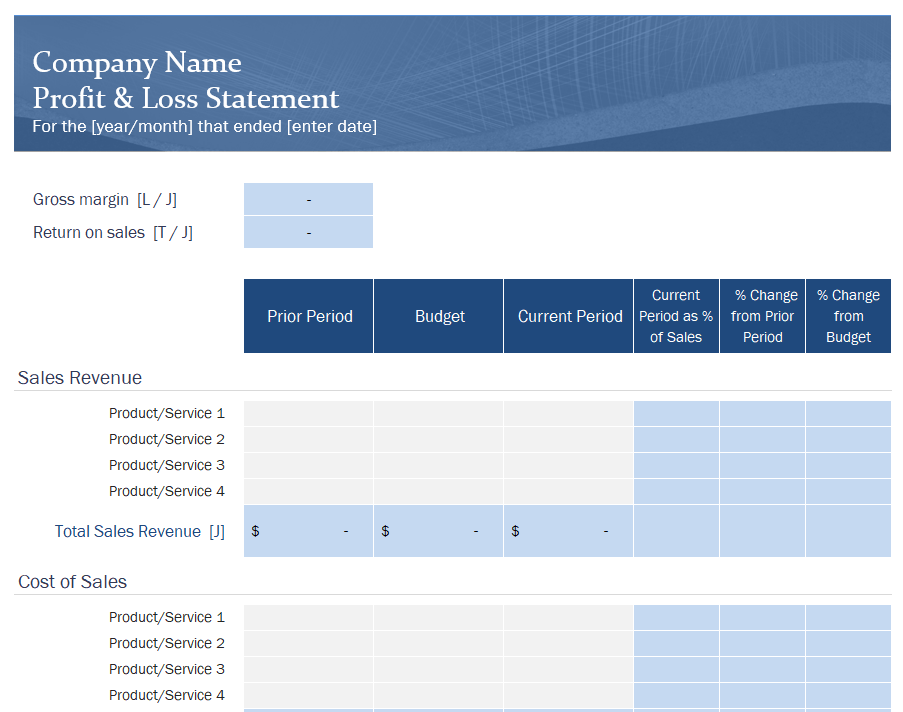

Download Best Profit and Loss Statement in Excel for small business

A profit and loss statement for small business —also called an income statement, is a financial statement that shows a small business’s net income revenue, expenses. The profit or loss is decided by taking the revenues and subtracting expenses from both functional and non-functional activities.

