A budget report is a report managers use to estimate previous budget projections over a definite period. To compare the budget estimations with the actual results the company reviewed during the designated time. Budget reports are mainly the economical goals that are based on information of financial projections. These budget reports almost differ from the final financial results.

How to Create a Budget Report worksheet in Excel

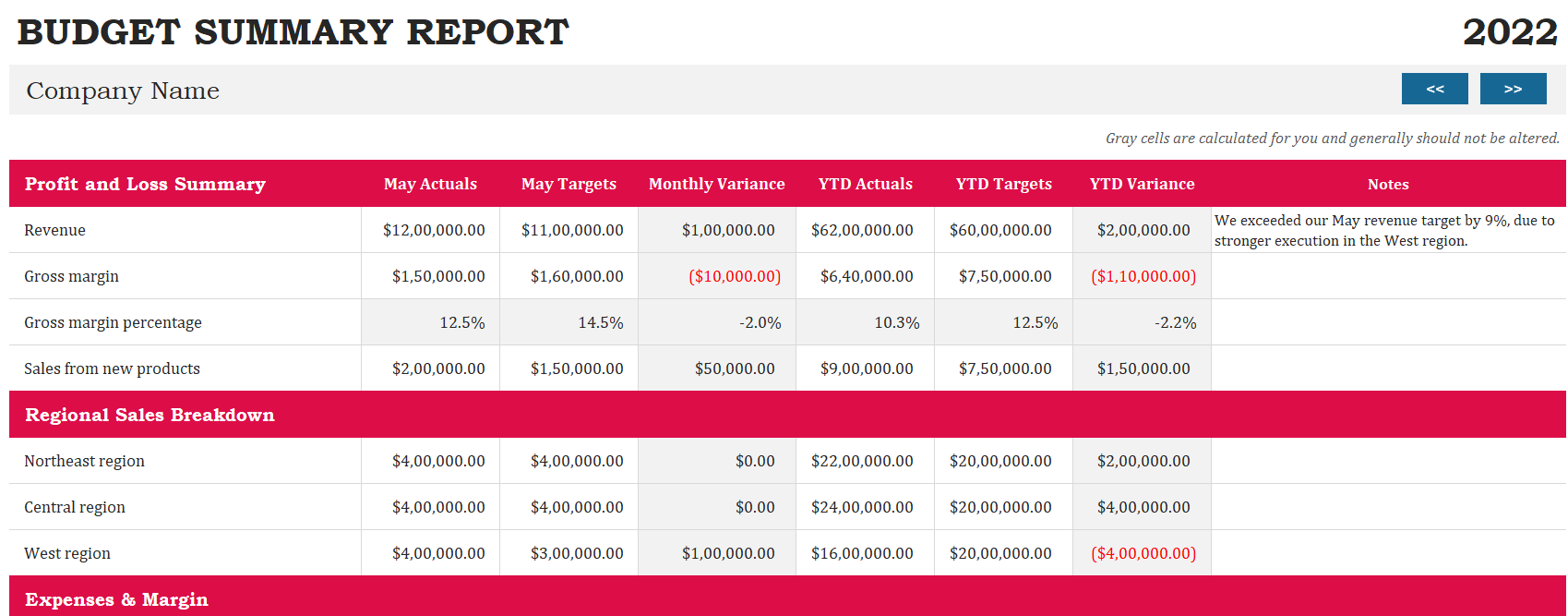

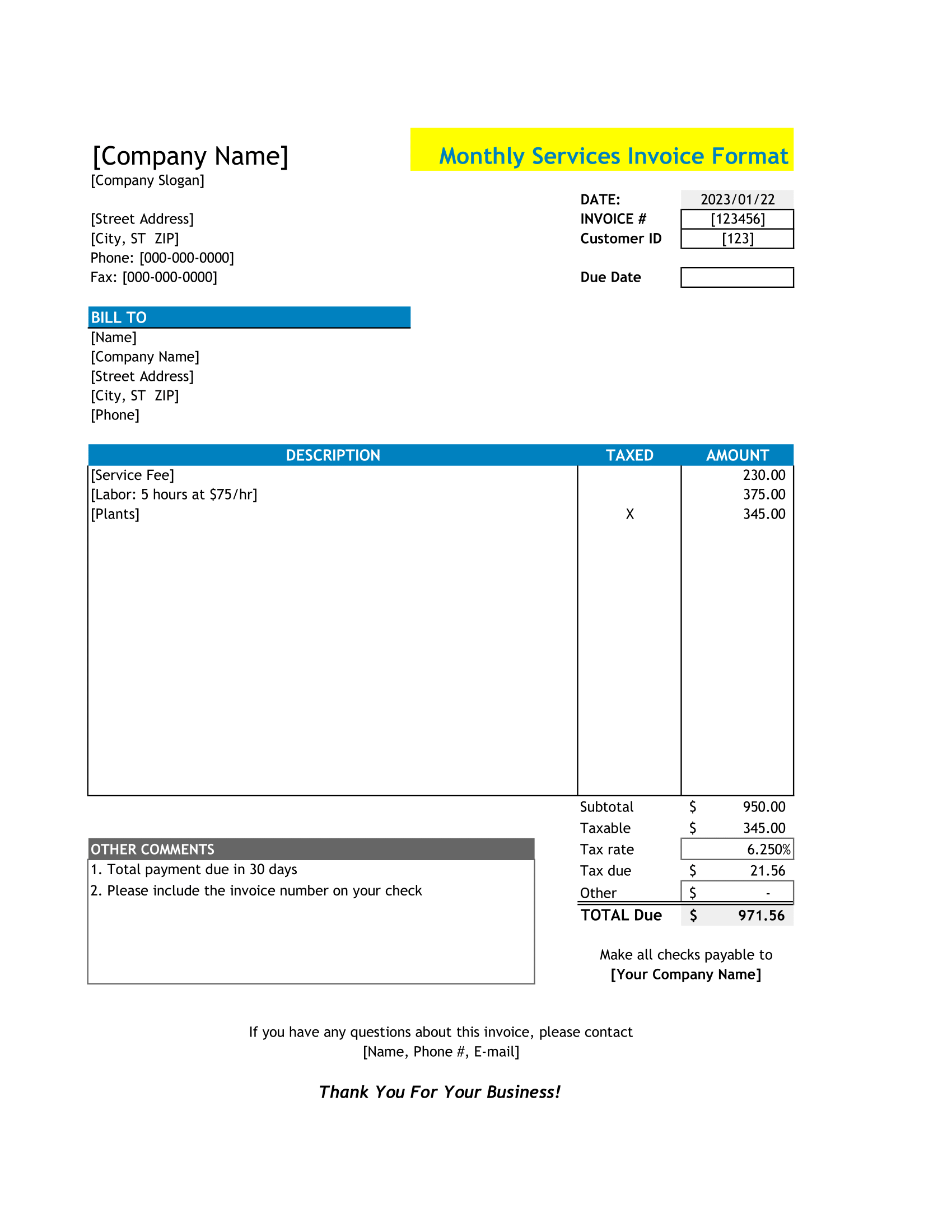

The budget summary report worksheet helps executive managers and finance teams to examine key financial, operating, and competitive metrics for monthly review. It generates an accurate budget and monthly variance. This worksheet includes all your business’s critical metrics.

The Budget Summary worksheet is formate to show the expense budget for the “Profit and Loss Summary” “Regional Sales Breakdown” Expense and Margin” and “Operating Metrics Summary”. However, you will use the PMT function to calculate the monthly payments.

In the Budget Summary sheet, we added the total annual payments. The formula that references cell locations in the Profit and Loss Payments and Regional and Marginal Payments to show their Actual, Targeted and Variance in the end.

For instance, a chart for Profit and Loss for the Targeted and Actual Summary for Revenue is added.

Added other formulas and functions to the Budget Summary template that can calculate the difference between the total spend dollars vs. the total net revenue for their Variance in the cell.

Formulas to calculate the spending rate and the savings rate as a percentage of net income is added.

Goals of a Budget Report

Displays Forecast rather than results

