UK VAT Payable Calculator Excel Template is an template that helps you easily calculate your tax liability payable to HRCM.

Additionally, you can calculate input vat as well as output vat separately. This template can be helpful to small and medium-size business.

What is VAT Payable?

VAT payable is VAT liability paid by the businesses registered under VAT in the UK. When we make sales we collect VAT on it. We issue Credit Notes and Debit Notes against invoices that we need to adjust while calculating VAT payable.

Furthermore, we are entitled to recoverable VAT input tax on purchases that we make for providing a taxable supply. This VAT input reduces tax liability and hence is deduct from total output tax.

Furthermore, as per VAT Notice 735 of the UK VAT Law, you have to pay VAT under reverse charge under some conditions.

Formula of Calculate UK VAT Payable

VAT Output Tax – VAT Input Tax = VAT Payable

Where:

Input VAT = VAT on Purchases + VAT allowable (acquisitions) – Input Tax Adjustment + Bad debt relief – VAT Debit Notes

And

Output VAT = VAT on Sales + VAT due (acquisitions) – Output Tax Adjustments + Annual adjustment (retail/apportionment scheme) – VAT Credit Notes

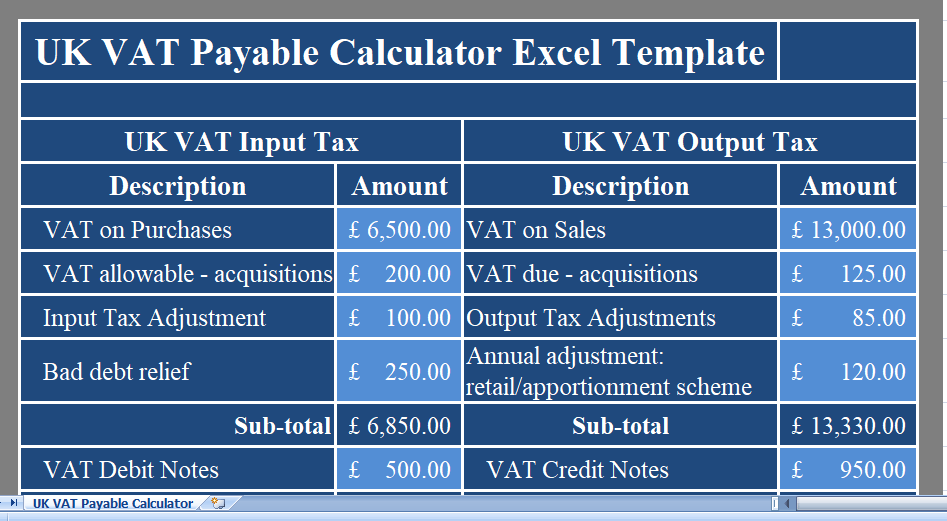

UK VAT Payable Calculator Excel Template

We have create a simple and easy UK VAT Payable Calculator Excel Template with predefine formulas. Just enter few details and it will automatically calculate your VAT liability.

Contents of UK VAT Payable Calculator

This template consists of following sections: Heading, Input VAT, and Output VAT.

Heading Section

The heading section consists of company name, log and sheet heading. Insert your logo and name of your company to customize as per your needs.

Input VAT Section

Input VAT section consists of following:

VAT on Purchase

VAT allowable – acquisition

Input Tax Adjustment

Bad debt relief

VAT Debit Notes

Insert the above detail and template automatically calculates Subtotal amount.

Subtotal = VAT on Purchases + VAT allowable (acquisitions) – Input Tax Adjustment + Bad debt relief

Total Tax Deductible = Subtotal – Vat Debit Notes

Output VAT Section

Output VAT consists of following:

VAT on Sales

VAT due (acquisitions)

Output Tax Adjustments

Annual adjustment (retail/apportionment scheme)

VAT Credit Notes

This template can be useful to small and medium-sized businesses like wholesalers, semi-wholesale and trading.