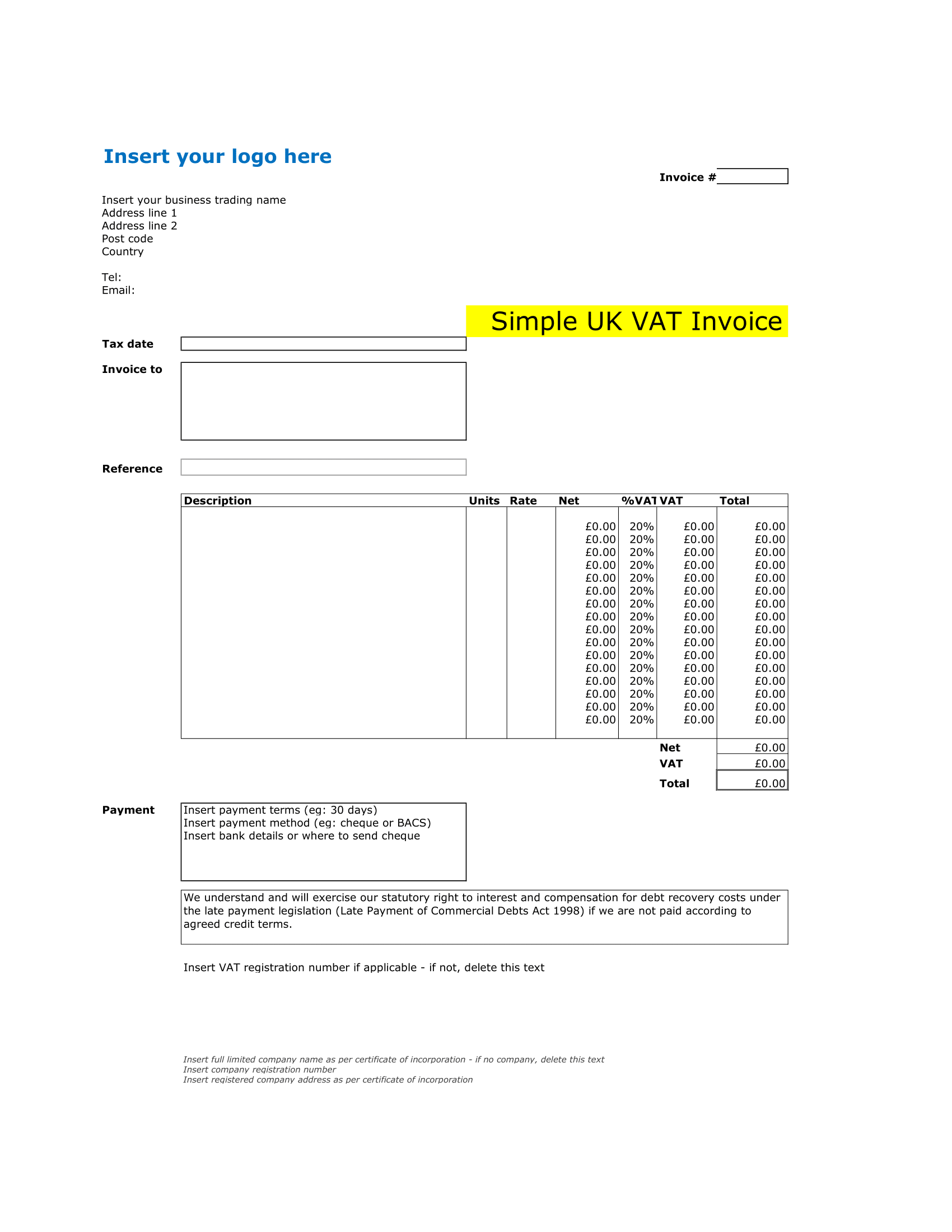

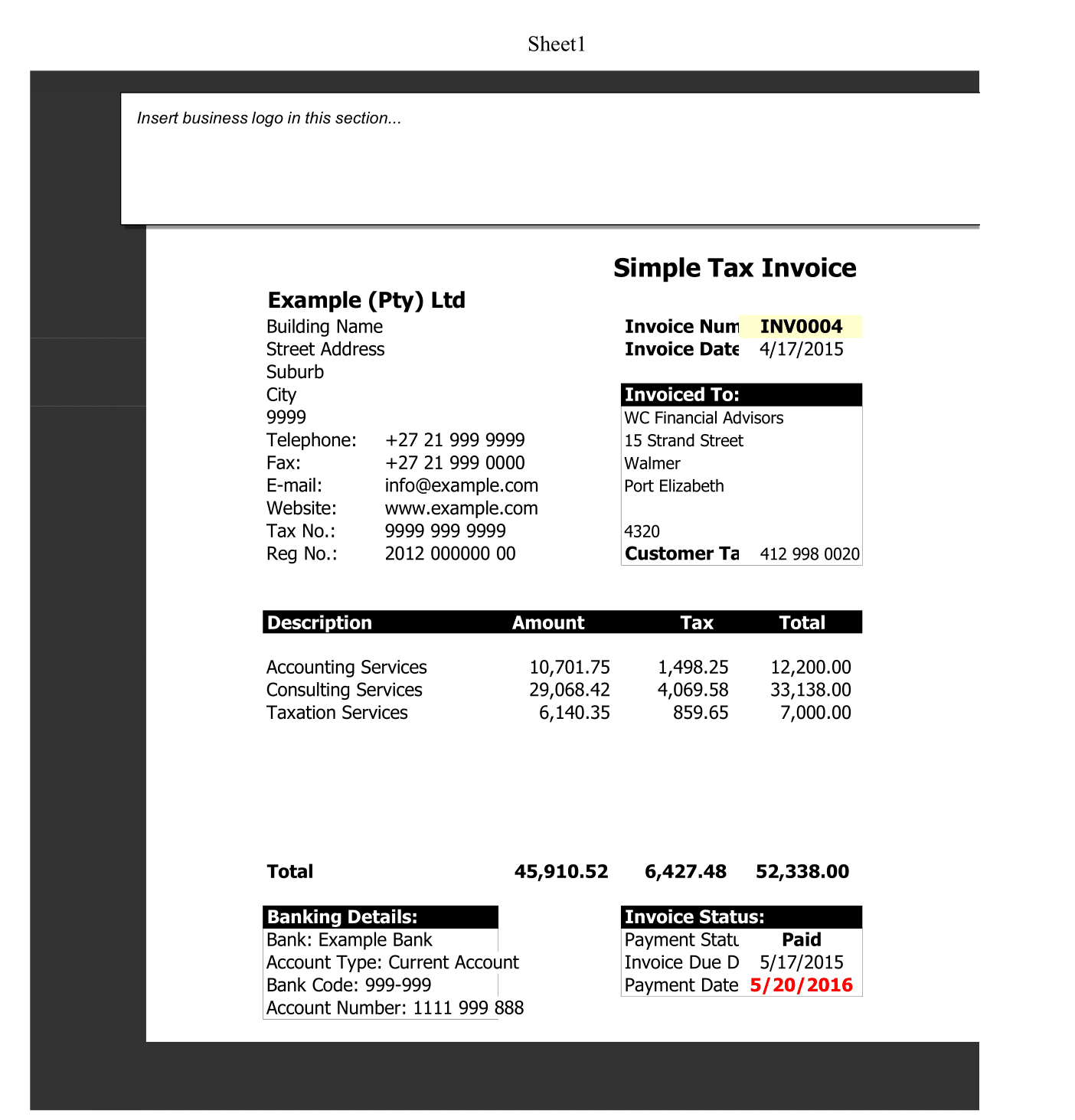

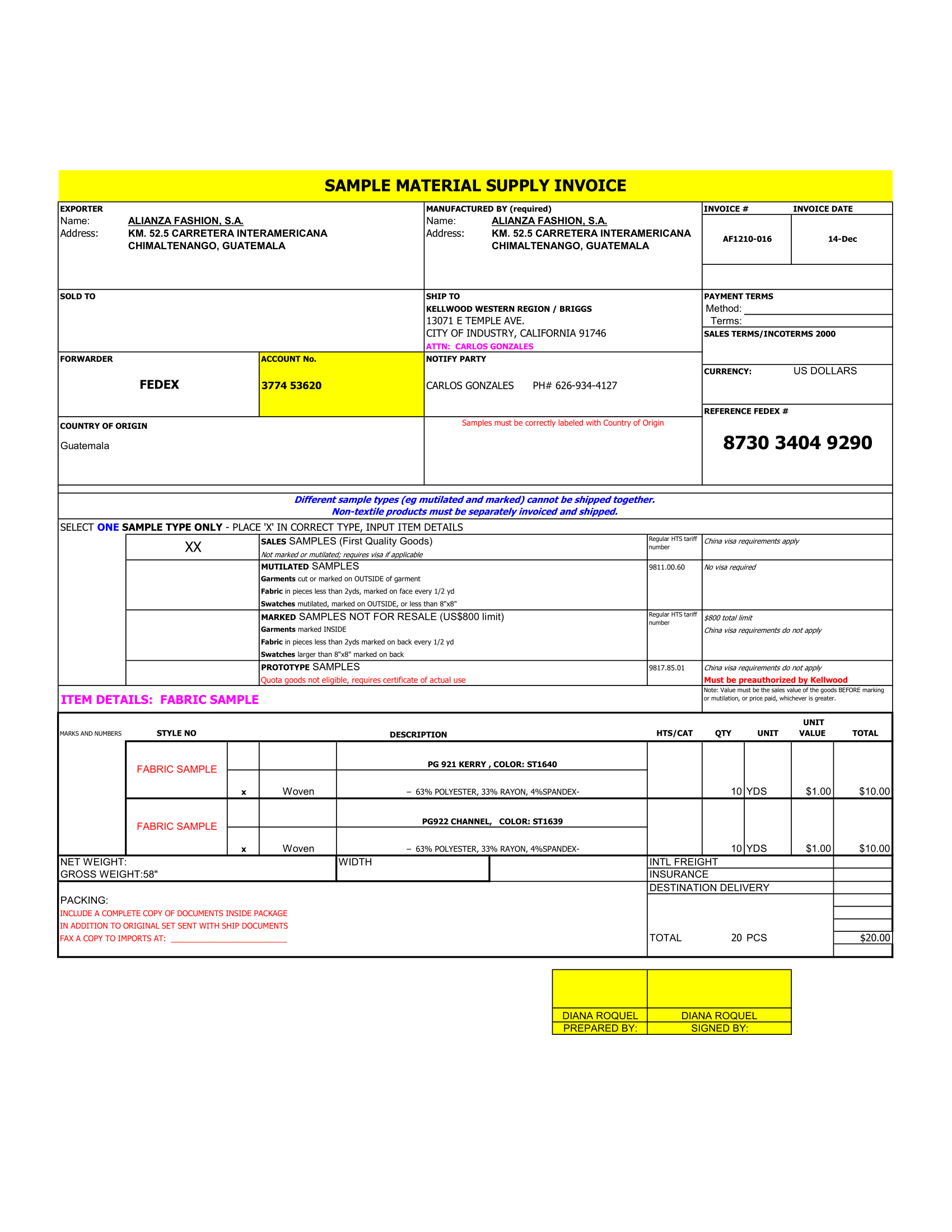

Use this Spreadsheet to make it simple to produce a P&L statement, that you familiarize yourself with the process. This will teach you how to examine and prepare a profit and loss projection—plus, download our free profit and loss statement Spreadsheet to use and create for your small business. This explains how to read a profit and loss statement primarily, for small businesses and provide a P&L example as an easy-to-follow guide.

How to use Profit and Loss Statement For Small Business

Just simply add Enter Data on sales, income, taxes and expenses in the template.

The Profit and Loss Spreadsheet helps you create a 4-year projection of income and expenses for your trade. It uses the same list of categories as the business budget, but also contains columns for calculating the Percentage of Total Sales, which helps you to analyze the cost of sold and operating expenses. This sheet contains two profit and loss templates that are planned for organizations providing services or selling. The worksheet includes a Cost of Stuff Sold section for recording purchase and calculating Gross Profit.

Use this profit and loss template below for a monthly cash flow analysis by changing the column from years to months.

