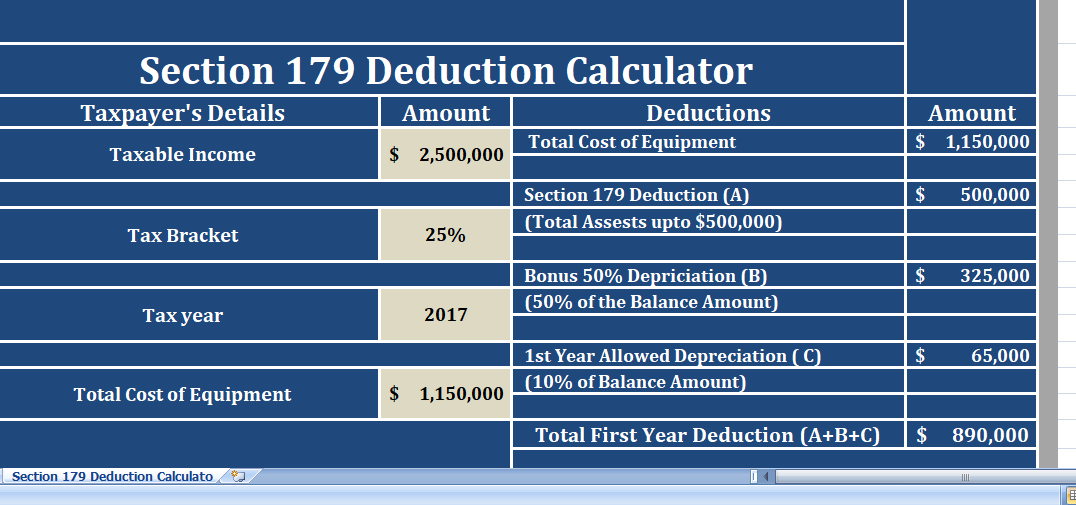

Section 179 Deduction Calculator is an excel template that helps to calculate the amount you could save on your tax bill by taking the Section 179 Deduction.

Similarly, As we all know Section 179 deduction is an immediate expense available for business owners on the purchase of business equipment during the tax year instead of depreciating or capitalizing over multiple years.

However, This initiative was taken by the government to encourage the small and medium size businesses to save money on the tax bill and use it for business enhancement.

Moreover, Keeping in mind all the points, we have created Section 179 Deduction Calculator with predefine formulas.

You just need to enter a few amounts and you will tentatively know that how much amount you could save on your tax bill. It is very simple and easy to use this calculator.

Contents of Section 179 Deduction Calculator

Section 179 Deduction Calculator mostly have 2 sections:

- Taxpayer’s Details

- Section 179 Deductions

1. Tax Payer’s Details

Taxpayer’s section consists of the following:

Taxable Income: Enter your taxable income in this cell. The purpose to provide taxable income here is that according to section 179 (b) (3), the deduction amount shall not exceed the aggregate amount of taxable income of taxpayer.

Thus, if the deduction amount is above the taxable income then section 179 deduction will not be available.

Tax bracket: You need to enter the tax bracket in the second cell on left. This will help calculate the amount you saved on tax.

Tax year: Applicable Tax year. Please keep in mind the calculator is design according to the limits and threshold of the year 2017 for Section 179 deductions.

Total Cost of Equipment: Enter the total cost of equipment for which you are planning to claim the Section 179 deduction.

2. Section 179 Deductions

When you have entered the above amounts in the taxpayer’s details section. Section 179 Deduction will calculate the total amount of the deduction.

Total Amount Of Deduction = Section 179 Deduction + Bonus Depreciation + Allowed Depreciation

Where:

Section 179 Deduction = Cost of Equipment up to $ 5,00,00.

Bonus Deduction = 50% of the Value left after deducting $ 500,000.

If the value of the equipment is less than $500,000. The bonus depreciation will not be available as the total value of the asset is shown as an expense.

1st year Allowed Depreciation = 10% of the balance amount remaining after deducting $ 500,000.

Similar to Bonus Depreciation, the first year depreciation is again not available if the amount is below $ 500,000 as the total value of the equipment has been written off as an expense.