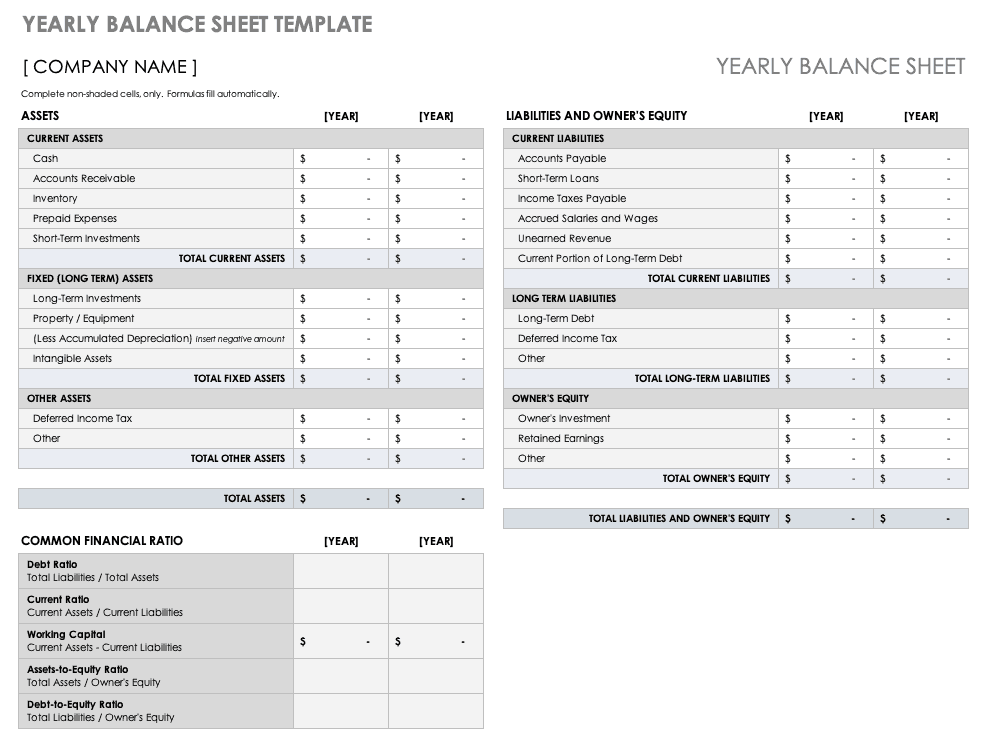

Use these free yearly balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas. So you can use it to evaluate account balances annually.

Yearly Balance Sheet

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure.

Moreover, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios.1

KEY TAKEAWAYS

- A balance sheet is a financial statement that reports a company’s assets, liabilities, and shareholder equity.

- The balance sheet is one of the three core financial statements that are used to evaluate a business.

- It provides a snapshot of a company’s finances (what it owns and owes) as of the date of publication.

- The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.

- Fundamental analysts use balance sheets to calculate financial ratios.

Year to Date Balance Sheet

Thus, The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own.

The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.