Calculating the present or future value of any investment is easy, as long as that investment generates even cash flows over the period of investment. But uneven cash flow present aa a challenge.

Cash flows are uneven:

- Where amount of cash inflows over different years is not equal, and/or

- Where time interval between cash flows is not equal.

Payback Period Formula for Uneven Cash Flow

Whether you are an experienced investor or investing for the first time, calculating the present and future value of your cash flow is critical.

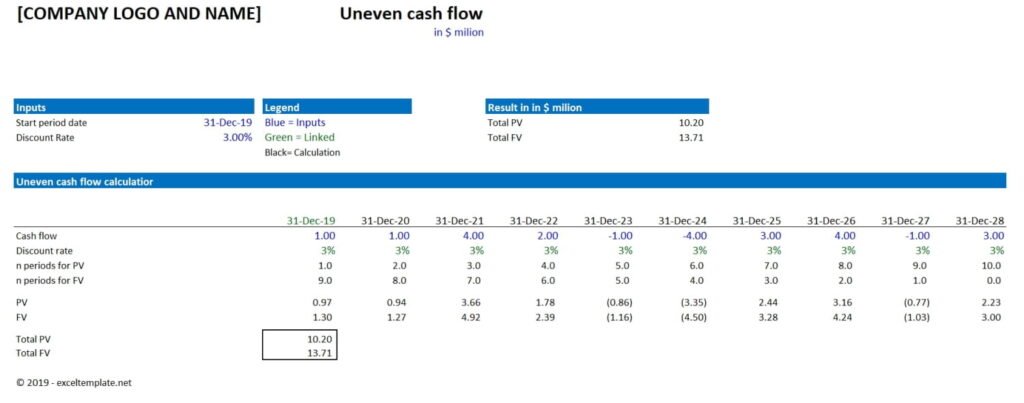

Unfortunately, calculating the future value of any uneven cash flow is complicate. Which is why we have created our Uneven Cash Flow Calculator, to help you simplify the process of valuing your uneven cash flows.

Our uneven cash flow calculator will assist you easily calculate the value of uneven cash flows using different present and future value factors.

Present Value and Future Value of Uneven Cash Flow

The concept of “the time value of money” works on present-value and future-value components. Moreover, The discounted cash flow method helps you calculate the value of both, based on a discount rate or cost of capital.

Present Value

Thus, The Present Value of an asset is define as the total of the current value of cash flows to be received over a future period, discount at specified discount rate. An increase in the discount rate results in a decrease in valuation, and vice-a-versa.

One reason behind decline in present value is the inflation rate. You can’t buy the same quantity of goods with same amount of money today versus the previous year. Here, the present value formula discounts the future cash flows to incorporate the effect of inflation.

Future Value

Future value is worth of an investment at a particular date in the future. Hence, The calculation of future value depends on estimation of earnings of an asset over the time period.

Drawback: Moreover, Future values do not account for effect of currency exchange rate fluctuations. Volatile exchange rates can have a major hit on your current cash inflows. This is relevant if the investment is in a different currency and/or cash inflows will be in multiple currencies.

How to Use Our Uneven Cash Flow Calculator

Moreover replace data in blue with your own information. Here are the step by step instructions on how to use this free financial calculator.

1) Start Period Date

Input date at which the present or future value is to be calculate. The future period will determine on cell data. Thus, The uneven cash flow calculator has been customized to include period of 10 years, but you can change that to a shorter period.

2) Discount Rate

The discount rate (for future value) is the rate of return that can be earned in future, if the amount is invested today. It is also refer to as the foregone opportunity cost, weight average cost of capital, and hurdle rate (for present value).

3) Cash Flow

Net cash flow is the total amount receive by investors over the period of investment. This can be in the form of interest, dividends, profit or commission, etc. Hence, Fill the calculator with the expect amount of cash to be generated during each year. This is use to calculate the present value or future value.

IRR and Uneven Cash Flows

The internal rate of return is the rate at which the net present value of an investment is zero. If you consider an expansion plan and have two options available for the type of machinery to purchase, you will choose option generating higher NPV.

So, Another factor to take into account is the time period require to materialize the returns, i.e. the period to construct the building or machinery, install equipment, etc.

Although the calculations may be cumbersome, the process is simplified by using uneven cash flow calculator.