It is mandatory in Saudi VAT Law that the Tax invoices issued by business entities in Saudi should issue Bilingual Saudi VAT Invoice. Bilingual express two languages.

According to Article 53, Clause No.5 of Implementing Regulations under Saudi VAT Law:

“A Bilingual Saudi VAT Invoice must include the details in Arabic, in addition to other language also shown in the Tax Invoice as a translation.”

Arabic is national language of Saudi. Thus the bilingual Saudi VAT Invoice must contain Arabic along with any other language.

Article 53 Clause No. 5 describes the contents of Saudi VAT Invoice.

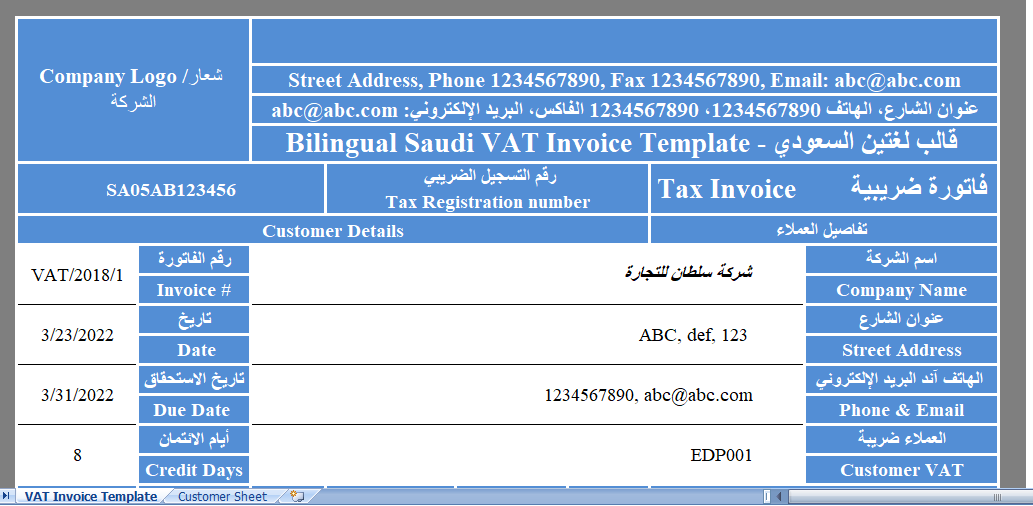

Keeping in mind the guidelines, we have created an excel template for Bilingual Saudi VAT Invoice with predefine formulas.

The user just needs to add his details to supplier’s details section and start using it.

