These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. So, Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

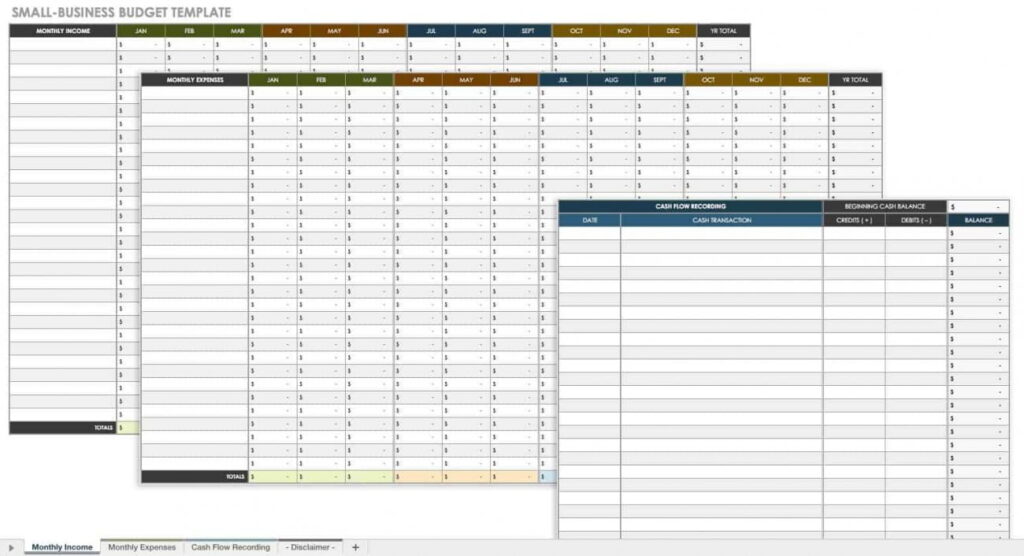

Moreover, This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. So, This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

How to Create a Business Budget for Your Small Business

- Analyze costs.

- Negotiate costs with suppliers.

- Estimate your revenue.

- Know your gross profit margin.

- Project cash flow.

- Factor in seasonal and industry trends.

- Set spending goals.

- Bring it all together.

Why is small business budgeting important?

Budgets are just as important for small businesses as for large corporations. At the very least, budgeting will help you keep a track record of your revenue and expenses. To the surprise of many, simple budgeting can bring more immediate benefits than financial planning, forecasting and other detailed processes.

A budget is an estimation of target activities over a specified time. Conventionally, a budget is an estimation of income and expenses for a specific period. A budget can also be termed as a tactical action plan or as an outline of the strategic business plan.

Moreover, Small businesses require budgets for various reasons. Small business budgeting entails controlling activities for different categories.

Small businesses require budgets for various reasons. Thus, Small business budgeting entails controlling activities for different categories.

Moreover, Budgets can be devised in various ways. Every business has different budgeting needs. Thus, depending on the business’s resources, current position and target state, budgeting can take a different form for every business.