Elevate Your Financial Management: Free Checkbook Register Excel Template

If you have ever struggled with keeping track of your checks and find manual bank reconciliation a hassle, then this post is just for you! We’re excited to introduce our free Checkbook Register Excel template – an efficient tool that simplifies your financial management while providing an extra layer of security for your transactions.

What is a Checkbook Register?

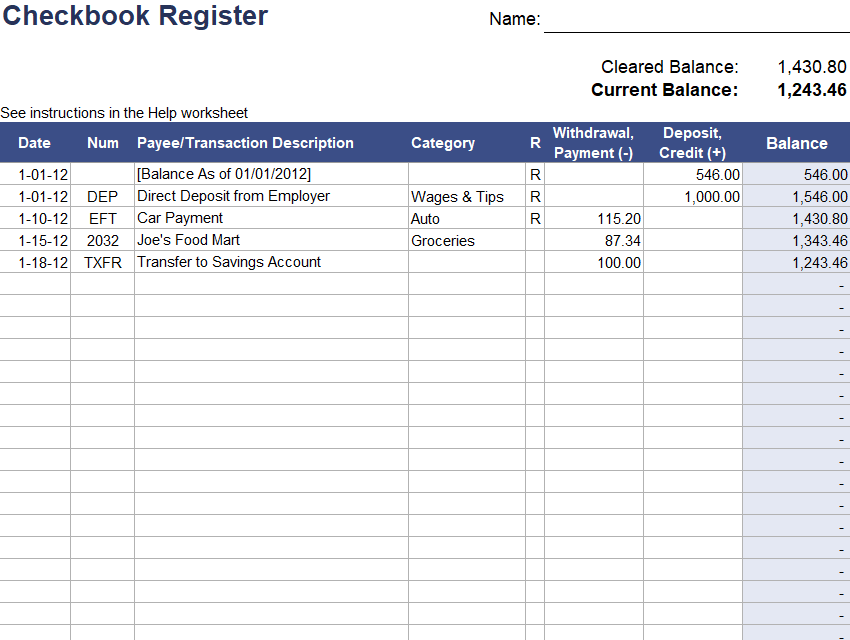

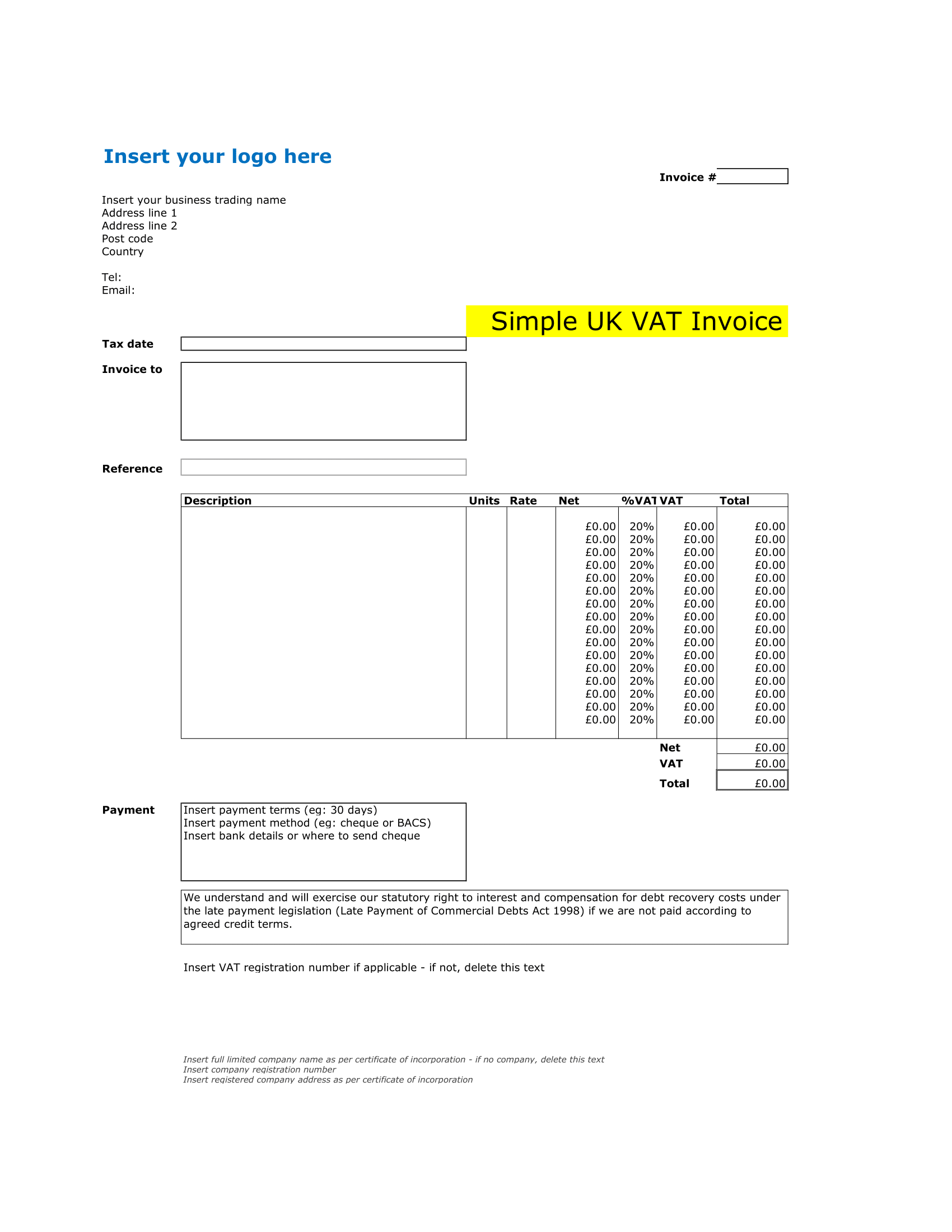

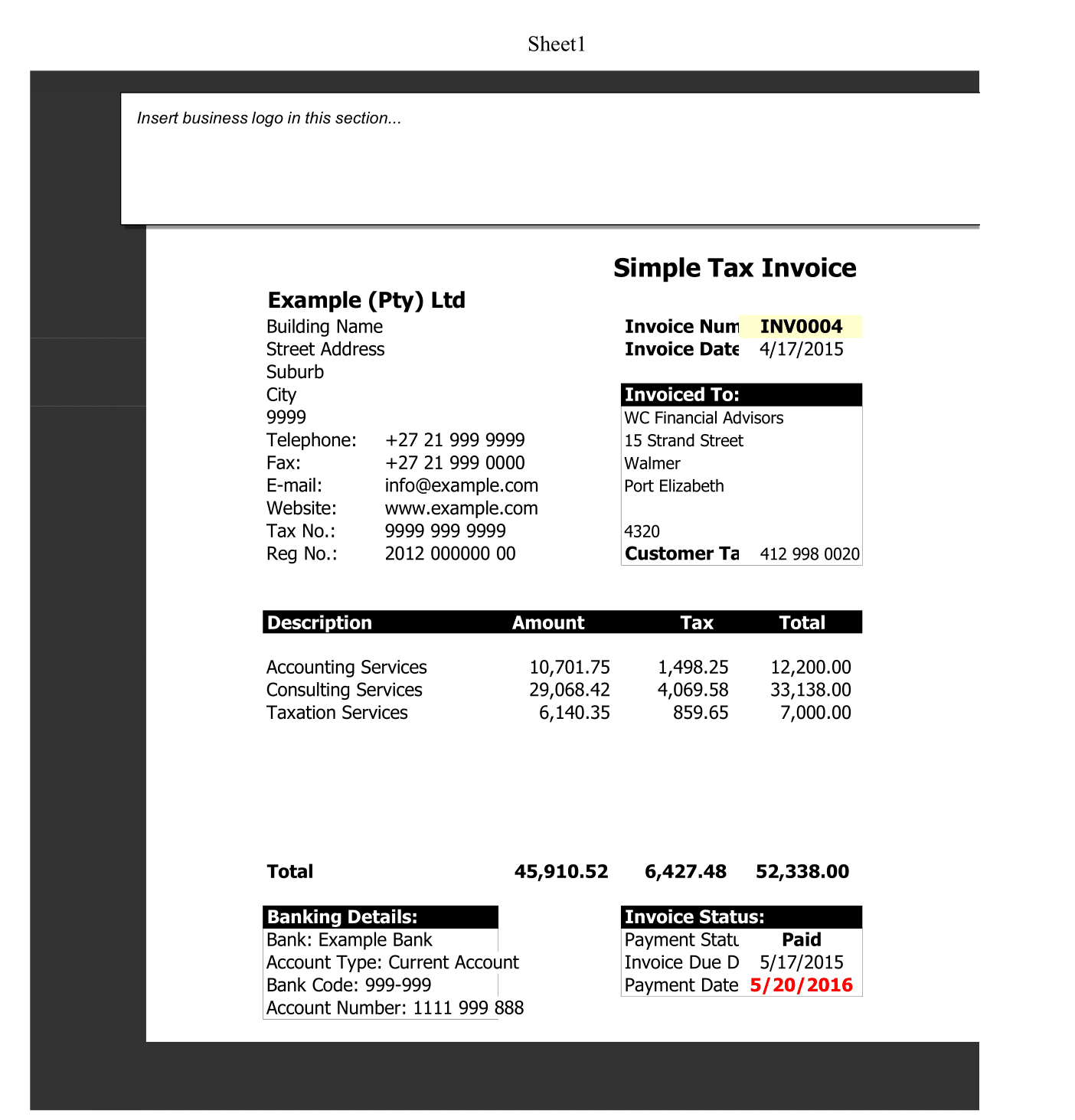

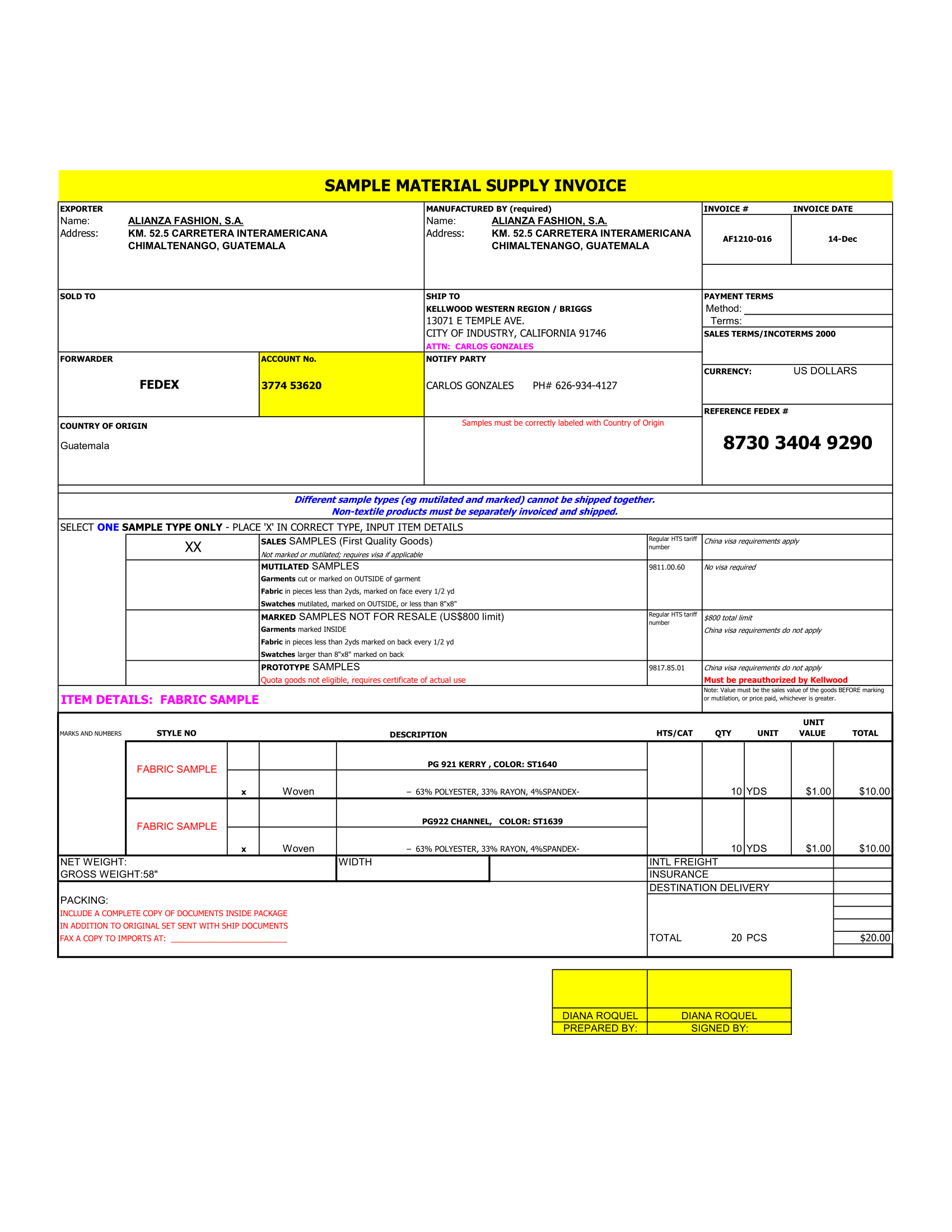

A checkbook register is a document used to record all financial transactions made through a particular checking account. It includes details like check numbers, dates, transaction descriptions, debit and credit amounts, and the running balance. Keeping a checkbook register is a simple yet effective way to keep track of your inflows and outflows, and avoid unnecessary financial complications.

