Arabic VAT Invoice is an excel template in Arabic language that is useful for all 6 countries under GCC VAT Agreement.

Business where turnover is above the threshold have to mandatorily register for VAT and other businesses can also register voluntarily.

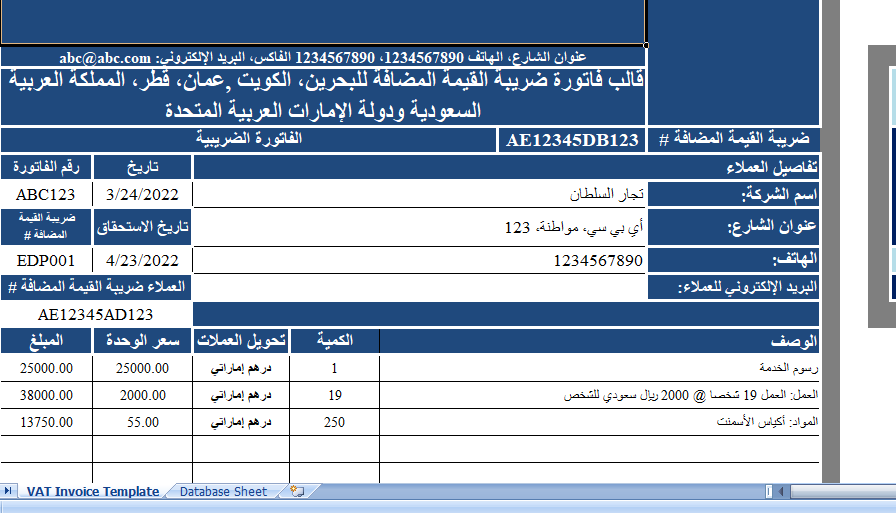

We have created ready to use VAT Invoice Template in Excel. So, The user just need to select his country and can start issuing VAT compliance invoices to their customers.

This template is useful to accounting professionals, clerks, trading companies etc.

Moreover, Before proceeding to the template contents, you need to select your country from the box given beside the template.

A dropdown list is created using data validation tool for all 6 VAT implementing GCC countries. When you select your country the currency will automatically change to respective currency.

Content of Arabic VAT Invoice

Above all, this Arabic template also contains 2 worksheets.

- Arabic VAT Invoice Template.

- Database Sheet.

The Database sheet consists of the details of customers like customer name, customer address, customer phone numbers and customer email address.

Moreover, The sheet has program with VLOOKUP function to display the customer details of the select customer. Enter your customer details that you need to reflect on the invoice.

So, Arabic VAT invoice is designed from right to left. Arabic VAT invoice template consists of 4 sections as in the English version.

- Details of Supplier

- Customer Details

- Product Details

- Calculation

1. Supplier Details

This Supplier detail section is header section. This section contains the company name on top of the invoice heading. Then your address, Invoice type, your VAT number along with your logo on right.

2. Customer Details

This section consists of customer details. It contains predefine formulas using the VLOOKUP Function.

A dropdown list for the customer is created. When you select customer name from the list it will automatically update all other details except the email address.

3. Product Details

Consequently, Product details consist the details of goods or services sold like product description, quantity, rate, and totals.

The Subtotal for the amount column has been given below and displays the total invoice amount before tax.

4. Calculations and Other Details

This section consists of 5% VAT computation on subtotal amount of the invoice.

In addition to this, it also consists of the “Amount In Words”, terms & conditions, space for company seal. space for the authorized signatory and business greetings.

Edit Terms & Conditions as per your requirement. The ” Amount in Words section is to enter manually.

Use this ready to use invoice template by entering your company credentials. Start issuing VAT compliance invoice to your clients.