Contents of Bilingual Saudi VAT Invoice Template

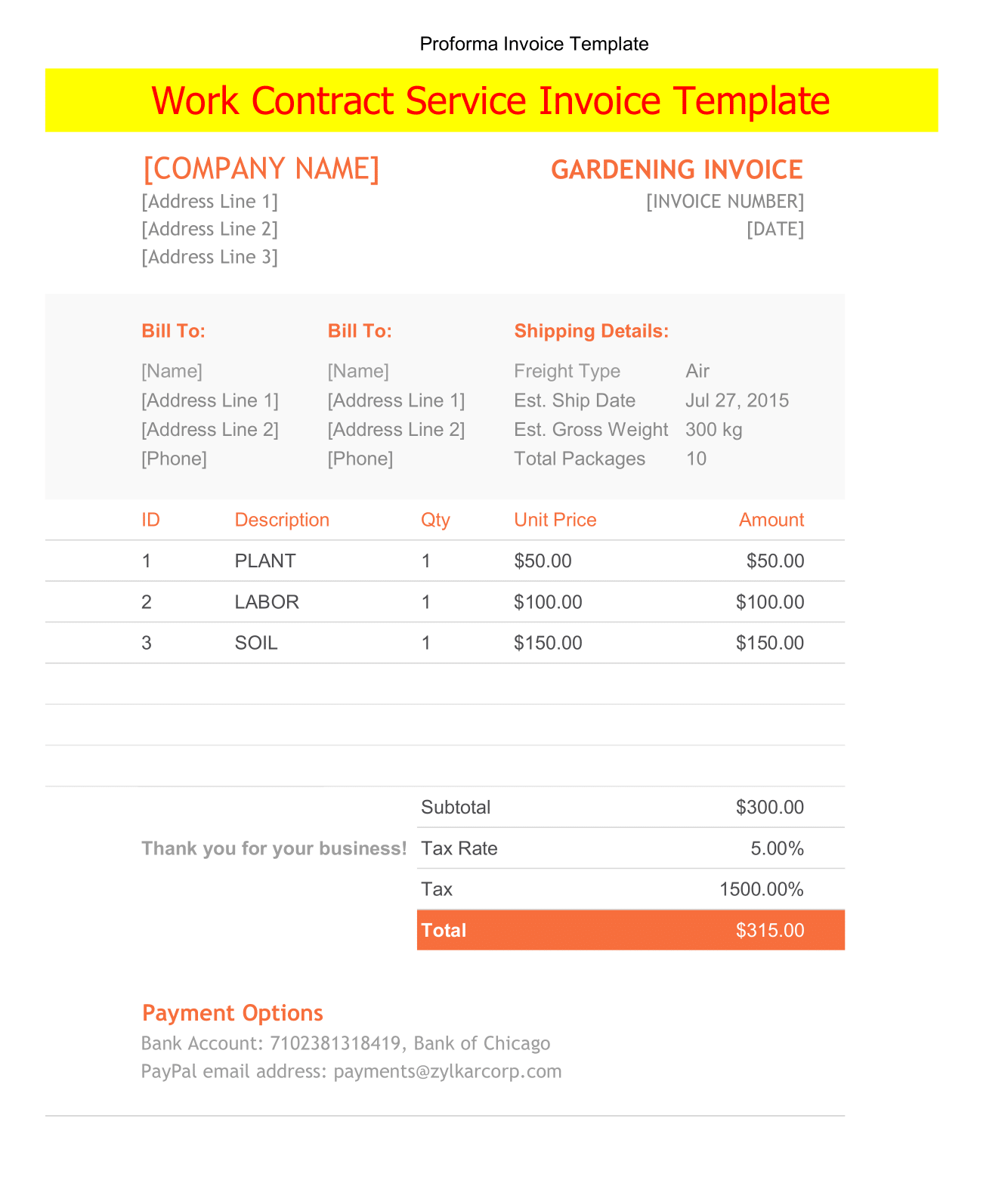

Bilingual Saudi VAT Template contains 2 worksheets which are as below:

- Bilingual Saudi VAT Invoice

- Customer Details Sheet.

All details in given template are in Arabic and English language.

Customer Details sheet consists of details relate to the customer like customer name, customer address, Customer VAT number, and contact details.

The purpose of this sheet is to minimize the manual entry in the invoice. However, this sheet is link to the invoice template using the Data Validation and VLOOKUP Function.

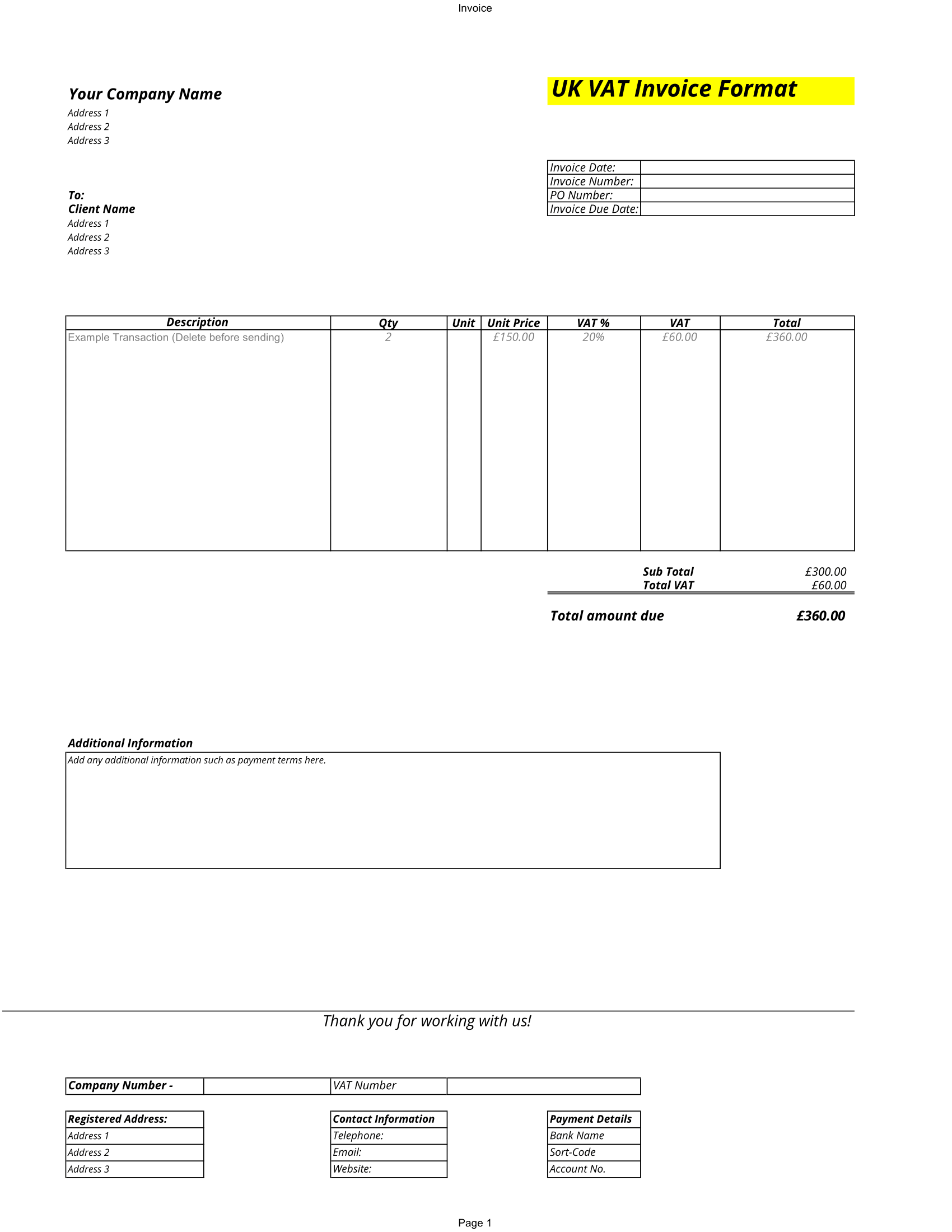

1. Supplier Details

In the header section, supplier detail like supplier’s company name, address, contact details, emails, vat number and type of invoice “Tax Invoice”

However you can see all details provided in this section are mandatory to display by law.

