In this article, we discuss the Traditional IRA Calculator which is helpful for you to decide the amount of savings you need to invest for your retirement goals.

A Traditional IRA is an individual retirement account. Investing in traditional IRA helps you to grow your earnings tax-deferred.

Best Traditional IRA

In traditional IRA, you are entitle to the tax deduction in the contribution year for that particular year.

You pay taxes on your investment gains only when you make sure to withdrawals during your retirement years.

This Calculator helps to set your retirement goals and choose the amount to invest in IRA to achieve these retirement goals.

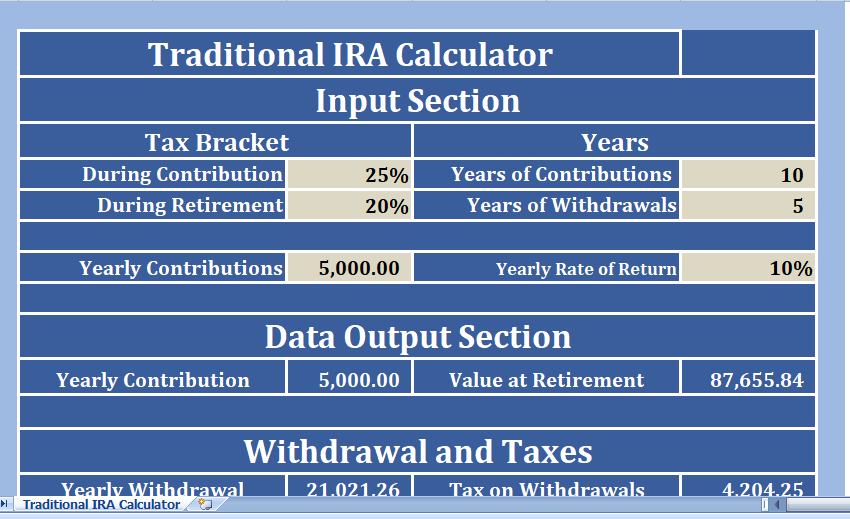

We have created an excel template for Traditional IRA Calculator with predefine formulas. You just need to input a few details and the calculations are automatic.

Contents of Traditional IRA Calculator

This calculator consists of 3 sections:

- Header Section

- Data Input Section

- Data Output Section

1. Header Section

As usual, the header section of the sheet ” Traditional IRA Calculator”. If you are a company, you can put your logo and company name on top of the sheet.

2. Data Input Section

The data input section consists of multiple details. In this section, you need to provide the following details:

Tax Bracket: Under this subheading, enter your current tax bracket and estimated tax bracket at the time of retirement.

Our sheet shows a very lower rate of tax bracket during retirement. Tax brackets are decided by federal authorities and thus it is always better to choose a feasible bracket. Because we don’t know what will happen during these ten years of the contribution.

Years: Also, Enter the number of years you wish to contribute along with the number of years of withdrawals.

Yearly Contributions: Yearly contributions means the amount you will invest on a yearly basis.

Yearly Rate of Return: As per the retirement goal you need to choose the investment plan. Different plans have a different yearly rate of return.

3. Data Output Section

Data output section consists of results entered values in respective cells.

Yearly Contributions: This amount is derived by linking the cell D9, It displays your amount of contribution.

Value At Retirement: It is total amount you will have at the time of retirement.

Yearly Withdrawal: After ten years, as you have opted for 5 years of withdrawal, you will get an amount every year for 5 years.

Tax on Withdrawals: As mentioned, you need to pay the then prevailing taxes on withdrawals in traditional IRAs. We have estimated an amount of 20%.

Take Home Amount: Take home yearly amount = Withdrawal – Tax % during retirement.