Revolutionize Your Finances with the Simple Budgeting Excel Tool

Managing personal finances can be a daunting task, particularly for those who are not experienced with budgeting. The good news is that you don’t need to be a finance professional to get your financial life on track. The Simple Budgeting Excel Tool is a free, easy-to-use template that has been designed by finance professionals to help you take control of your finances. This tool contains inbuilt formulas and is perfect for anyone looking to create a budget. In this blog post, we will discuss the benefits of using this budgeting tool, who can use it, and how to use it effectively.

Who can use the Simple Budgeting Excel Tool?

The Simple Budgeting Excel Tool is designed to be user-friendly and suitable for a wide range of individuals. Some of the groups that can benefit from using this tool include:

- Individuals and families: Anyone looking to manage their personal or household finances can use this template. It is particularly helpful for those who are new to budgeting or are looking for a straightforward way to track their income and expenses.

- Students: College students or those living on a tight budget can use this template to manage their finances and avoid overspending.

- Freelancers and small business owners: The Simple Budgeting Excel Tool can help those who work for themselves or run a small business to keep track of their income and expenses and ensure their business remains profitable.

- Nonprofit organizations: Budgeting is essential for nonprofit organizations to manage their funds and ensure that resources are allocated efficiently. This template can help them create a simple and effective budget.

How to use the Simple Budgeting Excel Tool:

Using the Simple Budgeting Excel Tool is as easy as following these steps:

- Download the template: To get started, you’ll need to download the free Simple Budgeting Excel Tool. It is compatible with Microsoft Excel and other spreadsheet software.

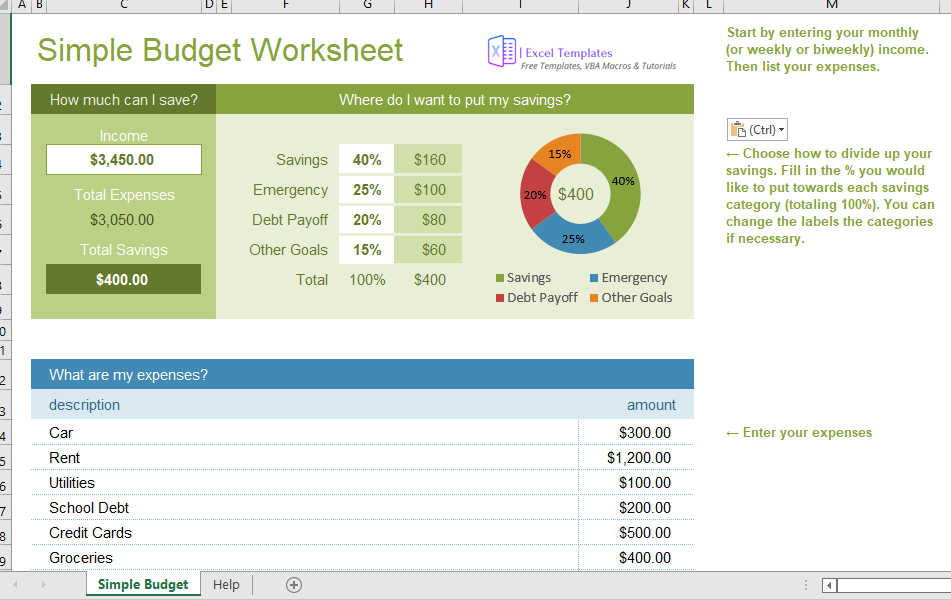

- Input your income sources: Begin by entering all of your income sources in the designated cells. This may include your salary, rental income, freelance earnings, or any other sources of income. The inbuilt formulas will automatically calculate your total income.

- List your expenses: Next, input all of your monthly expenses, including housing, utilities, groceries, transportation, insurance, and any other recurring costs. The template will automatically calculate your total expenses and subtract them from your total income.

- Categorize your expenses: To gain better insight into your spending habits, categorize your expenses into different groups like housing, food, transportation, entertainment, and savings. This will help you identify areas where you can cut back on spending.

- Set financial goals: Using the data provided by the template, set achievable financial goals, such as reducing debt or increasing savings. Track your progress in the spreadsheet to stay motivated and accountable.

The Simple Budgeting Excel Tool is a powerful resource for individuals, families, students, freelancers, small business owners, and nonprofit organizations looking to manage their finances more effectively. This free, user-friendly template, designed by finance professionals, will help you create a budget, track your income and expenses, and set financial goals. With the Simple Budgeting Excel Tool, you can take control of your finances and work towards a brighter financial future.