be carried forward to next tax period.