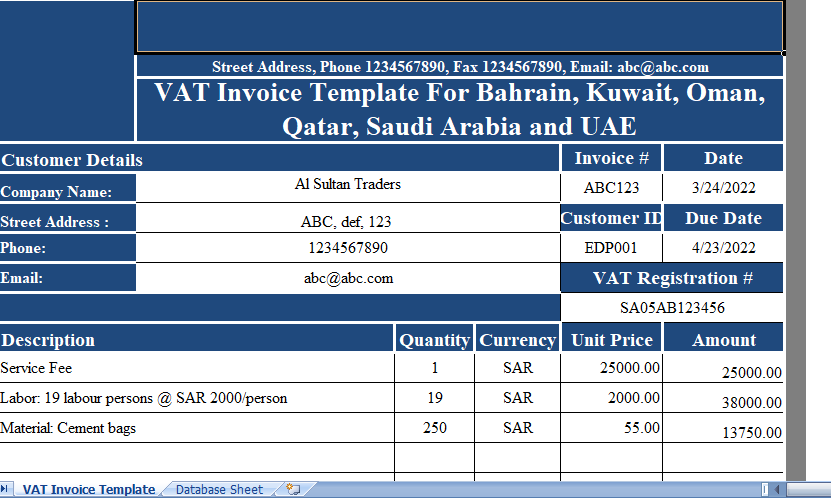

VAT Invoice Template is an excel template in compliance with GCC VAT Law. You can issue VAT invoice for 6 GCC Countries; Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE easily and efficiently using template.

All 6 GCC countries have sign agreement for introduction of VAT throughout the GCC in 2018.

Business operating in GCC countries have to prepare for compliance with GCC VAT Law 2018.

We have create a ready to use VAT Invoice Template in Excel. The user needs to select his country and can start issuing VAT compliance invoices to their customers.

Before proceeding to template contents, you need to select your country from the box given beside the template.

When you select the country, it will automatically change the currency in all the cells of template.

Content of VAT Invoice Template

This template consists of 2 worksheets.

- VAT Invoice Template

- Database Sheet

Database sheet contains list of names of your customers. This list is use for creating the drop-down list in customer details section of VAT Invoice Template.

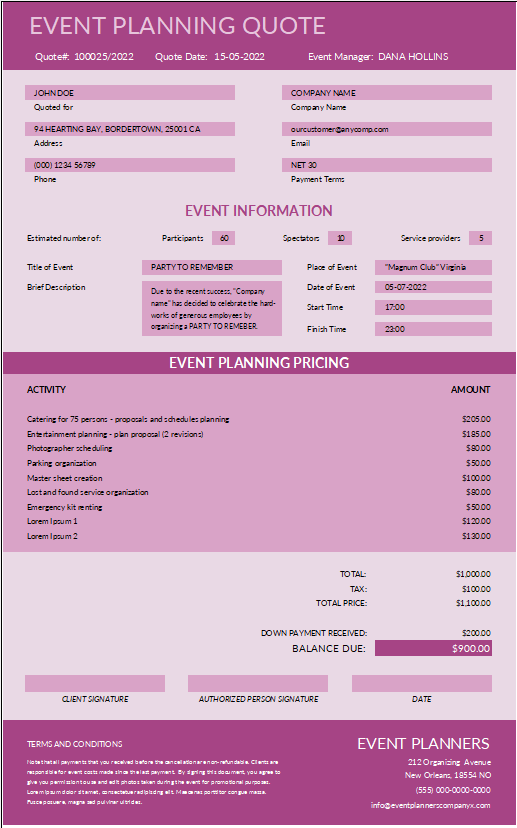

The invoice Template consists of 4 sections:

- Header Section

- Customer Details Section

- Product Details Section

- Other Details Section

1. Header Section

Header section contains the company logo, company name and heading of the invoice ” Tax Invoice”.

2. Customer Details Section

However, Customer Detail section programmed and referenced to database sheet with data validation and VLOOKUP function.

You can select the name of the customer from the drop-down list.

So, When you select the customer names, the template automatically updates other details of customers in the relevant cell.

Moreover, These details include address, phone, email and customer id.

On the right-hand side you need to enter invoice number, invoice date. The due date for payment which is set to 30 days from date of invoice will appear automatically. Then comes your VAT Registration Number.

3. Product Details Sections

Product details section consists of columns of Description, Quantity, Unit Price and Amount.

The formulas use are simple mathematical computations.

Quantity X Unit Price = Amount.

At the end, the subtotal line is given.

4. Other Details Section

Moreover, other details section consists of Amount in words, Terms & Conditions, VAT computations @ 5%.

In addition to this are given space for Company seal, signature box and “Thank you” message business greeting.

Moreover, It automatically computes the 5% VAT of the invoice amount and sums up the final total.