Taxable Gratuity Calculator Excel Template is ready-to-use excel template to the amount of gratuity that is taxable under the Indian Income Tax Act.

Income tax applicability differs according to the companies falling/not falling under the Gratuity Act 1972 and also the type of company (Government or non-government).

An employee is entitle to get gratuity when he/she:

- Resigns

- Retires

- Laid off

- Death or Disablement

An employee is entitle to gratuity if he/she completes a minimum service of 5 years in that particular company. There is no minimum eligibility period in case of death or disablement with limited contract gratuity

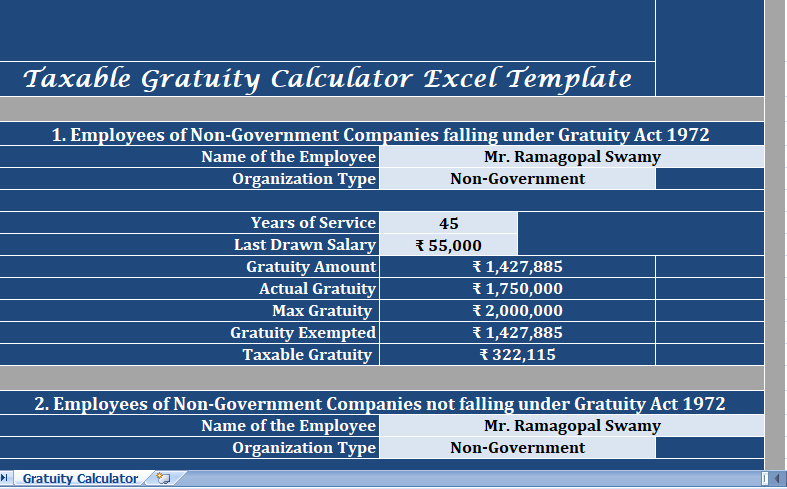

Taxable Gratuity Calculator Excel Template

We have created the Taxable Gratuity Calculator excel template with predefine formulas to easily calculate your taxable gratuity.

How To Use Taxable Gratuity Calculator?

There are 3 different criteria to calculate taxable gratuity for employee depending on his company and Gratuity Act applicability:

- Employees Falling under Gratuity Act 1972

- Employees not falling under Gratuity Act 1972

- State/Central Government Employees

Every employee is entitled to gratuity who is working in any company which has 10 or more employees on any day in preceding 12 months.

So, Once Gratuity Act is applicable to the company, even if the number of decreases below 10, the company falls under the Gratuity Act.

1. Employees Falling Under The Gratuity Act 1972

For employees falling under this category, least of the following is exempt from income tax [Gratuity Act 1972, Section 10(10)(ii)]:gratuity calculation formula

- Last drawn salary (basic + DA) X Years of Service X 15/26

- Rs. 20 lakhs

- Gratuity Actually received.

In this section, you need to enter your name, years of service and last drawn salary (that is Basic + DA). The template will automatically calculate taxable gratuity for you.

2. Employees Not Falling Under The Gratuity Act 1972

Employees falling under this category, least of following is exempt from the income tax [Gratuity Act 1972, Section 10(10)(ii)]:

- Last 10 month’s average salary (basic + DA)* number of years of employment* 1/2.

- Rs. 10 lakhs

- Gratuity actually received.

Similar to above section, enter the name, sum of 10 months salary (that is Basic + DA) and. So, It will automatically calculate the taxable gratuity for you.

3. State/Central Government Employees

Gratuity paid by government to government employees is fully exempt from tax. Gratuity received by state or central government employees on death-cum-retirement is completely exempt. Employees of the statutory corporation will not fall under this category.

Last drawn salary will not be total take home salary. It is only basic salary in addition to the dearness allowance.

If your years of service are less than 5 years gratuity calculator will display NIL.