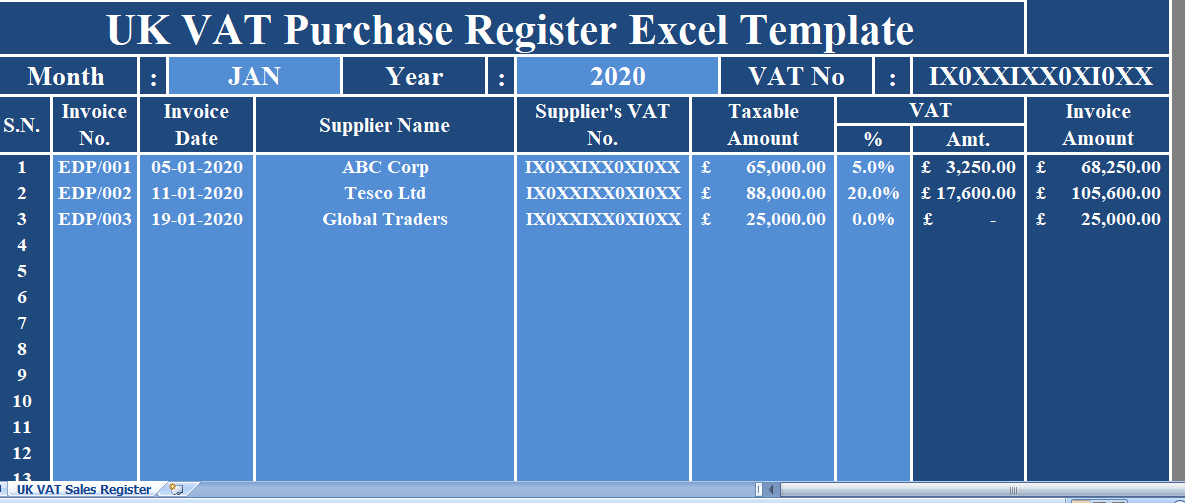

UK VAT Purchase Register is an excel template to maintain records of your purchase during a specific period along with details of Input VAT collected on those purchases.

A purchase register records all the purchase and purchase return transactions from suppliers of business. Also, it is your accounts payable ledger also known as Purchase ledger. Usually, we record our purchase transactions in it.

The VAT on purchase of goods or services which a business pays is refer to as Input Tax.

We have created a simple UK VAT Purchase Register Excel Template with predefine formulas and formatting. You can record your VAT purchases as well as purchase return in it. This template auto-calculates VAT amount for the given taxable value.

There is provision to enter up to 100 invoices in this template. If you have more than 100 invoices, you can insert additional rows as well. To maintain records for longer time, either make a copy of this sheet and you can use it for other tax periods.

Contents of UK VAT Purchase Register Excel Template

Purchase Ledger or Purchase register consists of 2 sections: Header Section and Purchase Transaction Section.

