How to manage your Weekly Income through a budget planner?

Weekly Budget Planner Template is created to help you assign a budget for a single week or bi-week expenses.

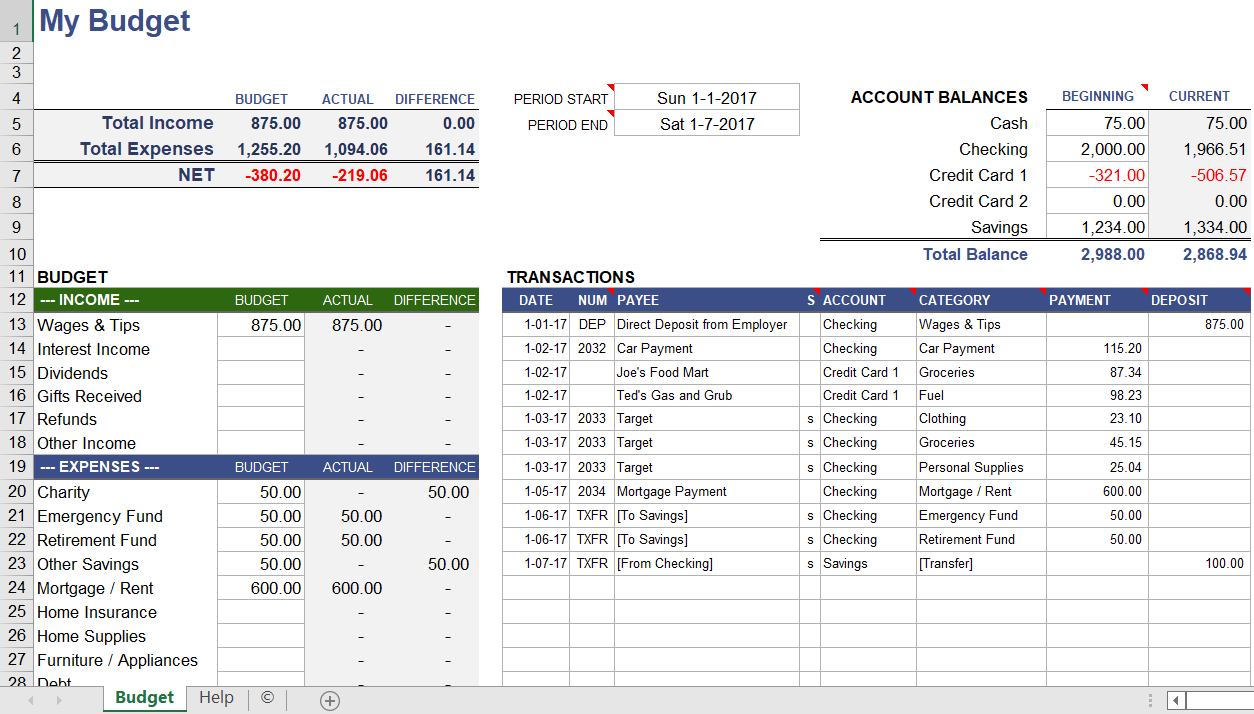

At the start of the week see your all expenses and allocate them into different categories. Then calculate the difference at the end of the week or even for a month. The difference between the allocated budget and the actual budget gives the total costs that occurred.

One can easily track the budget for a category and record the actual cost for that category during each week, all this varies between 4 or 5 weeks. This template is good for tracking money, and it’s easier to do a more detailed analysis of your transaction data in one register.

What is a weekly budget planner?

If your monthly salary is not enough for your household and other expenses and you’re working on a second job that paid weekly salary track your weekly salary in that case also.

On a weekly or biweekly schedule, you receive a paycheck every other week. Your employer distributes paychecks on the same day every pay week, usually a Saturday. Biweekly pay involves an employer paying their employees every two weeks, which means that the employee receives their paychecks more regularly than compared to a monthly payment.

This can be a good revive for those that like getting paid often as to wait a whole month before receiving their next payment. The more frequently you receive your cheque, the more frequently you can get your finances in better.

In a biweekly schedule, you receive 26 paychecks every year. If your payment is a fixed amount, your paycheck will be the same amount. If you are paid hourly, every paycheck differs and it reflects the number of hours you worked based on time.

Industries, construction, manufacturing, and mining organization usually prefer to pay their employees weekly. So, people working in these industries often show weekly pay schedules that reflect their cash flow needs.

Advantage of Weekly Paycheck

- Deductions are easier to predict

- Paycheck always on the same date

- Expense-effective

- Easier to calculate

- Extra Paycheck

How to use Weekly Budget Spreadsheet?

Start with creating a budget for a week, and recording the actual amount being used to analyze each category during the week.

By downloading this spreadsheet it records all your income details. Also, assign a budget for every type of expense at the start. So, this template is regularly updated to keep records of the actual expense under each head.

The spreadsheet tracks all Weekly Budget details from the income sources and the total sum received each week.

Design is based on easier to use (requires little Excel experience).

To calculate Net Balance subtract the Total Expense from the Total Income and add it to the Starting Balance.

The various categories of income are:

- Wages and Tips

- Interests Income

- Dividends

- Reimbursements

- Refund

- Savings

- Other Income

The spreadsheet provides a weekly budget summary table that offers details of the Balance, total Income, total Expense, net income, and expenses specifically. Also, helps you make better decisions on your weekly and bi-weekly expenditures.

The sheet also provides the details of Month to Date income and expenses. Additionally, the Weekly Budget Spreadsheet has various heads and tables for each category like-

- Emergency Fund

- Retirement Fund

- Home

- Daily Living

- Transportation

- Dues & Bills

- Other Payments

Importance of Weekly Budget

- Weekly Budget Plan helps you fulfil your savings targets.

- It helps you to control your spending and creates a good financial future.

- Savings for emergencies and retirement.

- To control your spending

- Helps in your financial contentment and prepare you for emergencies

- Keeps you organized

- Budgeting helps you to save money

- To avoid any unnecessary expenses that create difficulties in the process of saving in your long budget run. For instance, use this template to stay on track and updated on your financial situation.