How to create P&L Statement?

Revenue

Revenue, or Income, includes your business’s total sales. It also includes funds you receive from selling things or receiving a tax refund.

Revenue is the first thing you must list on your P&L statement. Therefore, it should be a positive number and include any costs you earned from sales.

Net Income

Net income, or net profit, is the main point of the profit and loss statement. The leftover you subtract all of your expenses from your revenue.

If you have a net profit, your company is earning more than it spends or, your expenses overbalance your revenue, you will have a net loss.

Expenses

Business expenses are costs you experience on day-to-day business operations, like insurance, marketing costs, and management. These expenses likely include operating expenses. Operating expenses include things like services, salaries, rent, and wages. So, these expenses keep your business good but do not produce sales. Subtract your expenses from income to build your profit and loss statement.

Income

Your cost of goods sold is how much expense you needed to produce your goods or services. Your cost of goods sold includes direct stuff and direct labor costs. For instance, to calculate your COGS, add your beginning categories and purchases during the accounting time together. Next, subtract your ending categories from the total.

Subtract your cost of goods sold from your revenue when you create your P&L statement to get your gross profit.

Why you need P&L Statement for Small Business

To place your Business in a Better Position

When you apply for business lenders, funds will often review your economical statements, including the P&L account, as part of the examine process. For this, your business scores and reports are the key factors considered when you apply for a debt. Therefore, a P&L statement that shows your company is in the balance can be a big plus.

Help you to prepare your taxes

P&L statements can help you to organize your taxes. If you’re not an accountant or a big fan of numbers, it helps you to prepare your business tax return. If you prepare regular P&L statements, filling out your tax return could be less stressful. So easily make P&L, because it have access to much of the information you need.

To increase your Earnings

You can use a P&L statement to improve your earning. By regularly taking supply of your company’s income and expenses, you have a better idea of how business is performing financially. You explore how to increase your net income by increasing revenue and cutting expenses.