Header Section

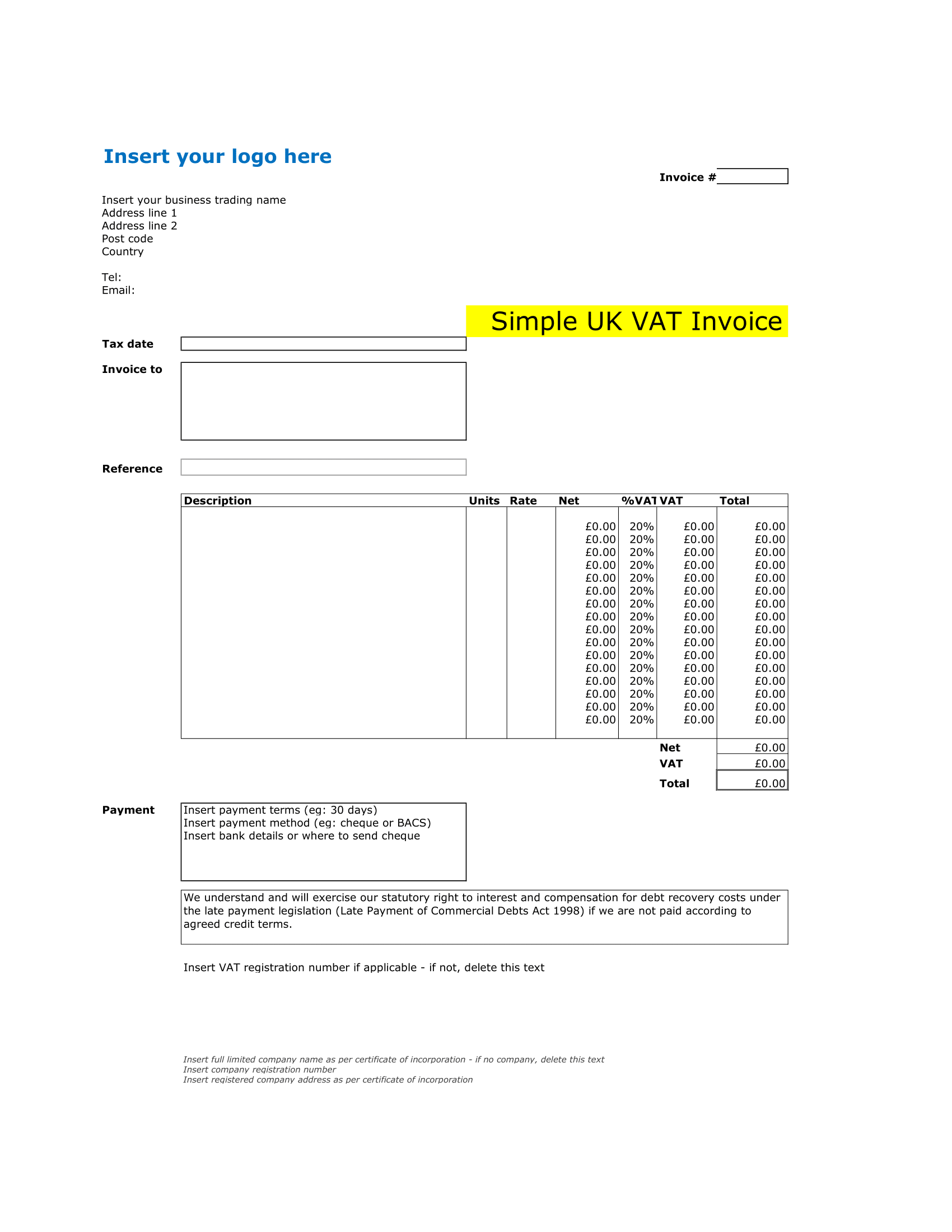

The header section consists of headings includes your company name, logo, and your VAT number.

This is monthly Purchase report. Select the month from the dropdown list and enter respective year.

Purchase Transaction Section

Purchase Transaction consists of 2 sections: Supplier’s Details and Purchase VAT Computation. In this section, you have to record your purchase invoices as well as purchase return debit note transactions.

Supplier Details

The supplier details consist of following columns:

Serial Number: The serial number is auto-generated hence you don’t need to make any entry in this column.

Invoice No: Insert purchase invoice or debit note number.

Invoice Date: Enter date of the invoice.

Supplier Name: Enter name of your client/supplier.

Supplier’s VAT No: Insert respective VAT number of your client/supplier.

Purchase VAT Computation

This section consists of following columns:

Taxable Amount: Enter taxable amount of the invoice in this column. The taxable amount is total amount

VAT %: Select the VAT % from the dropdown list. It can be either 20%, 5%, or 0%.

VAT Amount: This column consists of a predefine formula and hence requires no entry. The formula used to calculate the VAT amount is calculated is Taxable Amount X VAT %

Final Invoice Amount: Similar to previous column, this column also consists of a predefine formula. Final Invoice Amount = Taxable Value + VAT Amount.

In the end, there are column totals. The first one represents taxable value, the second represents Total Input Tax, and third one represents the total purchase amount including VAT.

This template can be useful to small and medium-sized businesses that don’t use any software for record-keeping.