2. Customer Details

This section is pre-program with data validation and VLOOKUP. The user needs to select the customer name from the drop-down list. It will automatically show other respective details the customer from the customer sheet.

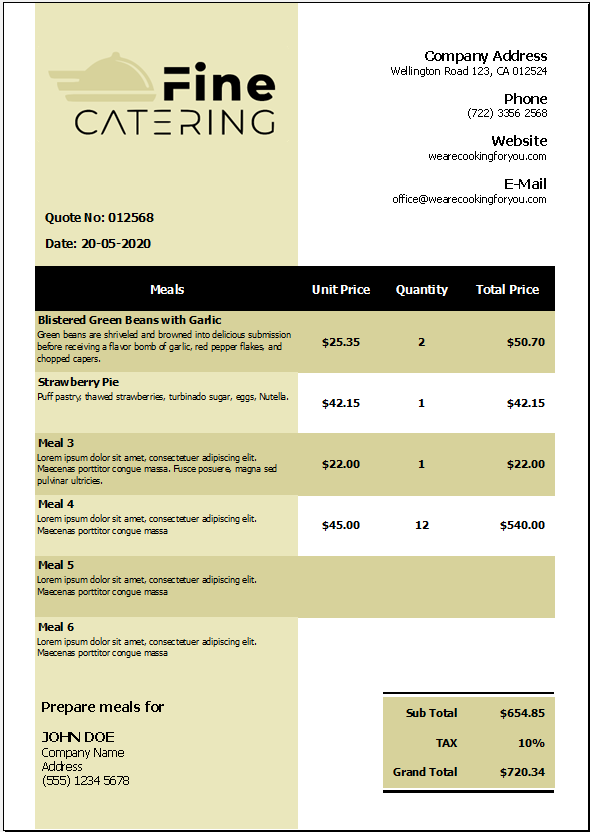

3. Product Details

Product detail consists of following:

Description – Details of goods or services or both.

Quantity – Quantity of goods or services.

Unit Price – Price per unit of goods or services.

Taxable Value – Taxable value is value on which the tax is calculated.

Taxable Value = Quantity X Unit Price

VAT % – Percentage of VAT applicable to the goods or services. Usually, it will be either 0% in case of zero-rated supply or 5% in case of taxable supply.

VAT – Also, VAT amount is calculated using the following formula.

VAT Amount = Taxable Value X VAT Percentage

Total – Therefore, Line total of each item.

Total = Taxable Value + VAT Amount

Columnar totals of each line are given below which displays the total of taxable value of complete invoice, Total of VAT Amount collect against invoice and also the Final total of Invoice.

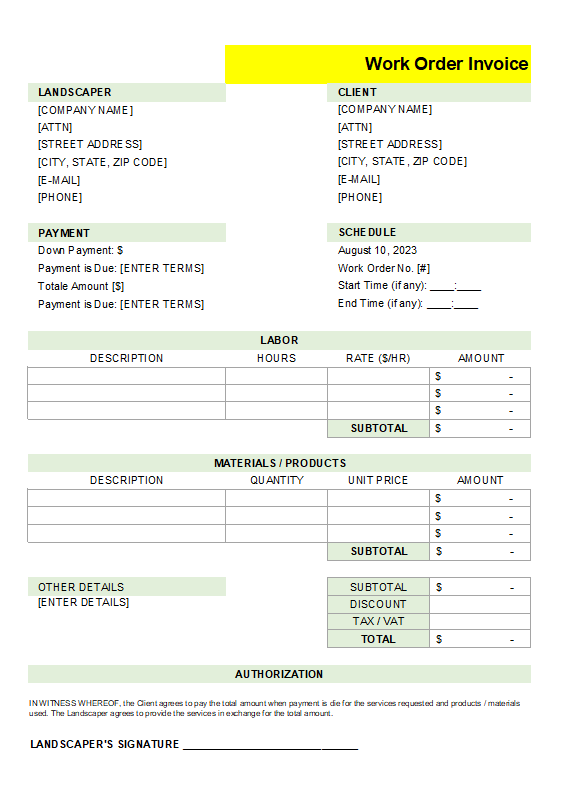

4. Other Miscellaneous Details

Other details include the following details of invoice:

Amount in Words

Terms and conditions

Prepare By

Approve By

Company Seal

Business Greeting

So, Everything in the invoice is bilingual except numbers. The numbers can be changed to the Arabic language by changing the regional settings in the control panel.

However, You can use the cell locking feature in excel to save you from deleting the important formulas.