GCC VAT Payable Calculator is an excel template with predefine formulas for computation of VAT liability. Output VAT less Input VAT is GCC VAT Payable.

The taxable person collects VAT on the Sales from his customers. Adjusts the Credit Notes and Debit Notes issued to customers during tax period.

A taxable person obtains recoverable VAT input on purchases which is use for business purpose. This recoverable input reduces tax liability.

In addition to this, the taxable person has to pay VAT under reverse charge mechanism for time of import.

Thus, VAT Payable = VAT Output – VAT Input

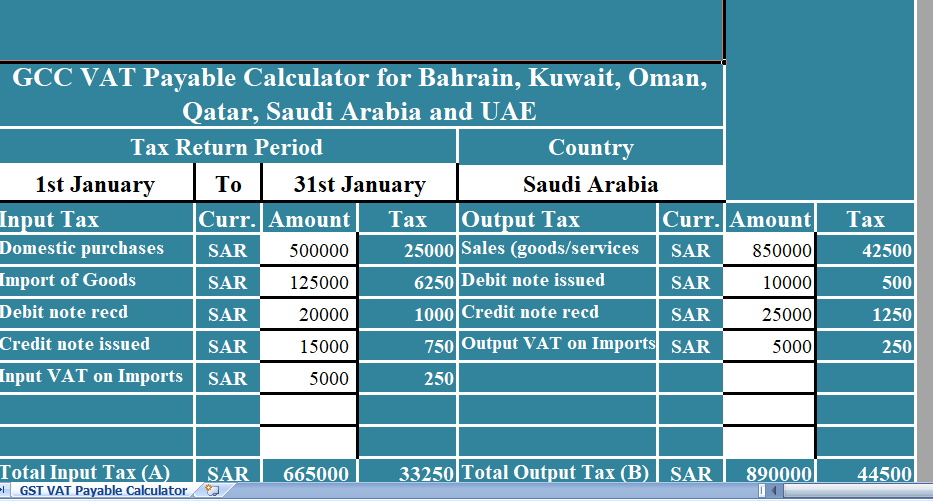

Taking into consideration the above points we created an excel template for GCC VAT Payable Calculator for all 6 GCC Countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE).

The user needs to enter the details of sales, purchase, imports and the template will automatically calculate the GCC VAT payable for you.

Contents of GCC VAT Payable Calculator

GCC VAT Payable Calculator consists of following 4 sections:

- Header Section

- Input VAT Calculation Section

- Output VAT Calculation Sections

- VAT Summary Section

1. Header Section

Generally, the header section consists of company name, company logo and heading of the sheet “GCC VAT Payable Calculator”.

Additionally, it consists of Tax period for which the calculations are being done.

As for now, this template is for all 6 GCC countries, the user needs to select the desired country. When the user selects the country, the template will automatically change the currency in all desire places.

A drop-down list has create using the data validation function and cells in which the currencies are display configure using multiple IF statements.

2. Input VAT Calculation Section

Input VAT calculation section consists of different subheadings like domestic purchases, imports, debit notes, credit notes and input VAT on imports.

However, VAT across GCC countries is 5 %. There is no need to enter the 5% VAT amount as it is already configure with predefine formula.

At the end, the total of input VAT is given. This cell is configure using the SUM function.

3. Output VAT Calculation Section

Output VAT calculation section consists of subheading like sales, debit notes, credit notes, output paid on imports.

You need to enter the respective amounts in the respective cells.

However, like the Input VAT Calculation section, the Tax Column here also is configured and will automatically calculate.

So, Subtotal of Output VAT is given at the end.

4. VAT Summary Section

Moreover, The summary section gives you your VAT payable amount. Simple mathematical calculations are used.

So, Total of Output VAT (B) – Total OF Input VAT (A) = VAT Payable.

Above all, In case the amount of VAT payable is negative then it means that you have balance with the tax authority and this balance can be carried forward to next tax period.