Teams can create budget reports before a certain period to examine and set goals for the company’s finances.

Inhibits several budgets

Budget summary reports show the company’s different projected budgets goals for certain periods.

Limited information

Reviewing a budget report, you mainly only see information like the company’s incoming and outcoming cash flow or its expenses. Displays results from the past that you can use to make upcoming financial budgeting.

Target the company’s goals

Professionals build budget reports to set targets and layout new financial goals.

Firstly the goal of budgeting reports is to understand how close the estimated budget is to the actual financial figure. That could be based on month, quarter or year. When a manager receives the financial report, they’ll compare the results with the report they prepared before from the start of the specific accounting time.

Budget reports typically serve as the company’s economical goals. If a report doesn’t reach the goals projected in the budget report, a manager can easily determine the problems by comparing the two reports. In addition, the manager also compares budget and economical reports to determine how accurate their financial predictions are from the previous one. Reviewing this information helps them to adjust the upcoming budget report.

Importance of Budget Report

- Essential for the management and the decision-making process.

- Enables information regarding the investor’s position and future recovery.

- It is a good tool to identify the credibility of a company to meet out its dues.

- Mainly useful for the information for investment purposes.

- It identifies the growth of the organization and identifies the survival of a future project.

- Helps to point out the weaknesses of a project.