Importance of a Checkbook Register

There are several reasons why maintaining a checkbook register is essential:

- Track Your Finances: A checkbook register helps you track your income and expenses, ensuring you are always aware of your financial status.

- Prevent Overdrafts: By regularly updating your checkbook register, you can prevent overdrafts and the associated fees by knowing exactly how much money is available in your account.

- Detect Fraud and Errors: It allows you to spot unauthorized transactions or bank errors, safeguarding your finances.

- Audit Trail: It serves as a valuable resource during audits, as it provides a chronological record of all transactions.

How to Use the Free Checkbook Register Excel Template?

To start using our template, follow these simple steps:

- Download and Open the Template: Download our free Checkbook Register Excel Template and open it in Excel.

- Input Your Data: Enter your transactions as they occur. The template is designed to automatically calculate the running balance, giving you a real-time overview of your finances.

- Customize If Needed: You can modify the template as per your needs, such as adding more columns or changing the format.

- Reconcile With Bank Statements: Regularly compare your checkbook register with your bank statement. This can help you spot any discrepancies and make corrections.

Checkbook Register for Fraud Prevention and Auditing

One of the less recognized benefits of a checkbook register is its potential to act as a safeguard in fraud prevention and auditing. Here’s how:

- Fraud Prevention: Regularly updating and reviewing your checkbook register can help you quickly identify unauthorized transactions or discrepancies. Early detection is key to limiting the impact of any fraudulent activity.

- Auditing: During an audit, your checkbook register can serve as a reliable record of your financial transactions. It provides auditors with the necessary evidence of your income and expenditures.

Automation of Bank Reconciliation

An added advantage of our Checkbook Register Excel template is that it can be used to automate your bank reconciliation process. By entering all your transactions into the register and comparing it with your bank statement, you can quickly identify any discrepancies. The template’s automatic calculations mean you spend less time crunching numbers and more time on strategic financial planning.

In conclusion, maintaining a checkbook register can revolutionize the way you manage your finances, and with our free Excel template, it’s never been easier. Don’t miss this opportunity to bring efficiency, accuracy, and security to your financial management. Download the template today and elevate your financial management game!